Nordic Asia Investment Group - Newsletter May 2023

Dear Investors,

Hope all is well in the recent month,

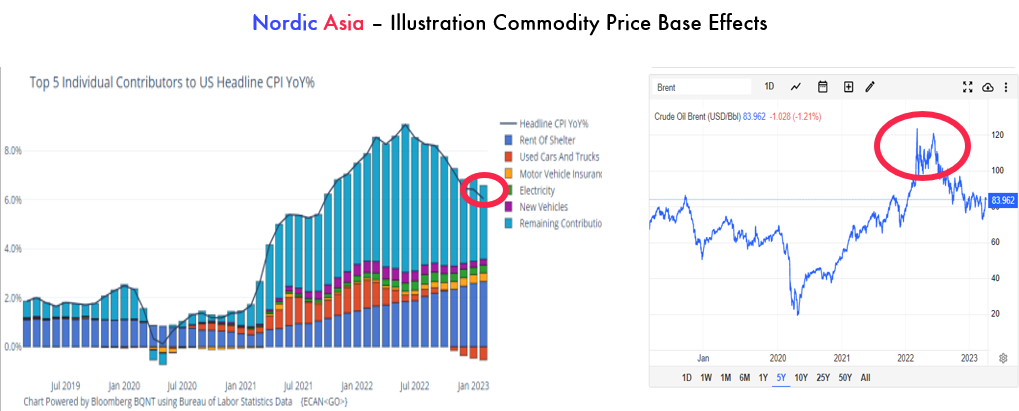

As discussed in our previous newsletter, the fallout of the SVB event earlier in April started to stabiles after the FED “Non-QE-QE” BTFP program as yields declined across the board and even the 2-year US treasury yield dipped below 4% despite the most recent rate hike to 5.25%, i.e. further implying market expectations that the FED will pause or revert its rate hiking cycle for now. Although this is a good sign for the financial market, the underlying issues (i.e. inverted yields effect on banks as described in the previous newsletter) pressuring financial institutions persists. Looking at the inflationary numbers in Europe this month, Eurozone saw preliminary inflationary numbers for April pick up again to +7% YoY and UK inflation stood at 10.1% in the latest march figure. However, one should still take into account the declining base effects of the high energy prices that were at “ATH” during this period last year.

Going forward, especially towards the second half of this year when the base effects of the high energy prices in H1 2022 subsidies – then there’s a risk for a positive contribution to headline CPI again from energy commodities. If this recurs, one cannot rule out a possible period of continued inflationary environment ahead until the fundamental problems of inflation gets resolved.

Domestically in China, despite weaker overall manufacturing PMI numbers in April (49.5) – service PMI remained at a high level (56.4) and domestic retail sales level reached further highs (March YoY China retail +10.6%). Thereby, despite the other two sectors of Chinese economy might continue to slow down i.e. exports and new construction starts, domestic consumption, retail, services and second-hand estate market transaction volumes (i.e. renovation market / discretionary retail) are clear drivers of the economy going forward. This case was further displayed during the past week of “Golden Week” (the first long holiday since Covid-19 reopening) holiday tourism and retail numbers further gave strength to the recovery of the domestic consumption market.

