Nordic Asia Investment Group - Newsletter April 2024

Inflation's True Course: Navigating the Path Ahead

As we navigate through the intricate interplay of monetary policies and statistical accounting methods, it becomes evident that despite a temporary decline in headline Consumer Price Index (CPI), underlying indicators reveal persistent high core inflation and risks for higher than expected CPI during 2024

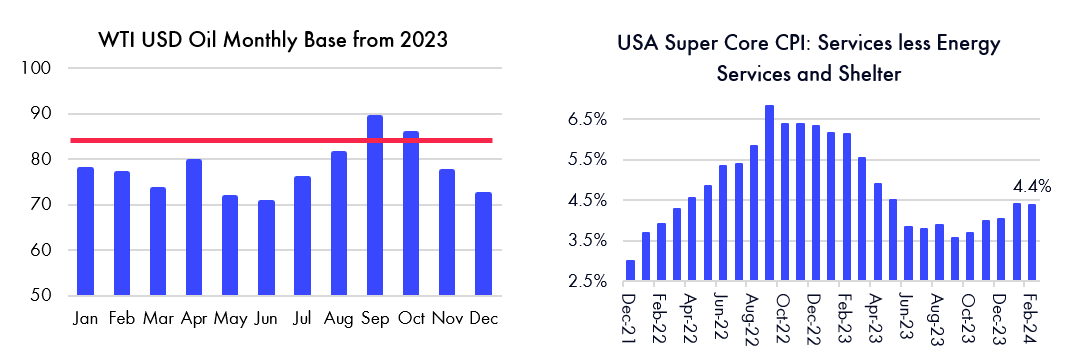

As we highlighted in January 2023, inflation is primarily a monetary phenomenon, its sensitivity to base effects from the previous year accentuated by statistical year-over-year (YoY) accounting methods. While inflation moderated during 2023, much of the decline in headline CPI stemmed from favorable high base effects driven by elevated oil prices in 2022. However, core inflation in the USA remains stubbornly high at 3.8%, notably in service and rent inflation, with some subcategories even experiencing increases. With the anticipated fading of favorable oil price effects, particularly from March onwards, a resurgence towards 4% in headline CPI for the USA this year is plausible. Such a scenario might prompt the Federal Reserve to further reconsider their rate cut guidance and inflation outlooks for 2024 and beyond. Thus, it remains premature to anticipate a meaningful turn in the current inflation and economic cycle.

- Inflation, seen as monetary-driven, is influenced by statistical YoY methods and past base effects.

- Despite a 2023 decline, much of the drop in headline CPI was due to favorable base effects from 2022's high oil prices.

- Core inflation remains at 3.8% in the USA, with stubbornly high rates in service and rent inflation.

- Anticipated fading of favorable oil price effects may push headline CPI towards 4% in the USA this year.

- Potential CPI increase could prompt the Federal Reserve to reconsider rate cut guidance.

- Current inflation and economic cycle change remain uncertain.

China Macro Overview

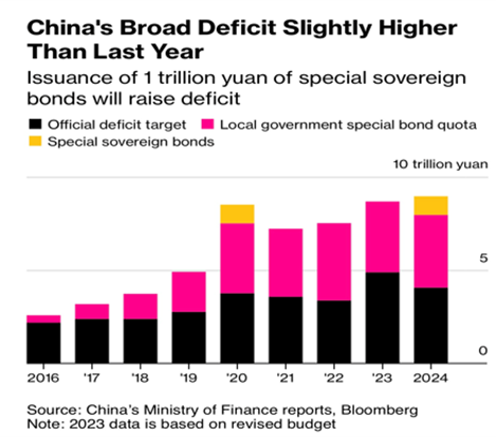

In China, the recent two sessions held earlier in March affirmed our anticipated targets for 2024, with GDP projected at 5% and inflation between 2-3%. While the base effect from Covid-19 supported a 5.2% GDP growth in 2023, achieving this year's 5% target implies a higher "real" GDP growth rate due to elevated base comparisons. Although no major fiscal stimulus package was unveiled, fiscal policy measures for this year are expected to approximate or slightly exceed those of 2020.

Despite persistent challenges, such as a the drag from the new build property construction sector, we foresee attainable GDP growth driven by sustained domestic consumption and investments in manufacturing and infrastructure. Moreover, export growth to Southeast Asia and other regions, coupled with currency effects and a rise in higher value-added export products, could bolster exports in 2024. Especially when consideration the nominal GDP outlook for 2024, due to negative inflation in 2023, this year’s inflation is poised come back to approx. 1.5% - 2% as the base effects from pork prices and oil reduces during year. Therefore, compared to last year, nominal GDP could come in much higher in 2024 than 2023 since inflation was negative last year.

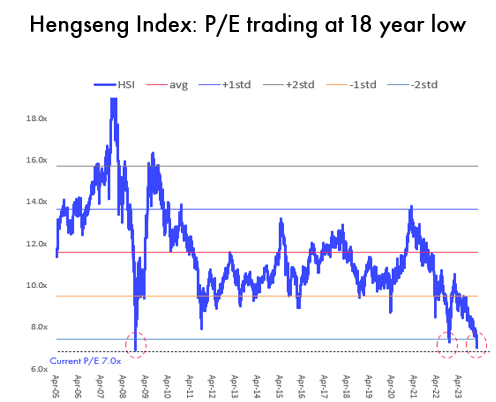

However, the current domestic real estate market is still quite weak given the start of the year thus far while the transaction volumes in the secondary property market is continuing to increase as % of total market transactions. As secondhand property prices are more affordable and usually have better location than that of new built. However, thus far we have continued to see further removal of previous purchasing restrictions. For example Hangzhou (tier 2 city) lifted all of its purchasing restrictions earlier this year and the 5-year LPR was cut by 25 bps earlier in Feb. Given the low base effects and more guidance on providing more support to real estate developers for financing and restructuring along with government led “urban renovation projects” and “public affordable housing projects”. There is still a high likelihood that we might see a gradual moderation of the decline in the property sector and possibly even report YoY growth number during a particular month’s data during H2 2024. Despite this, valuations across the Chinese and HK market are still very low from historical point of view but if China macro and micro continues to show steady improvement then longer term fund flows might start to come back to this sector during 2024.

