Nordic Asia Investment Group - Newsletter August 2023

Dear Investors,

Hope all is well and that you’ve had a good summer vacation during the month of July,

Entering H2 of 2023, we think this could be quite an eventful fall due to the following possible scenarios:

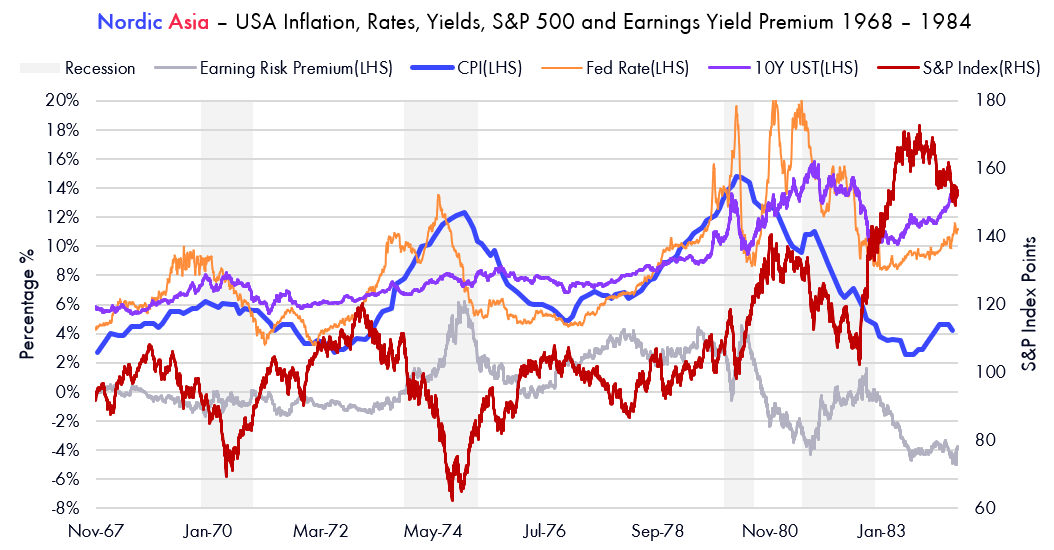

First, as we have written since the beginning of this year, the single most important variable to guide investment decisions this year is the analysis and outlook on the current inflation cycle. In our previous newsletters in Jan, we shared our internal analysis on the inflation cycle in the USA during the 1970s that showed more cyclical periods of inflation before finally stabilizing around the 2% target.

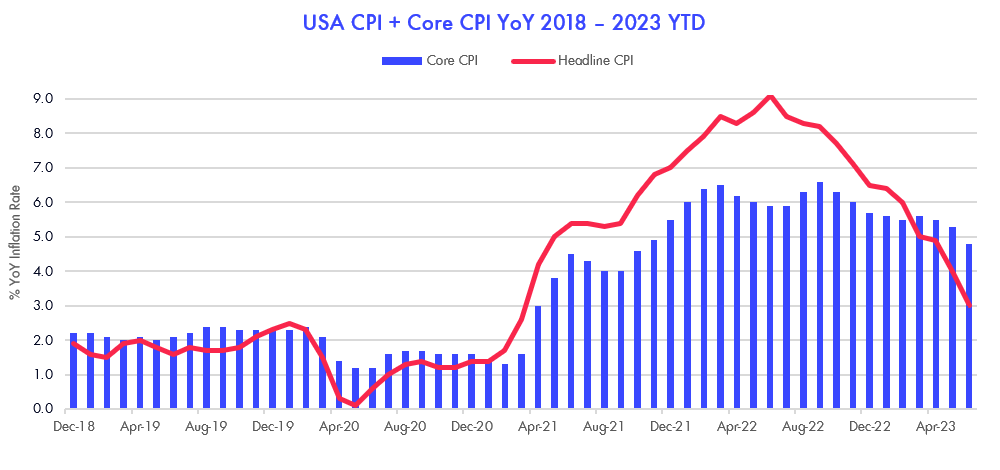

Looking into this year's US inflationary numbers thus far, since February, the high base effects from energy commodities have helped to cool off headline YoY CPI% and guide down inflation expectations, while core CPI has remained around the 5% average. However, the accommodating high base effects from energy prices will wear off gradually this fall, and therefore inflation expectations might change if inflation related data surprises on the upside.

Recently, we’ve observed both an uptick in WTI oil prices (which touched 83 USD) and continued MoM wage growth in the US labor market. As we are entering H2 2023, if oil prices (WTI) reach 85 USD or higher then YoY commodities CPI component might turn positive already in this September's CPI number (published in October).

