Nordic Asia Investment Group - Newsletter August 2022

Dear Investors,

Hope you have had a nice summer break during July / August,

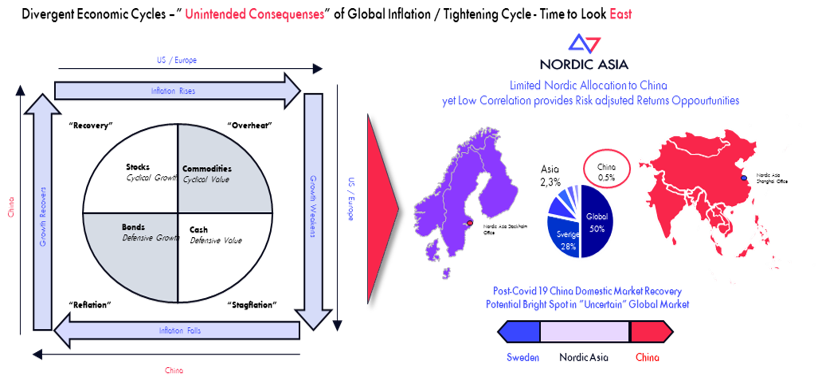

As we enter this fall, global market environment remains complex and is likely to further differentiate thereby portfolio strategy and sector allocation considerations will become even more profound and important as we enter a critical juncture of the global economy.

Since the start of year, we have written about the global inflationary pressure mainly caused by previous periods of aggressive monetary policy and rapid growth of money supply. Thereby as the growth in money supply is far greater than the growth in real economy (production of products and services) – the eventual “gap” becomes inflation. This “gap” becomes especially sensitive in those areas where “output” is further distorted by supply chain bottlenecks.

As Milton Friedman stated, “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output”. Since changes in real economy demand and supply balance are more structural in nature, therefore it is not surprising to see continued elevated levels of inflation unless the “gap” further narrows by adequate reductions in money supply. If interest rates dictate the “price” of capital – balance sheets size could reflect the “quantity” of capital. Thus, although higher interest rates will make capital more “expensive” and incentives more savings vs spending to reduce money supply in real economy, but can “price” alone be enough to rein in the money supply without a faster decline in total money supply i.e. “quantity”? Therefore, although we have seen a rapid pace of interest rate hikes, inflation could remain high as central bank balance sheets remain elevated as the pace of balance sheet reduction is quite gentle thus far.

If this high inflationary environment continues, then we should see a continued gradual decline in consumer demand as inflation and higher interest rates continues to weigh on consumer purchasing power. This on one hand this might be positive to combat high inflation level by reducing the overall level of demand and output of goods and services, but if inflations is more monetary driven then despite reductions in overall real economy demand / supply the continued “gap” of monetary supply vs production in goods and services could still cause elevated inflationary pressure. Hence, a possible prolonged period of stagflation cannot yet be ruled out.

In China however, the uneven pace of recovery continued in August as composite PMI remained slow at 53 vs July 54, mainly dragged by the manufacturing sector and gradual slowdown in the export sector. However, service sector PMI remained expansive although slightly down in August to 55 from July 55.5 as we continue to see sequential foot traffic improvements. During August, wholesale automotive sales remained strong especially the delivery of EV cars in August reached above +632.000 units corresponding to a +103.9% YoY growth. But nr of new residential apartment sold was still weak during the month down around -22.1% YoY in August as the new build sector is still ongoing structural policy driven shift to consolidate the market, reduce speculation, leverage, and excess capacity among local private developers.

In general, the key factors affecting the domestic consumption still boils down to the on and off situation of the current Covid-19 local flare-ups – during August the nr of cities affected by Covid-19 increased from mid-July of 45% to 53% towards end of August. Taking a step back, although domestic consumption stands for only 39% of total GDP as the structure of the economy is changing domestic consumption stands for more than two-third of GDP growth at the same time as service consumption proportion of the economy continues to grow. Service economy is also the key driver for new employment growth since manufacturing sector employment growth peaked in 2014. Therefore, the on-off effects of the Covid-19 and local flare ups continue to weight on the recovery path of the domestic consumption. But despite a patchy progress, overall offline traffic data e.g., subway traffic, hotel occupancy, domestic passenger flights and observed offline retail activity has improved significantly compared to late March - April – May period. Therefore, although the recovery is gradual the sequential improvement so far is still intact, and the gradual recovery of the service sector is highly welcomed.

