Nordic Asia Investment Group – Newsletter May 2022

Dear Investor,

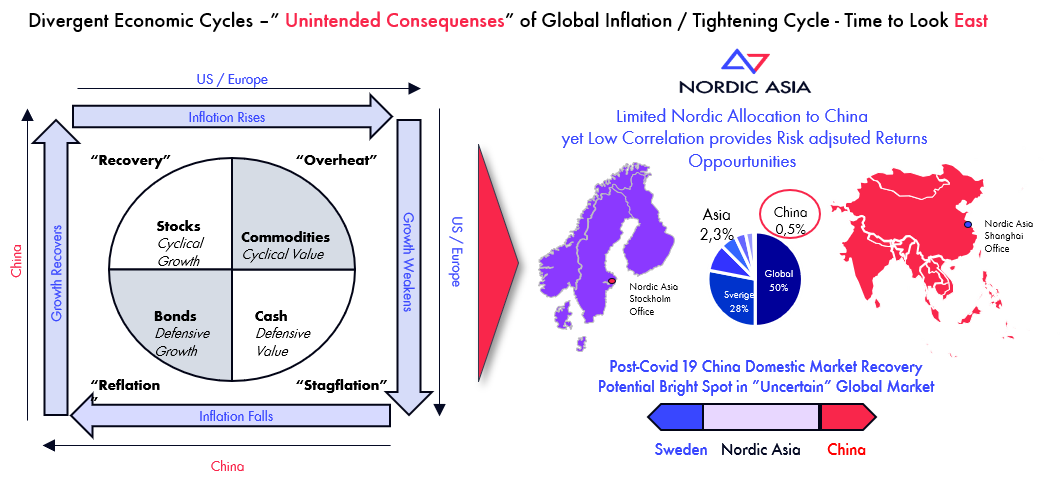

In the month of May, market conditions continued to develop in line within our strategic framework.

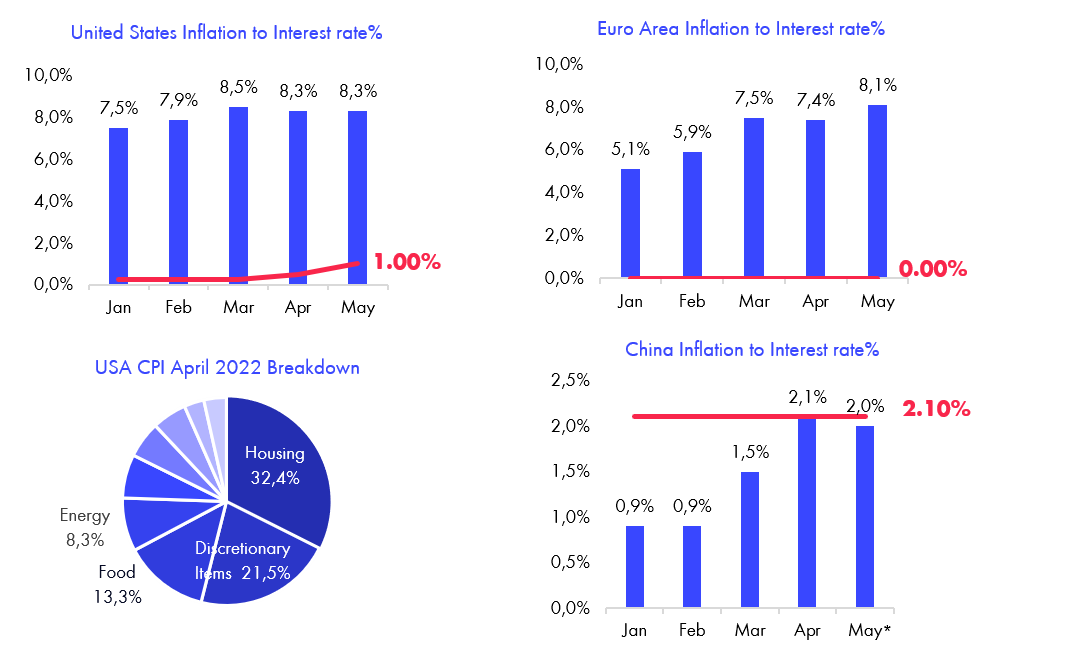

First of all, at a global level the main concern is the still the elevated gap between the concurrent inflation rates vs current interest rates. As an example, euro area inflation rate came in at 8.1% in May and benchmark ECB interest rate is still at 0%. In the US, despite having raise 50 bps during the last May Fed meeting, the gap between inflation and interest rate is still elevated at 8.3% inflation vs the 1% benchmark rate.