Furthermore, service inflation, which accounts for approximately 40% of the CPI weight, is highly correlated with labor market wage growth. Currently, service inflation CPI YoY growth is below YoY wage growth, but history shows the ‘gap’ is transitory. Therefore, if this ‘gap’ narrows along with the reduced base effect from commodities, then we cannot rule out the possibility that headline CPI reverts to around 6% by December's CPI print (published) in January 24 or earlier.

Now domestically in China, June retail sales came in at +3.5% YoY due to a high base in June 2022 (pent up demand after March – June Covid-19 lockdown). But looking more in detail in the data, most industries showed a MoM improvement vs the month prior, especially in the services sector, as Caxin Service PMI moved up to 54.1 in July. But private sector investments and estate market sales remained weak. Therefore, the focal point in the Chinese domestic market during this month was the politburo meeting and possible stimulative counter-cyclical measures to kick off the next private enterprise capex cycle.

Based on the above, the CCP Politburo Meeting was held on July 23rd and during the meeting, the government pledged to strengthen the counter cyclical adjustment, stimulate domestic demand and support private sector development, delivering affirmative signals to strengthen the Chinese economy via a series of counter-cyclical measures such as:

-

Restore private sector business confidence through 31 measures (announced on the 19th of July) to boost the confidence of private enterprises and support their operation and expansion. To ensure a level playing field for private business vs state owned business and revitalize the domestic capital market.

-

Expand domestic demand: Consumption is considered as the key component of domestic demand and the government would make efforts to increase residents’ income and boost discretionary consumption via 20 measures (announced on the 28 of July) to enhance wage growth and consumption spending in service, automotive and home renovation & appliances.

-

Stabilize real estate market growth and expectations: As the property market continued weakening this year, the central government has announced measures for megacities to restart migrant worker housing projects and improve public infrastructure, as well as reduced mortgage rates and the removal of certain purchase restrictions.

-

Fiscal and Monetary Countercyclical adjustments: Central government urged local governments to complete the issuance of infrastructure project backed bond issuances and lower the tax burden on SME companies and lower income groups and guided for further reduction of RRR and interest rate burden. Also, the central government vowed to initiate a “basket resolution” for managing existing local government debts.

Overall, the message of the politburo statements was more stimulative than expected, for example, where “活跃资本市场” (revitalize capital markets) was added and the restrictive tone of ”房主不少” (Real estate is not for speculation) was removed. The statements from the CCP Politburo Meeting can be viewed as high-level guidance for further detailed sector specific policies. Since then, specific measures related to 1-4 have been published almost on a daily basis, for example calls for banks to reduce existing mortgage rates for homeowners via refinancing tools and classifying homeowners with repaid mortgages as “new homeowners” in order to reduce the down payment percentages for second homeowners. Specific tax reduction measures such as lowering corporate tax rates for SME and micro businesses from 25% to 20% and reduced VAT or exempting VAT for small scale businesses, and extending the 10% VAT exemption for purchases of EV-cars along with further guidance on monetary easing to further reduce banks required reserve ratios and interest rates. We have previously emphasized the importance of the private sector for the domestic economy and the current lag in the private sector capex investment cycle post Covid-19. Therefore, based on the announcement of the politburo meeting statements above, the focus is clearly targeted to restore private sector business confidence and to further improve domestic demand.