However, in this process, the “dynamic zero Covid-19 policy” remains intact and we’ve observed quick responses to manage local flare ups, mass testing to cut off transmission chains to quickly normalize economic activity thereafter gradually. Therefore, absent a change in policy and based on more effective “dynamic zero Covid-19 policy” overall offline activity should remain around current observed levels with some locational variations i.e., still a gap vs “Pre Covid-19” but still much improved compared to Q2 2022.

On the monetary policy front, the PBOC continues its accommodating policies despite the tightening cycle externally. In August the PBOC announced further cuts to the five-year loan prime rate (LPR) by 15 bps from 4.45% to 4.30%- and one-year LPR rates by an additional 5 bps from 3.70% to 3.65% aimed at mainly reducing the mortgage rates to stimulate demand within the domestic property sector. Compared to same time last year, total five-year LPR cuts is now reduced by a total 140 bps YTD. Going forward, as domestic inflation rate is under control (Core CPI at 1%, CPI 2.5% – 3% range), there’s still further room for monetary easing later this year if needed.

Looking forward, we are now focusing on the economic policies to be further announced after the 20th party congress on the 16th of October. The CCP has two long term goals one in 2035 (GDP per capita reach to mid-income level) and other one at 2050 (GDP to reach per capita high-income level) these long-term goals require a growth rate around 5-6% in the midterm until the first goal is achieved and then a slight lower growth rate in the second phase. Therefore, during the beginning of this year the growth target for 2022 was set at 5.5% which was above market expectations. However, due to Q2 Covid-19 impact and continuing slowdown in the real-estate sector the current observed GDP run rate (H1 2022 2.5% GDP growth) is within the lower bound of the economic growth range. Therefore, further policy adjustments and/or growth reforms is likely to be announced after the 20th party congress to lift the domestic economy back to the acceptable range of economic growth rate.

Despite this complex market environment and gradual domestic market recovery, our portfolio companies despite Covid-19 in April demonstrate its resilience and strategic market position. For example, during this period Anta sports group grew +14% in H1 2022 while its main mass market brand Anta grew by +26% during H1 2022. Our companies within the F&B sector grew in average +22% during the second quarter partially due its less sensitivities of Covid-19 as an essential consumption product category. The EV car battery sector remained at triple digit growth rates due its structural growth niche and favorable policy conditions. However, the global smartphone market declined during the period as global smartphone demand remained weak due to Covid-19 and softer economic outlook, this intensifies the competition for Android based smartphones especially in the mid / low range category affecting sales of Xiaomi and Will Semiconductors (CMOS) camera sensors negatively during Q2.

Looking further into H2 2022, global market environments remain complex and if inflation remains high, it will continue to put upward pressure on the long-term yields at same time as economic conditions tightens in the export market. However, domestic demand fundamentals are expected to continue its sequential improvements ahead, driven by overall foot traffic improvements, domestic pent-up demand and sequential service sector improvements. During the upcoming mid-autumn festivals, we’ve seen flight booking more than doubled and train tickets sales increased more than five-folds vs same period last year. Therefore, normalization of effective “dynamic zero Covid-19 controls” or modifications of the current policy along with further key economic policies to be announced after the 20th party congress could both serve as a key catalyst ahead.

Therefore, in the current complex global environment – we expect the trend of divergent economic cycle to remain intact as external inflation might remain elevated as export demand slows yet domestic monetary policy in China remains expansive along with gradual yet sequential improving economic fundamentals.

Many thanks again for your partnership and support in Nordic Asia as always.

Please see below for more specific selected portfolio company highlights during H1 2022.