By looking at the key components of the CPI inflation below – one of the key components of the CPI inflation measure is housing (or “shelter” in its exact definition) and stands for approx. 1/3 of total CPI measurement. In the US, the change in the CPI measure of housing is calculated as the change in “owners’ Equivalent Rent” – i.e. the amount of rental that would have to paid to as if the house was owned. Thereby this measure is dependent on the change in mortgage rates, housing prices, taxes etc. The 30-year fixed mortgage rates in USA have increased from a low point of approx. 3% in December 2021 to almost 5% recently. If this relationship holds true going forward as well, increases in benchmark interest rates will continue to push up mortgage rates which in turn would counterintuitively put upward pressure on 1/3 of the CPI measure.

Thereby this “inflation” dilemma is likely to continue to put pressure on major central banks going into this fall as they will need to continue to face the difficult trade off between normalizing previous expansive monetary policies to cool of inflation pressure and yet limit the economic drag and tightened financial conditions caused by higher interest levels.

At a domestic level in China, we’ve finally started the reopening of Shanghai that underwent a lockdown to contain the latest Omicron virus variant since end of March. Although Shanghai stands for only 4% of China direct GDP, since it’s an important regional economic hub for commerce, manufacturing, logistics and international trade, the effects of the current Shanghai lockdown has affected the overall economy more severely albeit other cities. The total economic impact of this lockdown period is still less severe than that in Wuhan 2020, however after discussing with our partners, the latest estimate of Q2 GDP estimate is expected to range within 0-2%, significantly down from +4.8% growth in Q1 2022. Where the most of the negative drag occurred in April, sequential improvements in May (yet flattish YoY growth) and continued growth recovery in June.

Currently, the community dynamic zero policy is unlikely to change in the short term and the current strategy is to normalize the current “community dynamic zero” prevention controls as a mean to normalize economic activity similar to the measures in H2 2020 and most of 2021. For example, the normalization of Covid-19 requires the need to have a negative PCR test certificate every 72 hours to screen out possible new cases and limit new cluster spreads.

However, as this wave of Covid-19 resurgent has been controlled, the outmost priority for the government is to stimulate the economy to ensure stable economic growth for the full year 2022 (target 5.5%). Due to Covid-19, unemployment levels has risen to 6.1% and youth unemployment rates reached above 18%, well above the historical trend levels. Thereby economic policy makers in China are in a pressured position to first of all normalize economic activity and then stimulate the economy via a combination of fiscal and monetary policy for an economic recovery and stable employment growth in Q3 and Q4.