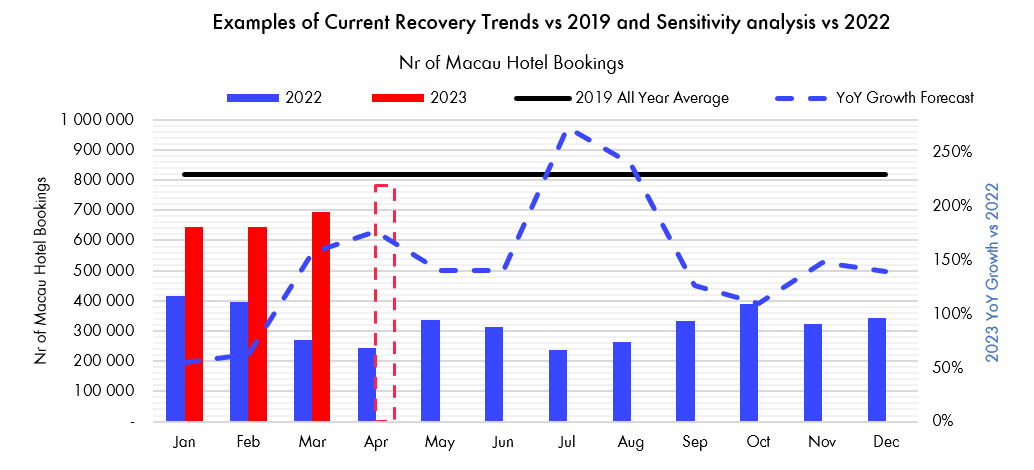

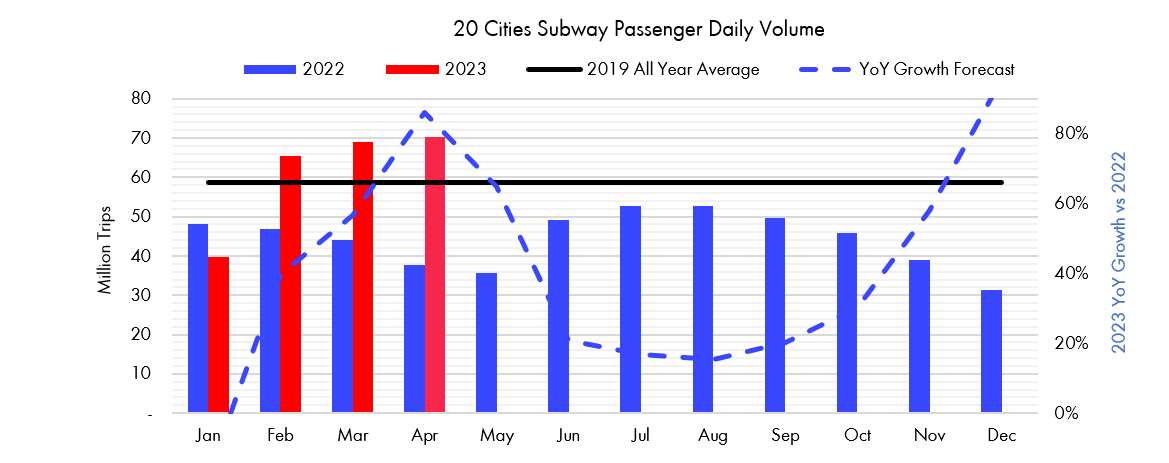

As the first long public holiday after the pandemic, China Labor Day holidays became the most popular travel period for China residents, leading offline consumption to recover almost back to 2019 level as expected. Overall, Passenger Volume resumed back as 103% as that of 2019, of which railway rebounded the most, exceeding that of 2019 pre-covid levels by 23%. Similarly, tourism and hotel business rebound are underway. According to official statistics, Tourists accumulated 270 million total, with a YoY increase of 70.83%, which recovered to 119.09% in the same period in 2019. Tourism revenue increased almost to 148 billion RMB, with a YoY increase of 129% and at the same level as in 2019. Regarding hotel booking, during May Day, hotel booking volume in one of the leading OTA platforms is twice that of 2019 and OCC exceeded 70%. Catering revenues surged during May Days, increasing by 62% YoY. According to Macau’s official report for the May golden week results showed that Macau’s hotel occupancy rate improved to approx. 90%, exceeding the Spring Festival level this year but still a bit below the golden week pre-Covid 19. Regarding International flights, despite international flights only recovering back to 39% as of 2019, It is estimated recovery will continue with the normalization of international travel as international flight capacity continues to improve.

Thereby, a promising sign is that the current recovery in the domestic market is on pace to recover back to 2019 levels across the service industry. If this trend continues for the full year, (i.e. most service industry, retail index levels return to approx.100% of 2019 during Q2-Q4) then due to declining the base effects from 2022 (see examples below) and the sequential recovery and seasonality factors in Q2-Q4 vs Q1, we should see quite favorable earnings reports with top line and bottom line improving more significantly in the coming quarters (Q2-Q4 2023).

This is quite aligned with our sensitivity analysis on this subject at the beginning of the year. However, the pace and the rate of the recovery back to 2019 levels were still uncertain back in Jan 2023. But now in April, the trend is clear and the Covid-19 drag on the domestic economy continues to subside. Of course, the next step up (i.e. further recovery above that of the 2019 level) could vary across sectors and be further dependent on the pace of disposable income growth / reduction of savings rate during this year.

