Nordic Asia Market Insights: Northbound Liquidity

What does Northbound Liquidity mean to the capital market?

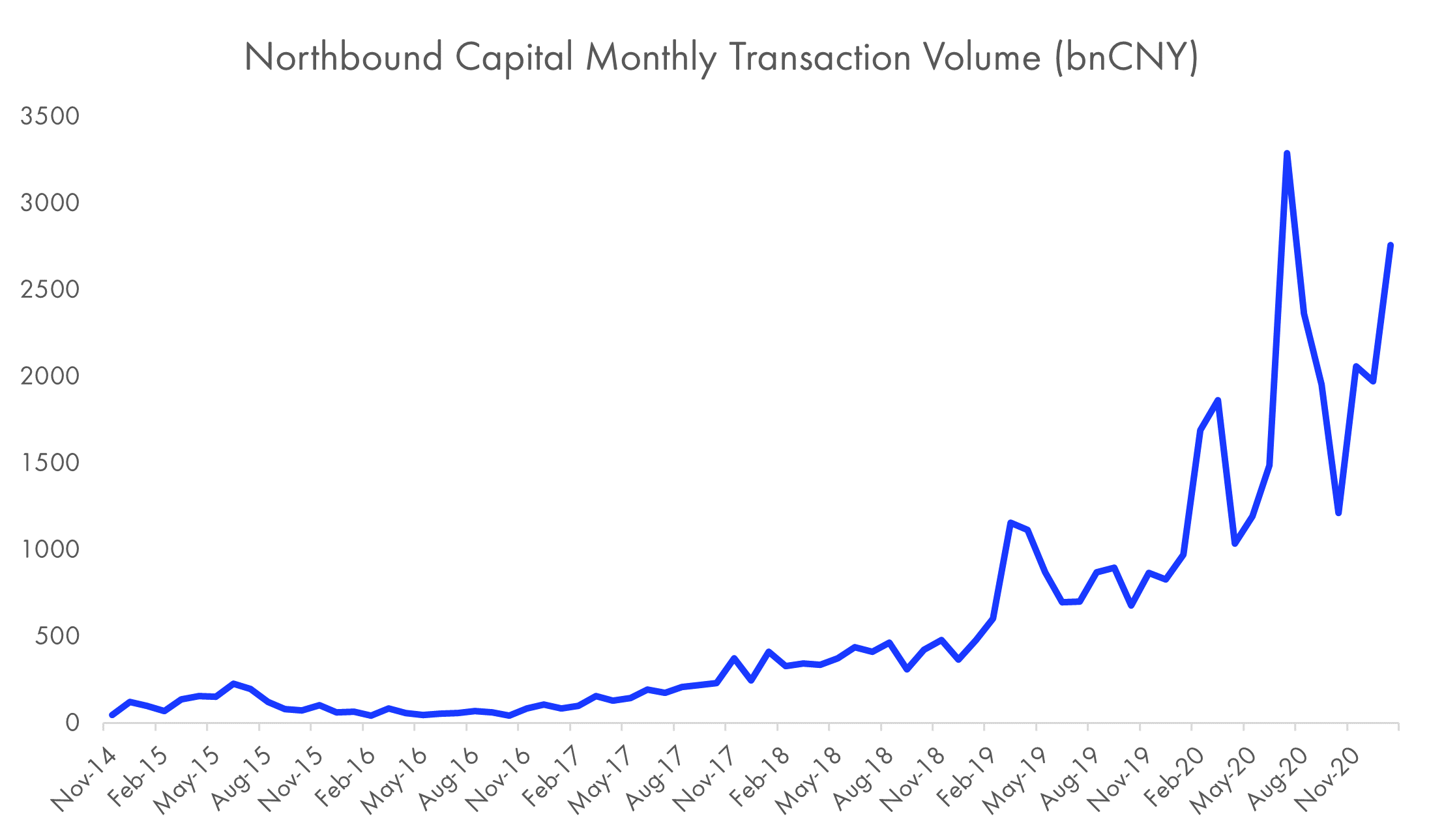

The capital flow of foreign investors buying A-share (Shenzhen and Shanghai) from Hong Kong (not through QFII) is called northbound capital. Since the Shanghai-Hong Kong Stock Connect was launched in 2014, there has been a cumulative net inflow of 1.28TCNY for northbound capital (as of Feb 8, 2021).

As the Hong Kong/foreign capital market tends to have a higher degree of maturity than the A-share market, northbound capital has been regarded as "smart money". The internationalization of China capital market (e.g. MSCI increased the proportion of A shares to 20%, and A shares joined the FTSE Russell Index) promoted the accelerated inflow of northbound capital into the A-share market. As an important source of incremental capital in A-share market, northbound capital can affect market sentiment to some degree. However, the northbound capital only holds 3.8% of the free float market value of A shares as of Jan 29, 2021. The correlation coefficient between northbound funding and major broad-based ETF is around 0.4-0.5, which is medium correlation.

What’s the preference of Northbound capital?