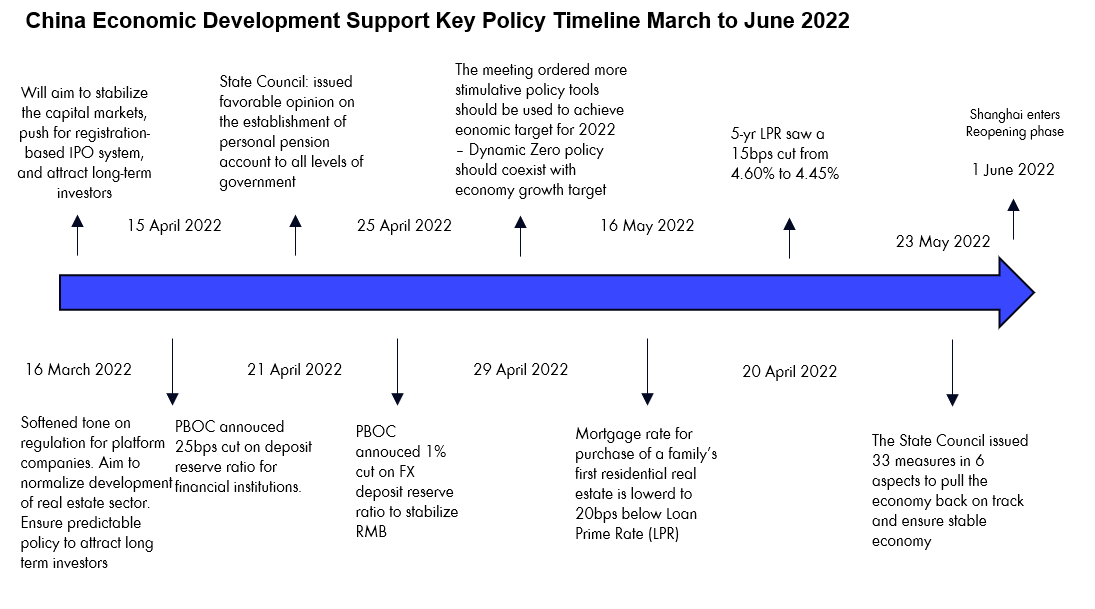

Thereby in the month of May we’ve seen stronger policy measures to restore, stimulate economic activity and central banks even lowering interest rates to reduce the cost of borrowing and restore investment confidence. The most significant reductions were the reduction of first hand homeowner mortgages rates by 20 bps from 4.6% to 4.4% along with a reduction of 15 Bps of the 5 year commercial loan prime rate from 4.6% to 4.45% which were significantly higher reductions as the standard reduction is more around 5bps. See key policy timeline below:

Thereby in line with our market view earlier this year, China continues to be on a path of an inverse economic cycle where inflation rates is controlled around two precent due to more cautious monetary policies and limited central bank balance sheet in the past along with more “slack” in economy due the recent Covid-19 lockdown drag. Policy makers still have more room for maneuver as mortgage rates where down to approx. 3.5% range previously in 2015. Thereby policy makers still have tools to further stimulate the economy towards a higher growth rate in Q3 / Q4 if needed.

Looking ahead in H2 2022, the economic recovery will need to firstly be led by fiscal investment stimulus, i.e new/old infrastructure investments, recovery to growth in the real estate sector along with stabilization of manufacturing sector industrial production value chains. Thereafter when consumption scenarios normalize, consumption expenditures and discretionary spending should pick up further during the later part of the year given a normalization of prevention controls and economic activity. In the short term, consumption spend should have sequentially improvement boost due to pent up demand and historical high savings rate especially in tier 1 / 2 cities.

