Nordic Asia Portfolio Insights: Kuaishou Technology

Kuaishou Technology– Company Introduction

Kuaishou is one of the largest short video & live streaming in China with 442mn MAU and 262mn DAU. Kuaishou is famous for its close to life contents and special “Buddy Culture”(老铁文化) that creates special connections between live streamers and their followers. Kuaishou is famous for its low tier penetration.

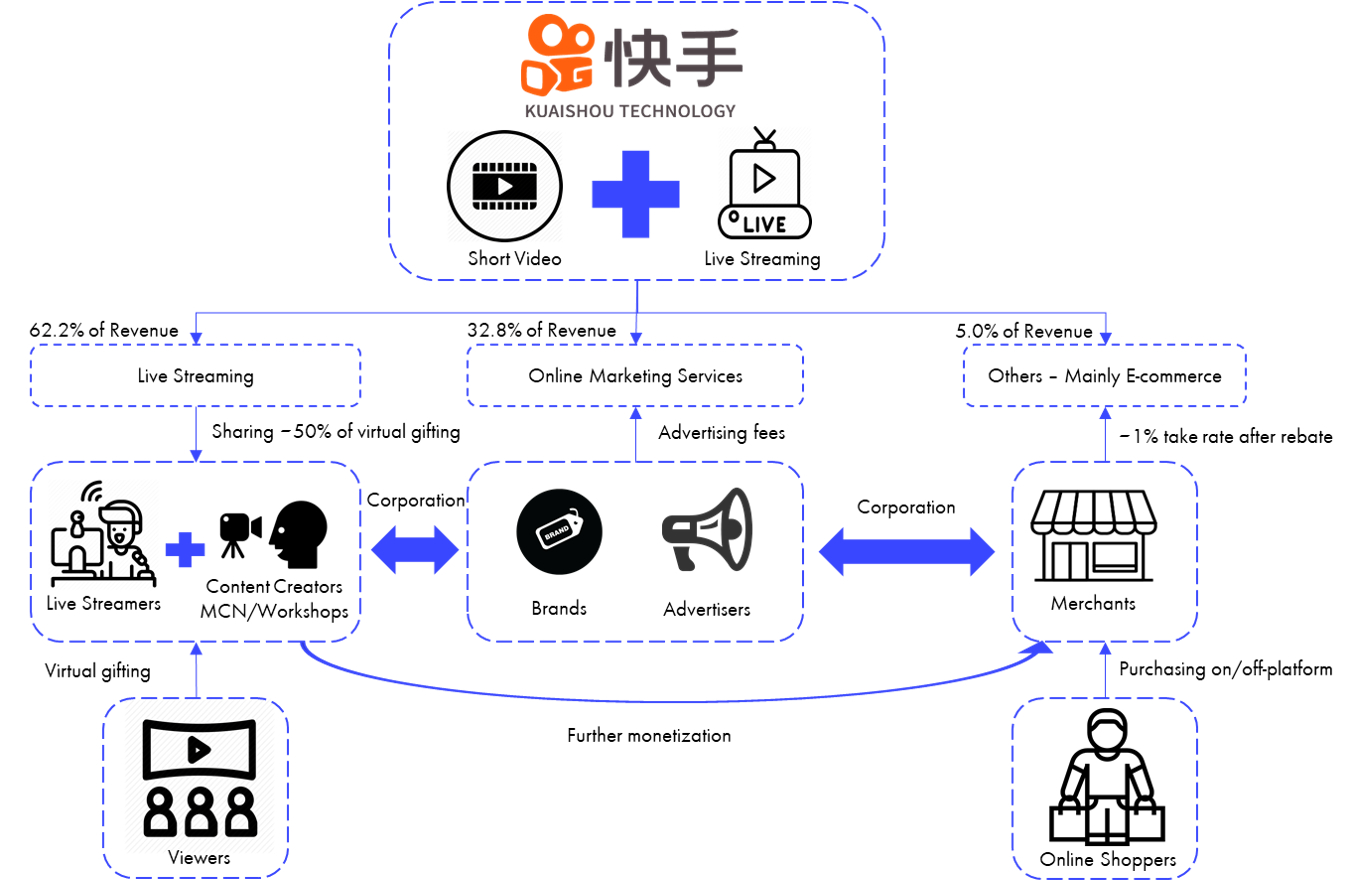

Kuaishou Technology – Business Overview

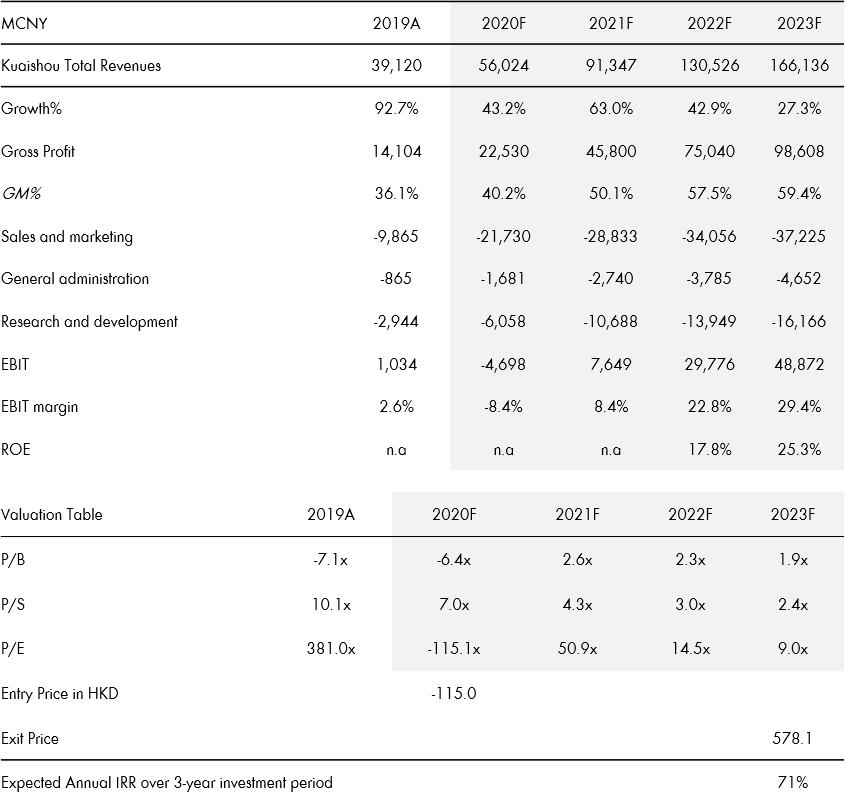

Kuaishou Technology – Financial Overview as of 4th of Feb 2021

Interview with Nordic Asia Research Analyst – Sunny Huang on his views on Kuaishou Technology

Do you use Kuaishou app yourself? How is your experience with the app?

Personally, I seldom use Kuaishou app due to content preference. Kuaishou’s current target customer group majorly located in 2-3 or lower-tier cities in Northern China. From my experience, Kuaishou’s is less attractive to me as it presented contents that are closer to the ground. Most of the content creators attract their follower with their unique features that only suits for certain groups of people but creating strong followership.

From Nordic Asia’s perspective what is the investment case for Kuaishou?

From an outside-in perspective, Kuaishou as one of the industry leaders in short-video field enjoyed the rapid industry growth thanks to the lower barrier of video mobile distribution by 4G transformation. Short video’s immersive feature, good use of fragment time and strong content engagement enabled it became the new trend of entertainment and marketing. Average DAU (daily active users) of short video platforms inclined dramatically by 98.7% CAGR for 2015-19 to 629.4mn in 2020E which penetrates 67% of mobile internet users. We believe the 5G transformation will further strengthen the position of short video and shapes short video into the one of mainstream marketing and entertainment.

From an inside-out perspective, Kuaishou’s edge in “Buddy Culture” and low-tier penetration enabled it strong at live streaming and user engagement. The strong loyalty of followers enabled it could monetize via advertising and e-commerce with higher user tolerance. Tencent’s investment in it also enabled it to access extensive pool of traffic from WeChat’s social network. An investment in Kuaishou will give us exposure to the development of China short video industry, the upside as Kuaishou develops its online marketing services business and the builds its e-commerce ecosystem.