Best Regards,

Yining, Jason and the NA Team in Stockholm & Shanghai

8th of September 2022

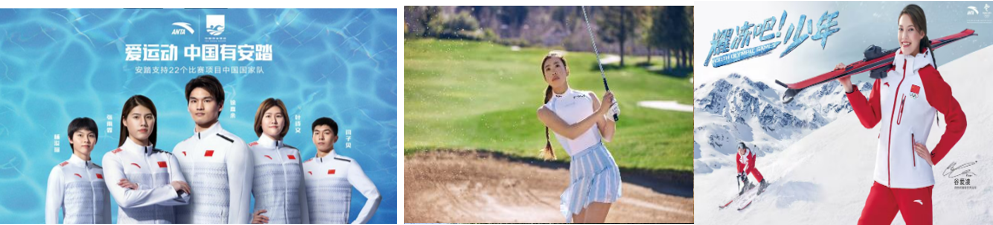

Anta Sports

Anta Sports delivered stronger than expected 1H22 result with revenue +13.8% YoY while net profit -6.6% YoY. Anta brand revenue growth was 26.3% YoY in 1H22 thanks to its DTC (Direct to consumer) transformation along with less impact from Covid-19 control in the lower tier cities. DTC revenue +79.3% YoY while online sales was also strong with 26.6% YoY growth amid pandemic disruption. Anta brand’s gross margin improved to 55.1%, +2.3ppt YoY in 1H22 while OPM declined by 1.1ppt to 22% due to DTC transformation. FILA brand revenue was flat YoY better than operating disclosure’s negative single digit sell-through growth. The brand was largely impacted by the pandemic lockdowns (20% from Shanghai and Northeastern China). Gross margin declined YoY to 68.6% similar to 2H21 level while OPM also declined accordingly as the brand was hit badly by pandemic in 2Q. All other brands revenue +29.9% YoY with slowed growth but better than expectation on their high exposure to high-tier cities. Gross margin of all other brands improved to record high 74.2% while operating margins improved to 21.6% thanks to ongoing efficiency improvement of Descente and Kolon. Amer sport profitability also improved to -2% of net loss ratio with 21% YoY revenue growth.

Looking forward, Anta will still be subject to China’s gradual recovery from Covid due to the unchanged zero covid policy. FILA brand’s growth could recover to double digit on lower base and ease in COVID control. Other brands are still in strong momentum with +30% YoY growth in 2H22 with sequential operating margin improvements. Overall, Anta Sports long term growth fundamentals are solid with its multi brand strategy which could capture wider range of types of customers and sports needs. The outlook is positive amid the consumption recovery, but growth pace is still subject to Covid-19 policy and conditions.

Anjoy Food

Anjoy Food delivered another solid result in 1H22 with revenue +35.5% YoY while net profit +30.3% YoY despite pandemic impact, thanks partly to new entity consolidation. Separating the new entity, Anjoy main body grew by +12% YoY on revenue level with net profit growth by 17% YoY thanks to higher mix of higher margin B2C product sales amid lockdowns. Mr. Dongpin, the ready meal brand, continued strong growth with 125% YoY revenue growth with net profit +200%+. Revenue of hotpot ingredient +5% YoY with strong growth of frozen seafood products which is more B2C category. Revenue from frozen pasta products and ready meals grew by 23.9% YoY and 185.3% YoY respectively thanks to their 2C nature which is consistent with our expectation. 1H22 gross margin was 21.9% dragged by the strong growth of Mr. Dongpin and the Xinhongye consolidation. Anjoy main body gross margin declined slightly due mainly to surge of logistics cost (+55% YoY) impacted by Covid-19 while less from raw material cost. Expenses control was better than expected with S&M% declined to 7.7% of revenue.

Looking forward, we see that Anjoy Food to maintain its momentum amid weak consumption environment caused by rigid Covid-19 control with its strong management capability, strong growth in ready meal segment and solid no.1 brand in the hotpot ingredient growth segment. We also expect Anjoy’s margin to improve sequentially with less lockdown and logistics disruption in place. Anjoy Food is actively expanding its market share in ready meals with trending products and channel exposure. In nearer-term, we see that 2H22 could also enjoy the 2B sequential recovery as Covid-19 control eased from 2Q lockdowns. Anjoy Food is the most well position name in the growing frozen food industry as it enjoys a solid top positions within hotpot ingredients segment, while expanding frozen pastas segment and rapidly growing ready meal segment benefitting from Anjoy Food’s strong brand name, channel management capability and nationwide exposure.