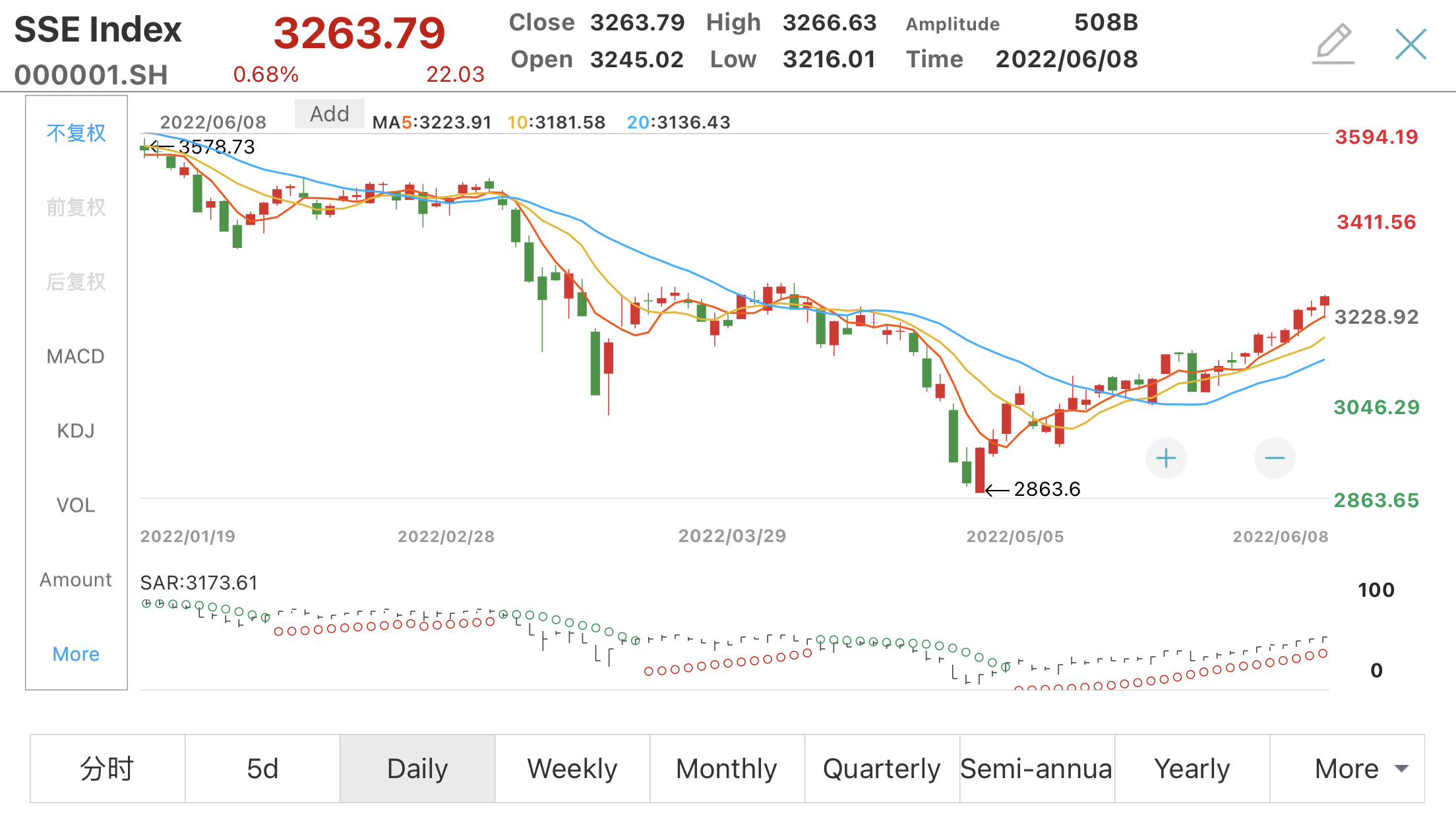

In the domestic market, the key benchmark indexes such as CSI 300 and MSCI China has continued to rebound since the bottoming of the market in late April and continued to “de-couple” against the external volatility observed in the S&P and Nasdaq in the month of May. Most of the negative Covid-19 drag has already been priced in as market multiples reached a historical low point earlier in April. More recently we’ve seen continued sequential improve of leading indicators for example manufacturing PMI improved +2.2% percentage points back to 49.6, while service sector PMI rose +7.1% from 40.0 back to 47.1 in May (both measures improved higher than that of March 2022) showing a steady recovering trend in the economy – indication the economy is continuing a path of recovery in anticipation of a continued recovering trend and thereby giving fundamental support to the rebound of the domestic market since late April 2022.

Also, encouraging during this recovery phase is the increased inflow of international capital back to mainland A-shares via northbound trading as net fund inflows reached 39 billion CNY during in the latest seven-day trading period. To a record high level seven-day streak during 2022 and reversal of the net outflows in mid-march, indicating a renewed interest by international professional investors to gain exposure towards on the China recovery case.