Looking into our Q1 results of those portfolio companies (A-shares) who have published their results thus far, we can see a clear improvement on earnings as most companies have cut costs or incurred extraordinary costs during Covid-19 years. Thereby, due to positive operating leverage, bottom-line growth is picking up faster than of top line. Additionally, the companies confirmed the sequential improvements during Q1 i.e. March vs vs Jan-Feb 2023 and guided for further pick up in April vs Q1. (For example, Chow Tai Gook mainland China same-store sales improved to +20% in March 2023, and Juewei same-store sales improved to +95% of 2019 rate in April). Some of the more sensitive niche sectors such as Huazhu Group have given guidance on Q1 YoY growth to reach 61% - 65% and Ctrip Q1 topline is likely to double on a YoY% basis. Therefore, at this point and especially given a longer-term ownership horizon we think it’s a good opportunity for us to further concentrate our portfolio positions and especially in those firms whose underlying business fundamentals are improving and the earnings cycle has started to turn here in the first ”innings” of the China reopening process.

However, during this process as we continue to concentrate our portfolio, external market volatility and sector rotations within existing fund flows could create more shorter-term portfolio volatility especially for those companies listed in HK and those dual listed in the US. Furthermore, although the domestic market recovery is well underway, we need to continue to monitor the risks of possible “stagflationary” scenarios in the major developed economies especially towards the second half of this year. Many thanks again for your support and look forward to report back on the continued progress of the domestic recovery trend ahead,

Yining, Jason and the NA Team

5th of May 2023

Anjoy Food 1Q23 review and 2023 outlook

Anjoy food delivered a much stronger than expected result in the 1Q23 result. 1Q23 revenue was 3.2 BCNY, +36.4% YoY while net profit at 362MCNY, +76.9% YoY, marking the highest quarterly net margin of 11.3% in history. Gross margin was 24.7% (+0.5ppt YoY or +0.9ppt QoQ) while operating margin improved by 4.5ppt YoY thanks to strong cost and expenses control. Raw material procurement price was contained as Anjoy acquired Xinhongye and Xinliuwu which are the top two suppliers of freshwater aquatic raw materials in China. Anjoy also enjoyed strong growth in premium products of 50% YoY in 1Q23. Hotpot ingredients overall grew by 28.8% YoY thanks to low base and recovery of consumption use cases like catering channels. The ready meal segment continued its strong growth of 64.7% YoY driven by strong market demand and Anjoy’s quality products. Finally, Anjoy Food’s contractual liability, an indicator of unrecognized order, grew both YoY and QoQ which further boosted market confidence. Anjoy Food’s 1Q23 result was well above expectations and the company is benefiting from both channel expansion its B2C business during Covid-19 but now also seeing a recovery in its B2B business. We expect Anjoy Food will further expand by penetrating into group meal channel and expansion of premium products in the catering channel. We also see margin upside from the increase of premium product mix and efficiency gain in the ready meal segment which will be partly offset by the selling and marketing expenses in the coming quarters. Overall, we are positive about Anjoy Food’s future performance despite potential slight growth decline in 2Q23 due to high base. Anjoy Food is more likely to further beat expectations given the recovering consumption sentiment after China reopening.

Juewei Food 1Q23 review and 2023 outlook

Juewei showed an improved 1Q23 result that was in line with expectations in light of the COVID disruption in 4Q22 and Jan-2023. 1Q23 revenue was 1.8BCNY, +8.0% YoY while net profit was 137MCNY, +53.7% YoY. Net margin rebounded to 7.5% in 1Q23 vs. 4.9% in 1Q22. 1Q23 Gross margin declined YoY to 24.3% (-6.0ppts YoY or +1.8ppts QoQ) as COGS surged on the shortage of duck supply. We saw that the high raw material cost started to decline since April-2023. Nonetheless, the 1Q23 operating margin was 9.9%, vs. 7.6% in 1Q22, thanks mainly to a decline in selling and marketing expenses, which nearly halved YoY due to the exit of franchisees subsidization after China reopening and lapping of the impact of stock incentive expenses in 2022. Management indicated that the same store’s recovery reached above 95-96% of pre-COVID level in April-2023 which confirmed our expected recovery trend. Management also claimed a better-than-expectation store expansion in 1Q23 despite less subsidization to the franchisees. Overall, we are seeing that Juewei’s fundamental is in improving a trajectory that is consistent with the larger offline recovery. The continued store expansion plan of 1,000-1,500 stores per annum since 2020 will further support the revenue growth. Juewei’s margin is likely to gradually improve on declining raw material costs, lower selling and marketing expenses, and improving operating leverage amid recovery thereby earnings is likely to outpace topline growth for the full year 2023.