Xiaomi

Xiaomi released its financial results for H1 2022 with revenue at 143.9 BCNY -12.8% YoY and adjust net profit was 4.9 BCNY, -60.1% YoY. Gross margin of 17.05% and adjusted net margin of 3.41%. The SG&A and R&D expenses accounted for 9.4% and 5.0% of revenue compared to 7.3% and 3.7% from 1H21. In Q2 Xiaomi’s smartphone shipments were 39.1 million units down YoY -26.2% but improved slightly QoQ mainly due to general slowdown in the global smartphone market, aggressive market share gains in the lower tier segment by Samsung in the Android smartphone market and domestic Covid-19 resurgence.

Despite the continuing impact of the global macroeconomic environment, Xiaomi has been actively optimizing management and committed to advancing the Group‘s strategies to enhance long-term competitiveness. According to Canalys data, Xiaomi ranked third in global smartphone shipments this quarter, with a market share of 13.8%, up 1.2% from the previous quarter. Smart TV global shipments bucked the growth to 2.6 million units. According to data from Aowei Cloud, in the second quarter of 2022, Xiaomi TV shipments ranked first in mainland China, and global TV shipments ranked top five.

Since last year, Xiaomi has announced its entrance into the EV car market with the aimed launch in 2024 with focus on autonomous driving capabilities based on its self-developed integrated hardware and software technologies and inhouse specialized R&D team. Recently, Xiaomi published a video of its autonomous driving technology by combining lidar sensor, algorithms optimizations and full-fledged scenario testing. Currently the company has around 140 autonomous driving testing cars in China. It is rumored that the first prototype to be revealed shortly but mass production to begin towards 2024. Furthermore, the entrance to the EV space will also enable the company to build up an ecosystem of accessories and peripheral EV car product similar to its smartphone ecosystem product strategy.

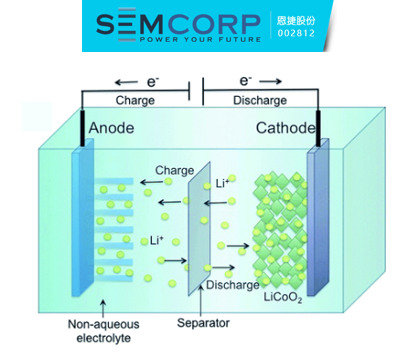

Semcorp

Semcorp is a global leader in new energy lithium-ion battery separators, and has maintained long-term and good cooperation with well-known companies such as CATL, Panasonic, Samsung, BYD among others. Semcorp released its financial results for H1 2022: with revenue at 5.76 BCNY and net income was 2.13 BCNY, growing +69.6% and +92.2% YoY, respectively. Gross margin of 50.02% and a net margin of 36.9%. The SG&A and R&D expenses accounted for 3.5% and 4.5% of revenue compared to 4.3% and 5.0% from 1H21. In 1H22, Semcorp developed rapidly. The production capacity and shipment volume of separators ranked first in the world. In order to actively grasp the development opportunities of the industry, Semcorp will continue to increase the scale of production capacity construction, actively explore domestic and foreign markets, and meet the needs of global mid-to-high-end lithium battery customers.

Relying on the technical advantages and forward-looking strategy, Semcorp is currently the industry leader in the field of wet-process lithium battery separators, and has global competitiveness in terms of production capacity, product quality, cost efficiency, and technology R&D. The company has set up separator production bases in Shanghai, Wuxi, Jiangxi, Zhuhai, Suzhou, Chongqing, Changzhou, Jingmen, Xiamen and so on. Overseas, the company has built the first overseas lithium battery separator production base in Hungary. The US base project has been launched to actively expand overseas markets to meet the needs of global mid-to-high-end lithium battery customers. Semcorp wet-process products have stable product quality and have established a strong brand image in the global mid-to-high-end separator market. The company has successfully passed the product certification of most mainstream lithium battery manufacturers, and is entering the most rigorous overseas power battery supply chain system.

The rapid growth of new energy vehicles will continue to increase in the demand for lithium battery separator industry chain. The company's existing major customers will have a production capacity + 1,300 GWh by 2025, an increase of more than 1,000G Wh from approx. 300 GWh by the end of 2021, which will drive a corresponding an annual growth demand for lithium-ion battery separators. Semcorp is uniquely positioned in this niche based on its market leading production capacity, quality, cost, and high entry barriers to penetrate leading EV car manufacturers and tier 1 suppliers to help the company constantly stand out as market leader in this niche segment.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.