To conclude, we finally started to see evidence “bottoming out” of the economy as most leading indicators showed sequential improvements in May. The further reopening of Shanghai, marks an additional milestone of this recovery. Although the path towards “normalization” is gradual and continued to be contingent of effective community dynamic zero policies in the months ahead, but the focus on economic recovery and stabilization of industrial output and employment is clear and policy makers are taking the lead to stimulate the economy towards a path of normalization, stable economic growth and job creation in H2 2022 with continued aim to reach its acceptable targeted growth range for 2022.

Therefore, based on the global economic outlook and continue inflation “dilemma” for global policy makers, we continue to see an opportunity for the China recovery trend to remain a possible bright spot in an otherwise continued complicated global economic and market environment for the remainder of H2 2022. At Nordic Asia we will continue to prepare ourselves to capture the recovery trend in H2 2022.

Please see below for more specific selected portfolio company highlights during this month.

Best Regards,

Yining, Jason and the NA Team in Stockholm & Shanghai

7th of June 2022

Tencent

Due to weak macro, lingering impact of regulatory tightness and Covid-19 impact on its advertising business. Tencent’s 1Q22 revenue was flat YoY or down 6% QoQ to 135.5BCNY. Adjusted net profit declined by 23% YoY to 25.5BCNY. By segment, Value Added Services (VAS)/Online Advertising (Online Ad)/Fintech and Business Services (FBS) grew by 0%/-18%/10% YoY respectively. Game revenue was weaker than expected at 29.1BCNY +0% YoY. Domestic game declined by 1% YoY on the impact of China’s minor protection policy in 2H21. International game revenue grew by only 4% YoY on user spending normalization post-COVID and front loaded revenue in 4Q22.

On the gaming front, regulators finally issued new game publishing licenses for new games in the month of April after a halt in approvals since July 2021 to counter gaming addiction. Tencent recently launched Apex Legends Mobile in May and claimed to release more titles starting from 2023 but with less products for better quality.

Online Ad revenue’s decline was due to reduced ad spending from education sector and the weakened demand from FMCG, eCommerce and travel advertisers amid tight Covid control. We may see some rebound from the Online Ad segment in late-2H22 as economy slowly recovers from the lockdowns. As for financial business services segment, payment volume via WeChat was impacted negatively by covid resurgence since March while Business Services declined YoY by single digit as Tencent proactively cut down the loss-making contracts. Tencent sees better uptake of business tools including WeCom and Tencent meeting due to higher demand in complex video communication during the massive lockdowns.

On the consumer side, Tencent also good progress in the development of its video accounts and mini-program user traction. Daily average users for both sections grew significantly to >500mn as of end-2021. Mini-program physical goods GMV transactions from independent merchants continued to grow at a high pace. However, video account user time spent still lags competitive short form video platforms such as Kuaishou and Douyin. Tencent will continue its effort in increasing content density by opening-up more support/benefit to live streamers and content contributors while try to increase VAS profitability by expanding advertisement monetization in both video account and min-program.

Looking forward, we expect Tencent to experience slow recovery as the macro condition gradually improves in coming quarters. We should see gradual earnings improvement in Q3-4Q 2022 as advertising spend is expected to pick ahead of economic growth. Tencent is currently trading at favorable levels in relation to its dominate market position and distribution channels via its deep rooted social network platforms used by nearly every Chinese citizen.

Anjoy Food

Anjoy Food (leading frozen food, ready meal brand in China) delivered solid 1Q22 result with revenue +24.2% YoY while net profit +17.7% YoY thanks to consolidation of its upstream partner XinHongYe and rapid growth of ready meal segment. Net margin improved QoQ to 8.7%. By segment, frozen meat/seafood/pasta/ready meal grew by 0.0%/1.3%/16.6%/129.9% YoY respectively. Frozen pasta was stronger in 1Q due to covid lockdown while ready meal remained as company’s strategic focus as expected. Gross margin improved QoQ to 24.2% thanks to price hike, higher consumer side product mix and lower retail discount. Operating leverage also improved YoY S&M/G&A ratio at 10.3%/3% respectively. We see good sign that contractual liability increased significantly both YoY and QoQ as distributors tried to lock-in shipments amid/before Covid lockdown.