Robam Appliance 1Q23 review and 2023 outlook

Robam delivered an in-line 1Q23 result with revenue at 2.2BCNY, +4.4% YoY while net profit at 389MCNY, +5.7% YoY (NPM: 17.9%, +0.3ppt YoY). Gross margin was 54.8% in 1Q23 vs. 52.6% in 1Q22 thanks to decline in raw material cost, which confirmed the GPM increase trend in 4Q22 that indicated by management. However, selling and marketing expenses ratio remained high at 30.9%, +1.9ppt YoY, due mainly to the investment in promoting new product groups of dishwashers, integrated stoves and steam & bake ovens. Hence, operating margin increased to 21.1% by only 0.4ppt YoY. By channel, management indicated a recovery in the traditional retail channel with 6% YoY growth while 20%+ YoY growth in the lower tier channels. We also saw strong growth in the developer channel of 38% YoY as Robam further captured the market with its comprehensive product portfolio and services. Robam saw increased developer orders in 2H22 and 1Q23 due to the exit of competitors.

In 2023, Robam will attract customers by different product tiers and different channels in order to achieve steady development. On the product level, Robam plans to capture the trend of diverging consumer behavior by attracting both high-end and mid-low-end consumer groups with dual brands, Robam and Mingqi. Robam will be the core brand for high-end consumer groups with new categories continued expansion in dishwasher, integrative stoves, etc. Meanwhile, Mingqi, the acquired brand, will provide affordable products to mid-low-end consumers. The operation team of the Robam brand has taken over the Mingqi operation in all channels which have delivered positive outcome. On the channel level, Robam plans to acquire more home renovation customers by proactively penetrating the local appliance stores and home renovation designers (companies) which rose as large retailers like Suning and Gome fell. Moreover, Robam is executing proactive retail channel expansion by leveraging the extensive Tmall and JD stores network in lower-tier cities. Robam has now penetrated >10,000 out of 30,000 POS among the lower-tier network which provided extensive customer exposure. Such channel recorded >30% YoY growth in 1Q23. Overall, we expect Robam to achieve a steady growth in 2023 given the recovering real estate market and consumer sentiment. Usually the renovation market trends to lag that of transaction volumes by a period of approx. 4-6 months. Thereby as we are seeing a pick up in overall second hand sqm transactions in Q1, the subsequent recovery release of home renovation demand is expected to pick up during the second half of the year.

