Nordic Asia's IPO Pipeline - 2021 Key Watchlist

2021-01-27Nordic Asia Team

Följ oss på:

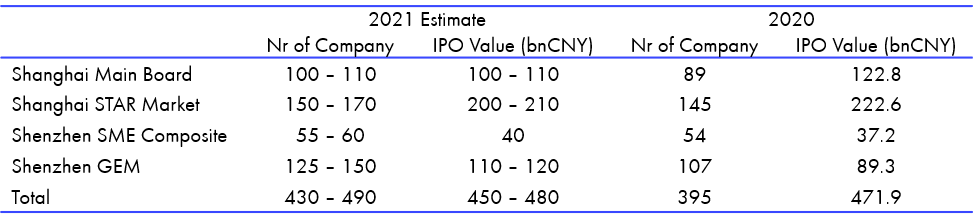

2021 IPO market outlook

Looking forward, the Chinese IPO market is expected to keep booming due to the new pattern of "double cycle" and the strategic opportunity of the central "14th Five-Year Plan" to enter a new stage of development, a number of supporting factors are good for the capital market and focus on the promotion of the full implementation of the registration system.

* PwC estimate

* PwC estimate

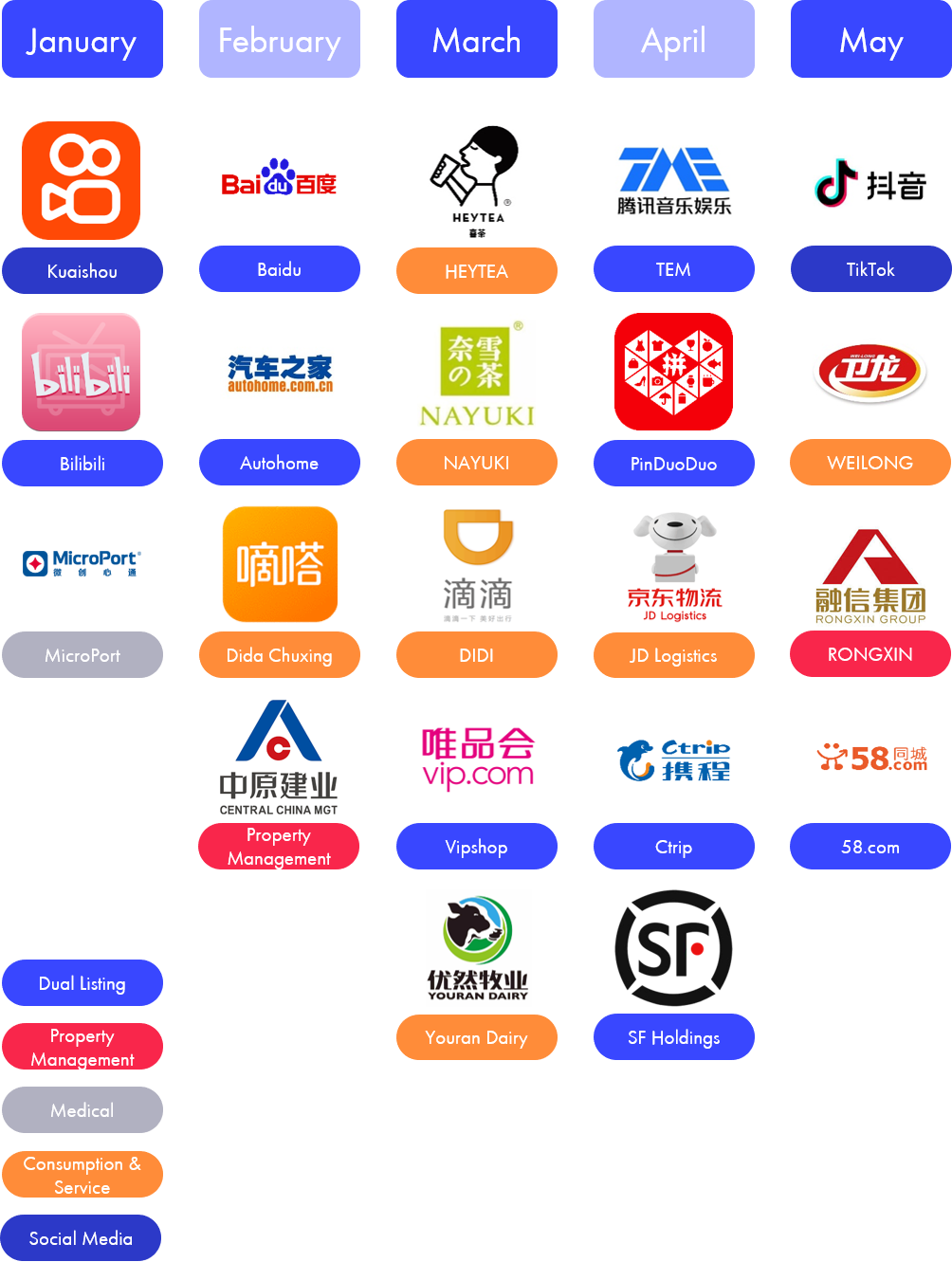

Expected Upcoming IPOs

According to reports, many Chinese technology companies are preparing for the IPO next year.

According to reports, many Chinese technology companies are preparing for the IPO next year.

- DiDi, the car-hailing company, is considering an IPO of billions of USD in Hong Kong next year. Due to escalating tensions between the United States and China, the company reconsidered its previously plan of listing on NYSE.

- JD Logistics, the third unicorn company of JD Group, is alleged to selected Bank of America and Goldman Sachs to prepare for this year's Hong Kong IPO. The company's valuation may reach about US$40 billion.

- ByteDance, the world's most valuable unicorn to some extent, is planning to make TikTok listed in Hong Kong.

- Kuaishou, a short video application that competes with TikTok in the Chinese mainland market, applied for an IPO in Hong Kong, raising up to US$5 billion and the company's valuation was as high as US$50 billion. According to reports, Kuaishou plans to be listed on the Hong Kong Stock Exchange as early as the end of January 2021.

- Bilibili is planning to go to Hong Kong for a second listing next year. Bilibili's fundraising may be as high as US$1.5 billion.

- As the U.S. exchange imposes more and more stringent regulatory restrictions on Chinese companies, Bilibili will also join the growing list of Chinese companies listed in the United States that are going to Hong Kong for dual listing.