Nordic Asia Portfolio Update: SF Holding

SF Holding 2020 Financial & Operating Highlights

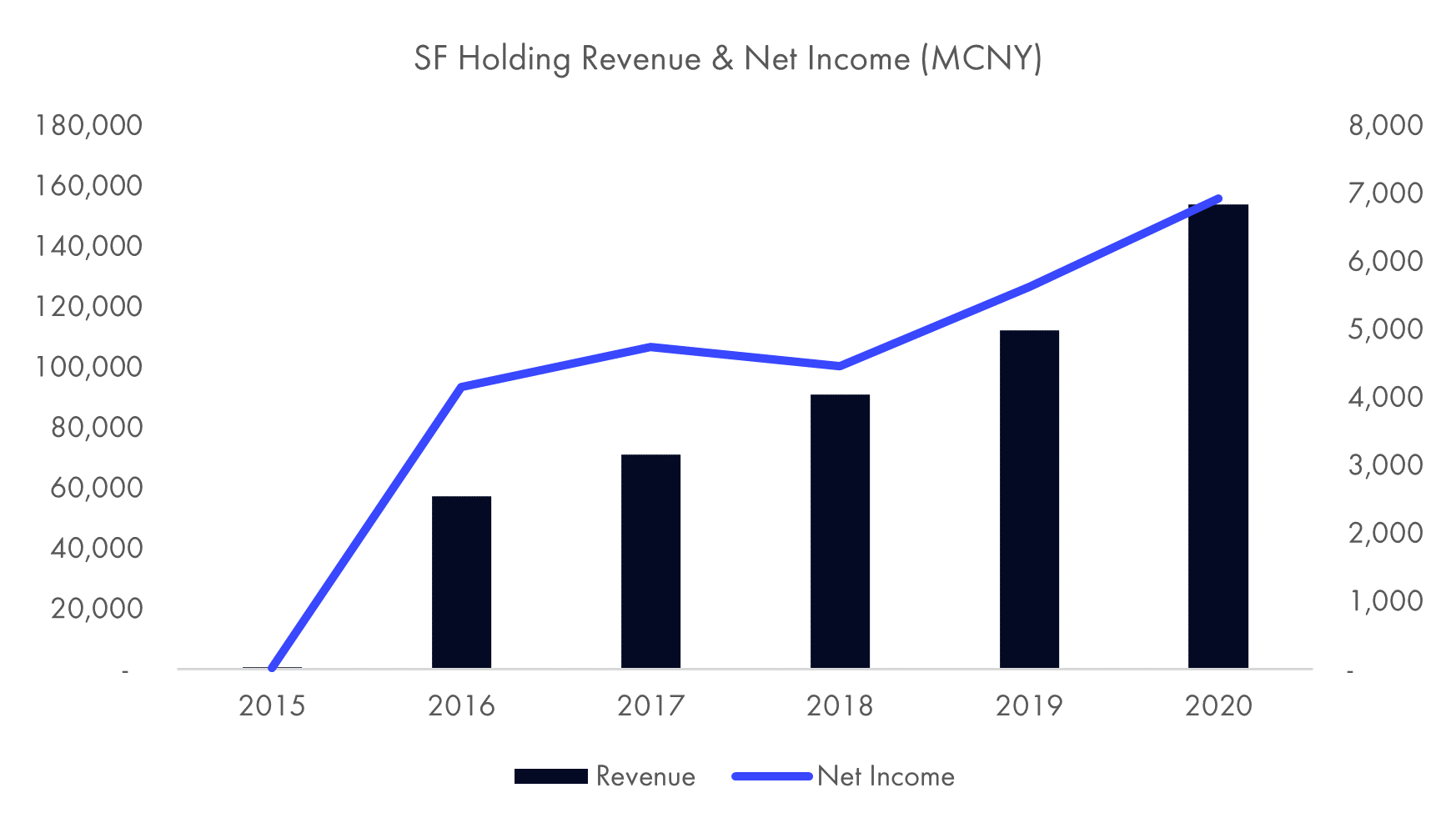

SF Holding’s 2020 revenue came in at CNY154bn, up 37% YoY, in-line with expectations. Its net income grew 26% YoY to CNY7.3bn in 2020, slightly missed consensus, mainly due to the lower GPM caused by land transportation infrastructure capex and growing mix of new business. However, the margin headwind is just a short-term sacrifice for the long-term development of the company. The aggressive investment in land transportation infrastructure follows the trend of SF’s growing land transportation business, and the ramp-up of the new businesses helps the company to reach a comprehensive layout as a leading logistics solution provider.

How did SF perform during 2020 and how was it affected by COVID-19?

Overall, SF Holdings performed well and handed in satisfying results in 2020. During the COVID-19, the company continued providing high-quality services thanks to its strong management and operating capabilities and took the opportunity to gain more market share. Besides, the company seized market opportunities of growing high-end e-commerce demand during the epidemic. The business volume of high-end e-commerce customers has increased significantly, relying on the differentiated services with high quality.

Recently, SF announced that it merged with Kerry Logistics. Why SF choose to merge Kerry Logistics? How will the merger add value to SF’s current business?

SF’s merger with Kerry Logistics is to improve the business layout of the company. Kerry Logistics has a wide coverage network of international freight forwarders, which is a make-up for SF’s current weakness in shipping & international logistics & custom clearance capabilities. With current solid client base, SF targets to provide one-stop solutions to clients in the future, and help Chinese businesses expand in overseas markets. The M&A with Kerry Logistics is expected to create synergy after integration, and further enhance the company’s competitiveness in international business and supply chain business, to become an integrated logistics service provider.

Which are the key drivers and challenges for SF Holding that we should follow during the coming twelve months?

With the recovery of the macro economy, we expect SF to benefit from more high-end consumer goods express business. The construction of the land transportation network is expected to be completed in the second half of 2021, and the increase in utilization rate will thus drive the growth of gross margin and earnings. The fierce competition in mid/high-end logistics market and uncertainties in land transportation network construction could be the key risks for SF in the following twelve months.