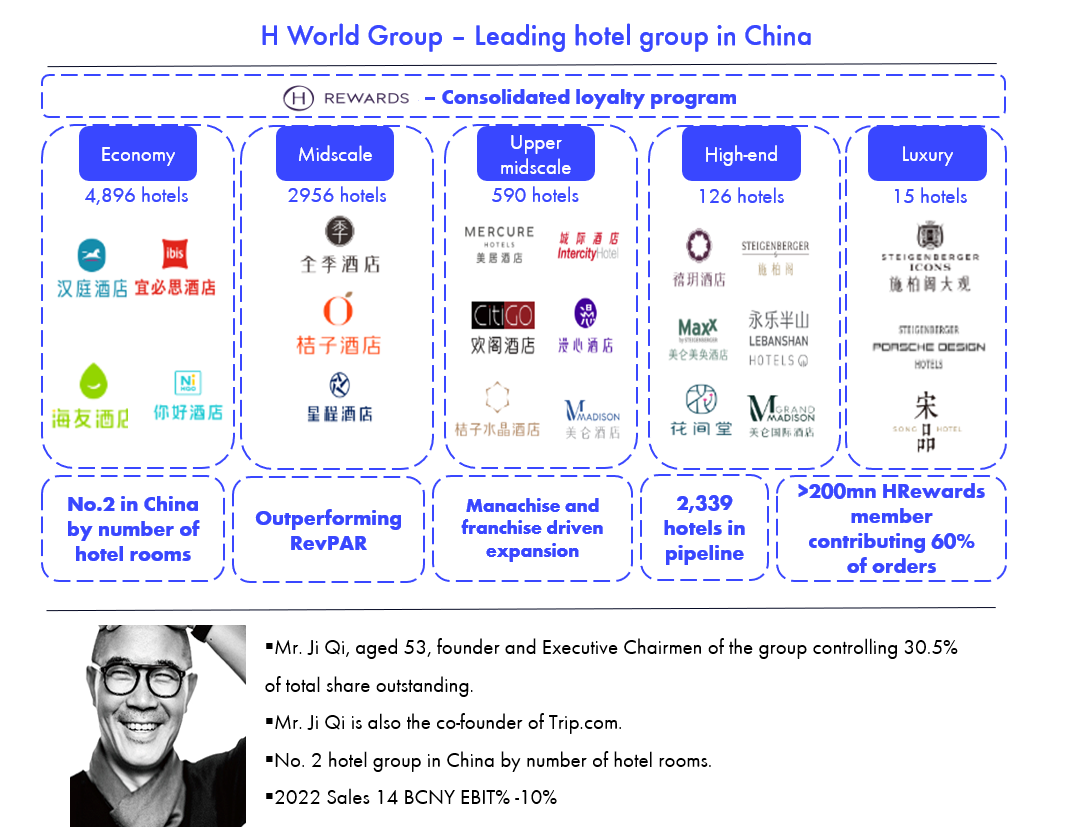

**H World Group **

H World Group is the second large hotel group in China. The group started as an Economy hotel brand called Hanting in 2005 then gradually expanded along with the fast-growing China market. In 2010, H World Group was listed on NASDAQ and started its midclass hotel expansion by launching its first outlet of the Ji Hotel brand in Shanghai, capturing the trend of consumption upgrade. Then H World Group started its venture of developing a higher-end hotel chain by expanding Ji Hotel, acquiring StarWay, and forming a strategic corporation with Accor Group. The group also developed a consolidated central reservation system (CRS) much better than its peers Jinjiang and Capital Tourism Group. As a result, H World Group become the first hotel with an inter-connected CRS and loyalty program in China. In 2017-2020, the group further acquired Crystal Orange and DH Group for more premium hotel brand expansion while launching its own luxury brands Blossom and Joya. Now, H World Group has evolved into a hotel management group managing 8,592 hotels (820,099 hotel rooms) that cover>400 cities around the world.

H World Group’s core strengths are the outstanding management and better than domestic peers’ hotel products. Currently, China hotel market is still in a developing stage with ~78% of the hotels being limited services hotels (Economy and Midscale). Starting as an economy hotel chain, H World Group has developed a solid foundation in efficiency utilization. The group demonstrated a strong track record in the domestic market with RevPAR that outperformed the industry across the economy, midclass, and up-class while providing high-quality products (location, decoration and services). H World Group also enabled higher efficiency by its highly developed CRS (Central Reservation System) which improved customers’ experience with a consolidated loyalty program and provided steady customer sources for the group. As a result, CRS contributed 60% of H World Group’s orders. Leveraging its strong track record and products, H World achieved ~6x expansion via franchised and mechanized model in terms of the number of hotels. By adopting the mechanized model, franchisees could enjoy management outsourcing, a consolidated procurement system, and stable customers source from H World Group in exchange of a 10-12% take rate of hotel turnover vs. OTA’s ~15% take rate without stable customer source for individual hotels.

On the market level, China’s hotel market is currently fragmented with only 35% of hotel rooms for the hotel chains vs. >60% in the developed countries meaning room for further market consolidation ahead by the leading hotel groups with their CRS and mechanized model. H World Group’s total China hotel market share was is only around 4-5%. Thus, there’s significant room for further expansion of H World Group Hotel group in both the high end market as well as penetration more lower tier cities with its economic offering coupled with further regional expansion supported by solid management, high quality products and a comprehensive brand portfolio to further lift earnings growth after 2023 recovery phase.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.