How does Kuaishou differentiate itself from its peers such as Bytedance’s Douyin and WeChat Channels?

The dundamental difference between Kuaishou, Douyin and WeChat Channels is the method of content distribution. Kuaishou adopts the double feed masonry layouts, a decentralized algorithm, as the main distribution method while Douyin employs single feed centralized algorithm as the main distribution method. Tencent Channels, the latest joiner of the battle field, adopts Tencent’s social network as the distribution mechanism. On top of that they each built different content universe.

Recently, Kuaishou upgraded its app with single feed interface for better distribution efficiency in online advertising. Kuaishou also launched content creation campaign like mini-drama to improved its brand image in order to penetrate into higher-end market.

How did Kuaishou perform during 2020 and how was it affected by COVID-19?

Kuaishou’s 9M 2020 revenue recorded strong 49.2% YoY growth and reached 40.7BCNY thanks to the more staying home time for online entertainment amid Covid-19. Kuaishou acquired user more aggressively with sales and marketing campaigns in 2020. As a result, S&M cost surged up from only 25.2% of revenue in 2019 to 48.8% in 9M 2020, driven mainly by heavy user acquisition and subsidy. Live streaming revenue grew by 10.4% YoY from the increase of monthly paying user (MPU) by MAU increase but paying ratio declined to 12.4% from 14.8% in 2019. Online marketing services boomed with 212.7% YoY growth in revenue driven by the launch of single feed interface and increase in ad load. Other services, mainly e-commerce so far registered strong 37x increase as Kuaishou actively build its e-commerce society. Kuaishou e-commerce GMV reached 332.7BCNY for Jan to Nov-2020, driven by take rate as low as 1% and strong followership in Kuaishou.

Which are the key drivers and challenges for Kuaishou that we should follow during the coming twelve months?

Looking 12-month forward, we believe Kuaishou will maintain its strong momentum as one of the leaders in the short video industry. Live streaming would recover as the ease of pandemic but only stable growth contribution. Online market services will be core driver in the next year as Kuaishou further increase its ad load. The main challenge lies on user acquisition, to achieve the goal of 500mn MAU in 2021 and declining S&M cost to 32% of revenue, Kuaishou’s user acquisition and maintenance cost per net addition of DAUs will effectively more than doubled to estimated 741CNY.