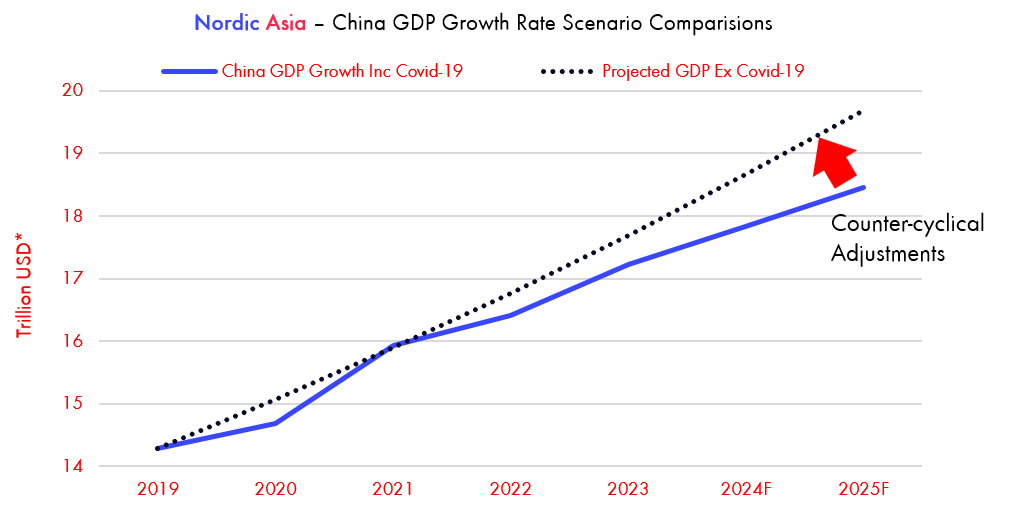

The rationale behind these measures and possible implications for domestic economic growth could also have been influenced by the need to restore the economic growth trajectory back to “pre-covid’ growth path. I.e. during the “Covid-19” years (2020-2022) the average real GDP inclusive of 2023 target of 5% is approx. 4.6% during this period. If we exclude the base effects from 2022, GDP in 2023 would reach an adjusted real growth rate of approximately 3.5%. Looking into the longer trajectory of China GDP targets for 2035, which include doubling its GDP, this target implies a compounded growth rate of +5% from 2022 to 2035. Therefore, the more stimulative than expected measures could be seen as a more decisive counter-cyclical cushion to push GDP growth faster back to its longer-term trajectory path of 5% (ex Covid-19 base) and lift inflation back to its 2-3% target range. Please see the illustration in the scenario comparison chart in the next section.

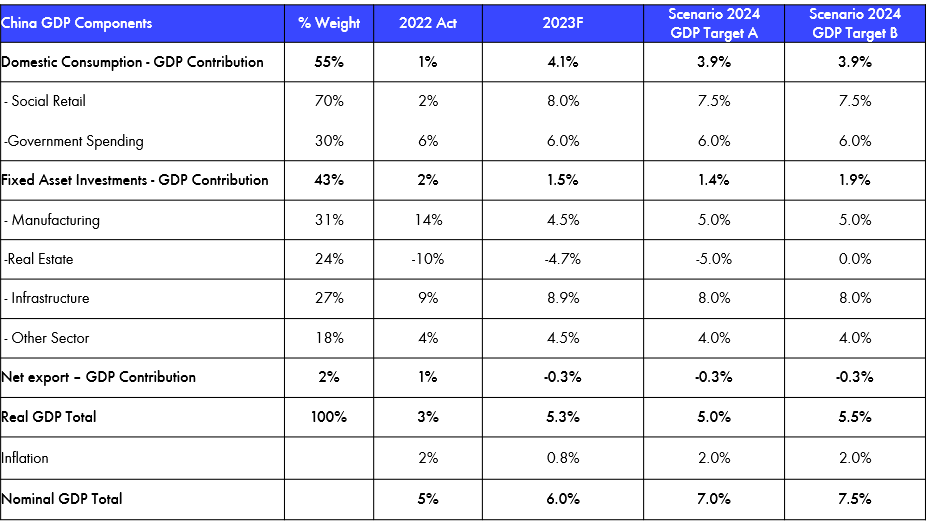

Therefore, if the goal of the announced policy measures is to “narrow” the gap in the longer-term GDP growth rate, then the GDP targets (excluding base effects) might need to reach +5%-5.5% going into 2024 and 2025. Therefore, a possible growth target for next year based on its subcomponents could manifest in a targeted growth scenario such as the one below:

I.e in the ”Post-Covid 19” years ahead, domestic retail sales need to reach above +7.5% (ex-Covid-19 base), inflation needs to climb back to 2-3% and reverse the current GDP drag from the decline in new real estate projects in order to fulfill its “counter-cyclical” target. Thus, for our portfolio companies, these accelerated domestic accommodating policy announcements are very welcome, but at the same time, we need to continue monitoring the effectiveness of these policies and gather more specific and improved data points. But the direction is clear, and despite a complex external environment, the Chinese economy is much more driven by domestic growth factors today compared to before.

Internally within Nordic Asia, we’ve continued to implement our current portfolio concentration strategy, and we’ve reduced the total nr of holdings from 16 to 14 during this month with the aim to further reduce it to 12 by the end of this Q2 reporting period. Nordic Asia Investment Group and our business are well positioned in this converging business cycle, and hopefully, with the accommodating policy push above, it could further support our growth momentum in H2 and beyond.

Thanks again for this and looking forward to having you visiting us later this year.