Outlook

From a microeconomic standpoint, we have observed a notable surge in market activity and brokerage involvement. Our recent participation in the Guangfa Securities Spring Investor Conference in Guangzhou serves as a prime example. With over 4,000 investors in attendance, the increased interest contrasts sharply with the subdued mood and lower participation levels witnessed in Q4 last year.

Looking ahead in April, since we know Q1 last year 2023 was quite strong base. Therefore, if China Q1 (April print) could reach to close 5% then the remaining part of 2024 economic growth should be even easier to beat given lower base effects for most of Q2-Q4 2023 especially nominal GDP growth is likely to pick up further given uptick in inflation during this year.

During our Q&As with mgt our sense is that from a company guidance point of view that the full year guidance in 2024 is slightly more cautious vis-à-vis the economic cycle and macro-outlooks for this year. But likewise, last year in Q1, mgt guidance was slightly more optimistic than actual growth recovery in H2 2023.

However, we do expect global markets to continue be quite complex given an uncertain inflationary path ahead and if overshoot it will cause ripple effects and higher volatility across major currencies, bond and rate markets etc. But due to an “inverse” economic cycle and more prudent monetary policy in China and historical low valuations. We are seeing an increased activity and interest to our segment recently and if the property market will shows further signs of stabilization then that could drive further fundflows to our sector during this year.

- Company guidance for 2024 leans slightly cautious compared to last year's optimism, while macroeconomic conditions and fiscal policy more proactive in 2024

- Global market complexity persists, driven by uncertain inflation paths, potentially leading to increased volatility.

- China's prudent monetary policy and low comparison bases for 2023 suggest a gradual recovery trajectory.

- Expected uptick in inflation contributes to the outlook for nominal GDP growth in 2024.

- Company level performance and cash generation at all-time high levels with further room for increased shareholder returns.

Portfolio Snapshots

BEKE Holdings

BEKE released 4Q23 result with revenue at 20.2BCNY, +20.6% YoY while adj. net profit at 1.7BCNY (8.5% margin). Existing home GTV was +30.1% YoY that in-line with the market development. We saw take rate in existing home transaction reduced due to direct commission rate cut and dilution from BEKE’s non-Lianjia network expansion. New home GTV declined by 9.7% YoY, vs. market’s -20% YoY. Nonetheless, we saw take rate increased despite higher GTV contribution from SOEs, which indicated BEKE’s gain of market share. Home renovation recorded 73.9% YoY revenue growth but suffered margin pressure (-2.1ppts YoY), on BEKE’s promotional initiatives. Looking ahead, we expect BEKE’s GTV could drop in 1Q24 due to high base and weak market conditions still in Q1 2024 despite continued uptick in secondhand home transactions. Momentum of home renovation segment remained strong under investment cycle but with margin pressure in 1Q24 on seasonal impact. We maintain our view that BEKE could significantly benefit from increased activities during the recovery phase of the real-estate sector, especially on increased transactions of secondhand homes and within its home renovation business.

H World Group

H World Group released an in-line 4Q23 result with revenue at 5.6BCNY, +50.7% YoY while adj. net profit at 657MCNY on 362MCNY impairment loss. Legacy Huazhu achieved 4.4BCNY revenue in 4Q23, +59% YoY, with RevPar at 228.6CNY (+19.7% vs. 4Q19) supported by resilient ADR. Net hotel opening was 235. Adj. EBITDA margin for legacy Huazhu declined by 12.7ppts QoQ to 29% in 4Q23, due to seasonality and 200MCNY impairment loss. Legacy DH recorded 1.2BCNY revenue in 4Q23, +26.5% YoY only with RevPar at 73.4EUR, +1.4% YoY. Adj. EBITDA margin for legacy DH was at -0.1% on DH’s effort in costs control.

Management guided +11-15% YoY revenue growth ex. DH in 1Q24 while 8-12% YoY revenue growth ex. DH in 2024, indicating flat to slight positive growth of legacy Huazhu RevPar which is in-line with our view in start-2024, and gradual recovery of China business travels. H World also plans 1,800 hotel gross opening while 650 closures with upgrade in both product and services, toward upper-midscale hotels. Management also guided light-asset model transformation for legacy DH which would further support the bottom-line. We think H World’s RevPar is well supported by the mix upgrade despite the low-tier penetration. we continue like H World’s solid hotel portfolio and strong management.

During this period, we also started to look at its smaller peer named Atour, a newer hotel group founded by one of ex-H World senior executives. Atour now operates ~1,200 hotels (compared to H World of approx. +9,200 hotels) mainly at upper-midscale level. Atour penetrates the market with 4-star hotel services and Huazhu-like model, which led to slightly higher ADR with fully franchised managed business model with quite room for further expansions due to limited footprint in China so far.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.