Looking forward, we see Anjoy to be relatively resilient in 2Q with slight margin improvement on higher mix of consumer side product during the total lockdown in Shanghai started from April, despite the revenue decline due to logistics disruption. Anjoy is also on the right trajectory of margin improvement on flatten raw material cost, factories across the nation and strong channel management. We should see Anjoy to enter an improving trend in 2H22 as Covid control becomes less tight and sales of its frozen food products to pick up in the catering B2B sector to complement its growth on the B2C front.

Luxshare Precision

Luxshare Precision is domestic leader of consumer electronics manufacturing industry, released its financial results for first quarter 2022 late last April: revenue was 41.6 BCNY and net income was 2.1 BCNY, growing 97.9% and 33.6% YoY, respectively. Gross margin of 11.8% and a net margin of 5.0% both show consistent compared to margins from year 2021. The SG&A and R&D expenses accounted for 6.6% and 4.1% of revenue compared to 7.3% and 4.3% from 4Q21. After the merger and acquisition of Likai, the company's management ability has played a synergistic effect, which is the main reason for the decline in the cost rate.

As of the end of 2021, Luxshare Precision achieved a revenue of 153.9 billion yuan (YoY +66.43%), and a net profit attributable to the parent company of 7.1 billion yuan (YoY -2.14%). In 21 years, all businesses increased significantly year-on-year. The company has given full play to the efficient collaboration among various product lines / business modules. In 2021, all businesses have achieved substantial revenue growth. The revenue of computer interconnection products and precision components / automotive interconnection products and precision components / communication interconnection products and precision components / consumer electronics reached 78.6 / 41.4 / 32.7 / 134.6 billion yuan respectively, with a year-on-year increase of +123.1% / +45.7% / +44.3% / +64.6% respectively.

Luxshare Precision has been deeply involved in the apple supply chain in the field of consumer electronics, and has undertaken the vertical integration of the industrial chain from parts to components. In addition, the company actively laid out the field of intelligent automobile manufacturing. In the field of automotive wiring harness, it has become a comprehensive supplier integrating the design, verification and manufacturing of complete low-voltage and high-voltage vehicle wiring harness, special wiring harness and charging gun, and has expanded some new customers. In terms of connector products, the company has designed and developed all connectors in the whole vehicle. In addition, the company cooperates with Chery Automobile to prepare for undertaking possible new energy automobile products from its current key customer. Furthermore, Luxshare Precison is developing its production capabilities for wearable devices, AR, VR products to launched with its core OEM customers which is a new potential profit growth area for the company.

Jiangshan Oupai

Jiangshan Oupai, leader in wooden door and furniture manufacturer, achieved 491 MCNY in revenue and 55 MCNY in net income during 1Q 2022, growing at 3.4% and 67.5% YoY, respectively. On the cost side, gross margin decreased 4.6% over same period last year to 24.9% caused by a higher percentage of revenue from retail market with lower gross margin in the revenue mix and as the high margin business with Jiangshan’s key account customers were reduced. Meanwhile, SG&A increased slightly to 20.7% from 20.4% and R&D expense grew from 4.05% of revenue to 3.84% of revenue last quarter.

In the past, Jiangshan Oupai's customer structure was mainly a B2B business serving China's largest real estate developers, including Vanke, Evergrande, Country Garden, China Resources, as key account customers. However, as the real estate sector policy supervision has led to slower industry growth, Jiangshan Oupai, in the past years has actively developed new business models and sales channels to transform from a B2B company towards the larger B2C renovation market. Up to now, the company has attracted more than 300 distribution channel agents and more than 12 740 retail channel franchisees (+74% YoY Q1 2022). Driven by the omni channel marketing strategy, the company’s new distribution accounted for more than 60% of revenue in the first quarter of 2022. Due to the expansive monetary policies announced so far, China's real estate industry is expected to rebound in H2 2022. Based on Jiangshan Oupai’s new distribution channels and retail outlets we look forward towards a continued business transformation and improved business fundamentals and growth for the company in 2022.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.