Best Regards Yining, Jason and the NA Team 7th of Aug 2023

H World Group 2Q23 Operational Update

H World Group released a positive 2Q23 operational data preview. Domestic (Legacy Huazhu) RevPar was 349.5 CNY and recovered to 121% of 2Q19 level, with April at 127%, May at 115% and June at 123%, better than the previously guided 110-115% recovery and market expectation. The strong RevPar recovery was driven by very strong ADR and OCC recovery. ADR was at 305CNY in 2Q23 (129.2% of 2Q19 level), while OCC was at 81.8% (101.5% of 2Q19 level), possibly due to continued release of pent-up tourism demand. The new opening was 374, offsetting by closure of 216 due to carryover from last year. Hence, a net adds of 158 in 2Q23 was slightly lower than expected. Pipeline was increased to 2,808 in 2Q23 vs. 2,304 in 1Q23 while new hotel signings reached 1,000+, reflecting the rising confidence of franchisees. Overseas (Legacy DH) RevPar was 117EUR in 2Q23, equivalent to 111% of 2Q19 level (vs. 94% in 1Q23), also mainly driven by strong ADR of 83EUR while OCC also improved to 67.1%.

H World Group is one of the major winners in China’s current recovery phase, benefiting not only from the recovery of business travel but also from increased leisure demand. The group’s edge in product offering, membership system, and management capability, along with expansion during Covid-19 is now bearing fruit. Also, H World Group’s strength in its mid-scale and economy hotel brands is likely to serve as a fitting choice for travelers at different price points.

Anta Sport 2Q23 Operational Update

Anta Sport released 2Q23 operational data that was in-line with our expectations. Anta brand recorded HSD (high single digit) YoY sell through growth, with HSD growth in the offline channel and MSD (mid single digit) growth in the online channel due to Anta’s strategy of clearing old inventory via online platforms. Channel inventory was maintained at less than 5x level, which is a healthy level. Discounts also improved QoQ without further deepening YoY. Management indicated the Anta brand did well, but there is still room for improvement during H2 2023. The company will further improve the product offering and promotional events by switching some marketing focus from high-priced products to more valued products to capture more consumption from the mass market.

FILA brand outperformed Anta brand with high-teens sell through growth in 2Q23 led by 60-65% YoY growth in online channel. Channel inventory also remained healthy at below 5x level with less discount QoQ and YoY. FILA found itself highly suitable to the online channel, especially on the surging live streaming platforms and Xiaohongshu. The improvement of FILA performance was also driven by the improvement of store structure (more large stores) and better product structure with more shoes. Other brands (Kolon, Decente), which enjoy high ASP and upward brand momentum in China, recorded 70-75% sell through growth in 2Q23. The outstanding growth of Descente +67% YoY and Kolon +100% YoY indicated the strong purchasing power of wealthy groups in China, along with strong product and channel power.

We maintain our favor in Anta Sport for the well-established brand matrix that covers consumers from different needs and price points and Anta Sport’s strong management capability that enables it to secure growth and profit even during Covid-19 years. Due to a healthier inventory level and reduced discounts, we should see Anta Sport’s gross margin gradually recover in 2023, and operating leverage effects should lift net profit margin in 2023.

Tims China – Meeting with CFO

We met with the CFO of Tim's China recently in discussion of Tim's China’s strategic development. The company operates ~700 stores across the country and expands rapidly in the under penetrated China coffee industry with its unique image of “Coffe + Hot Food” by leveraging on the well-established “Tim's Horton” brand. Currently, more than 50% of all coffee orders are served with hot food bundle packages. The company has successfully built its brand equity and is gradually ramping up its franchise store models. For this, the CFO reiterated that the medium-sized store model named “Tims Go” will be among the main store models in its further expansion and more suitable for smaller franchisees. The Tim's Go model operates a 50-80 sqm storefront with an initial investment of 400,000–450,000 CNY. The expected payback period will be 1.5–2 years at the store EBITDA margin at 15-20% level (for franchisees). The Tims Go Concept will help Tims China further expand its store network and serve as a good complement to its standard concept store network if the payback period can meet its target as new store sales ramp up and continue to improve in the “post Covid-19” period.

Furthermore, Tim's China has added new personnel to both the marketing team and product team, which could lead to more launches of signature products and new products to drive consumer traffic and consumer retention. As a result, product launch frequency will also be doubled to cater to the needs of building signature product series.

Overall, we think the market timing for Tim's China store expansion is currently quite favorable, since the overall coffee market penetration is still very low in China. However, it will require strong management focus, proper operational execution, and a combination of operating and financing cash flow investments to seize the current market opportunity and achieve its pace of store expansion plan of +2.700 stores by the end of 2026.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.