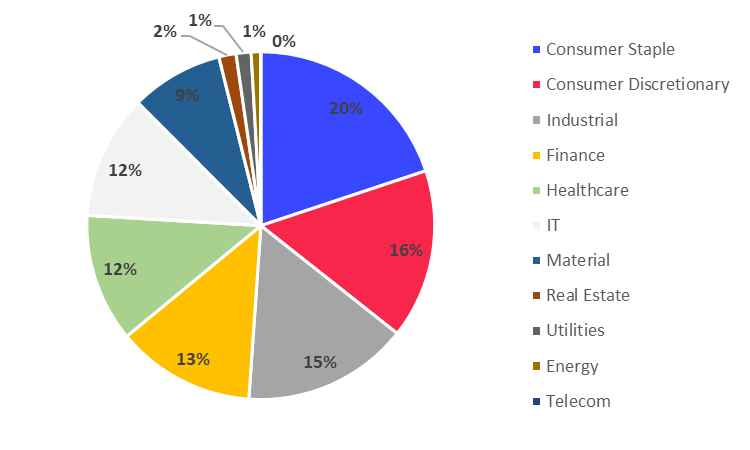

From the perspective of the stocks held by northbound funds, the overall preference is for stocks with large market capitalization, low valuation, and leading position in the subsector. In terms of the allocation style of the northbound funds, they are more inclined to hold stocks with long-term stable performances. In terms of the sector preference of northbound funds, consumer is the most popular one, accounting for 36% of northbound holdings. Northbound capital also picks industrial, finance, healthcare, and IT sectors.

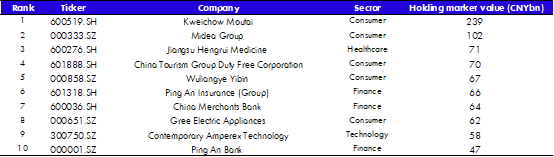

The top 10 stocks held by northbound funds are mainly the leading companies in the consumer and finance sectors.

What are the main factors that will affect the northbound liquidity?

Due to the foreign-invested nature, northbound liquidity is obviously affected by the global financial situation and liquidity. When the international market environment undergoes major changes, a sharp rise or fall in the external market will immediately affect the net inflow and net outflow of northbound. The inflow of northbound capital was relatively continuous in 1H20, when market valuations were low, and China’s epidemic situation was first brought under control. In 2H20, after the gradual increase in market valuation and sharp rise in technology, medicine, and consumer stocks, the market began to fluctuate and the momentum of northward funds also began to weaken. The siphon effect caused by the Fed election and potential IPO of Ant Financial (as a large-cap stock) also influenced the northbound liquidity in 2H20.

Which industries did the northbound capital flow into recently? and why?

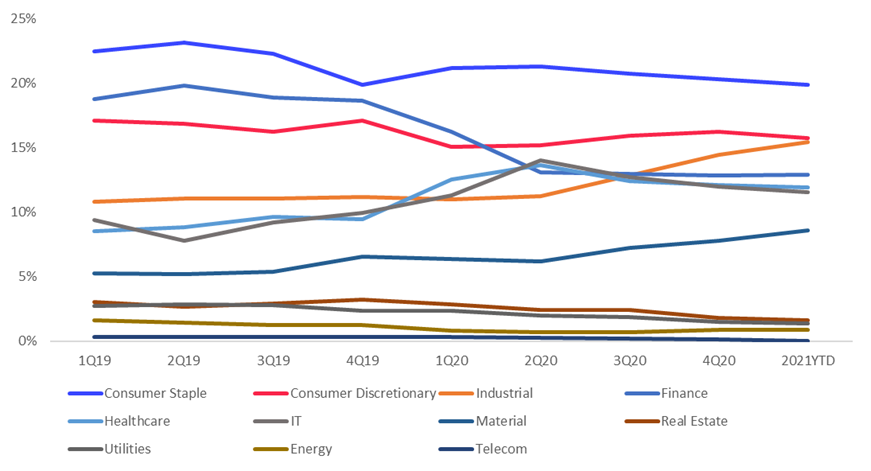

According to the below chart, northbound capital started to invest more in industrial (11% in 1Q19 to 15% YTD2021) and material (5% in 1Q19 to 9% YTD2021) sectors since 2Q20, which could be mainly attributable to the procyclical investment following the economy recovery expectations. Besides, northbound capital also added investment in healthcare (9% in 1Q19 to 12% YTD2021) and IT sectors (9% in 1Q19 to 12% YTD2021), which are service-oriented and technology-oriented industries, following the consumption upgrade trend in China. The moves are also related to the market style at the time.

What’s your outlook for northbound liquidity in 2021?

2021 is expected to be a "big year" for northbound capital inflow into A shares. In 2020, the risk appetite of foreign investors is overall low due to the uncertainties of COVID-19. As the global economy gradually recovers in 2021 with loose overall liquidity, the risk appetite of foreign investors is expected to increase. The foreign investors tend to find markets with higher investment returns, which should bring northbound inflows to A share market. Besides, with the eased US-China relations under Biden’s policy, the signature of EU-China Comprehensive Agreement on Investment, and the opening-up measures of China’s financial industry, we believe the northbound capital will continuously flow in A share market in 2021.