Nordic Asia Investment Group - Newsletter February 2023

Dear Investors,

As we mentioned in our Jan newsletter, the buoyant start of the year was possibly a bit overly optimistic around the prospects of “peak inflation” and the current path of the rate cycle.

In February, US CPI came in slightly above expectations at +6.4% while the Stickier components of the CPI came in at +7.9% for Shelter and +7.6% for Services CPI. Although the tightening cycle has accelerated in the past year, the end in sight is still uncertain. When measured in terms of the “Taylor Rule” or observed in previous inflation cycles – current real interest rates are still negative and central banks’ balance sheets are still at elevated levels. Therefore, as we move forward in the months ahead, the price transmissions of a tight labor market and higher overall costs of living might continue to push Sticky CPI higher.

Furthermore, as we move towards the second half of this year, the high base effects of YoY commodities price declines since Jun last year will start to wane off and thereafter possibly starts to become a positive headline CPI contributor starting from late Q3 or the start of Q4. If this occurs and the stickier parts of the core CPI remains elevated, then overall inflationary pressure might further exceed market expectations as we move into the latter part of this year.

At the fundamental level, we are already seeing the effects of the rate hikes from last year, especially for those sectors and companies/individuals / countries with relatively high leverage and floating rates compared to income.

A micro-analysis for “cost of living” shows that for the average median income households, significant costs increase due to higher mortgage rates as “cost of living” significantly outpaces net after-tax income growth, causing a decline in real purchasing power. Especially for younger demographic groups with higher leverage ratios and a higher proportion of variable mortgage rates. This real purchasing power decline will likely continue given continued inflationary pressure. Furthermore, credit investors in this environment will likely demand higher-term premiums to compensate for inflation and credit risk as the economy slows down.

Therefore, to navigate through the complex market environment in 2023 it is imperative to follow and understand the underlying dynamics of this tightening cycle to better separate risk from opportunities in this environment.

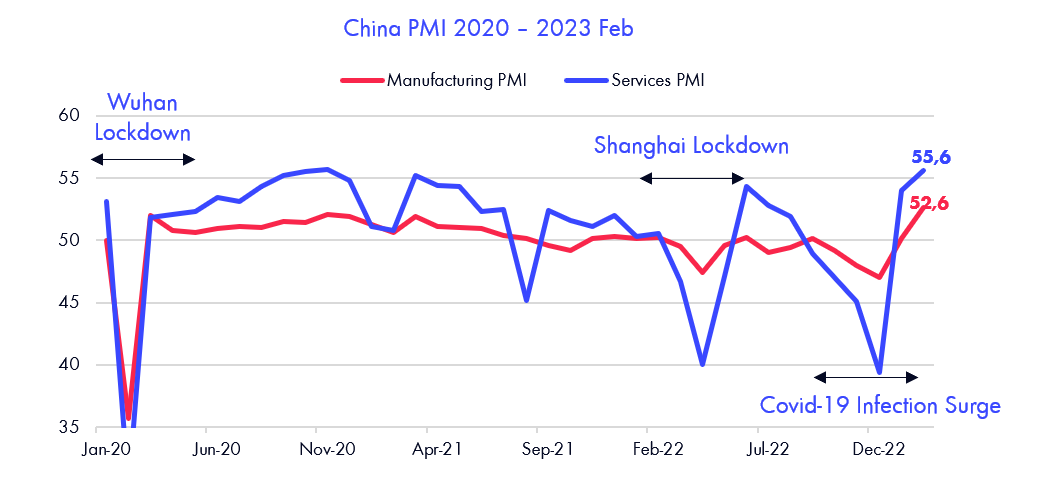

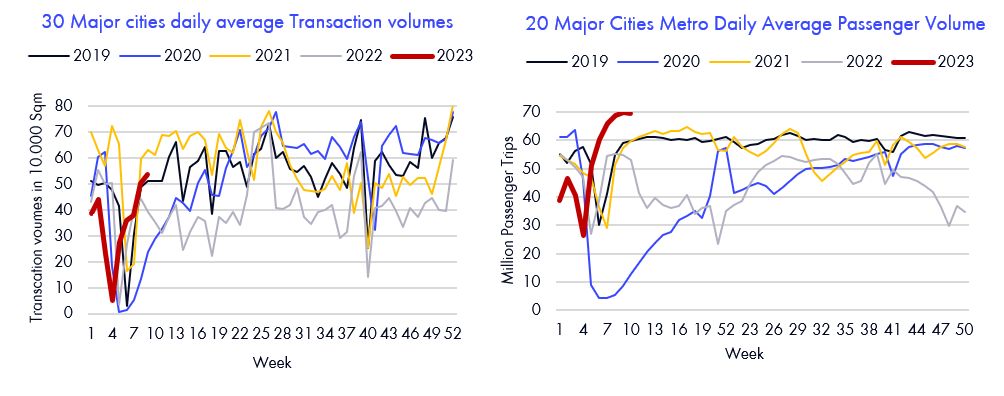

At micro level, it has been encouraging in the past month to see the rebound in foot traffic after loosened Covid-19 policies in China and after this year’s Chinese new year calendar effects. First of all, it was much easier to fly into Shanghai than expected (Barely checked my PCR test). Thereafter during rush hours, traffic jams are recurring for road traffic, subways, lunch restaurants, and for elevators lifts. Signs of Covid-19 restriction policies (except for face masks in public areas) feel like a memory of the past. Therefore, it was not surprising that China’s Feb PMI came in above expectations at 52.6 and the services sector PMI rebounded to 55.6.

In addition to this, due to continued favorable policies and lowered mortgage costs, the secondhand market for real estate transaction volumes has rebounded well in the year new and surpassed 500.000 sqm per day recently.

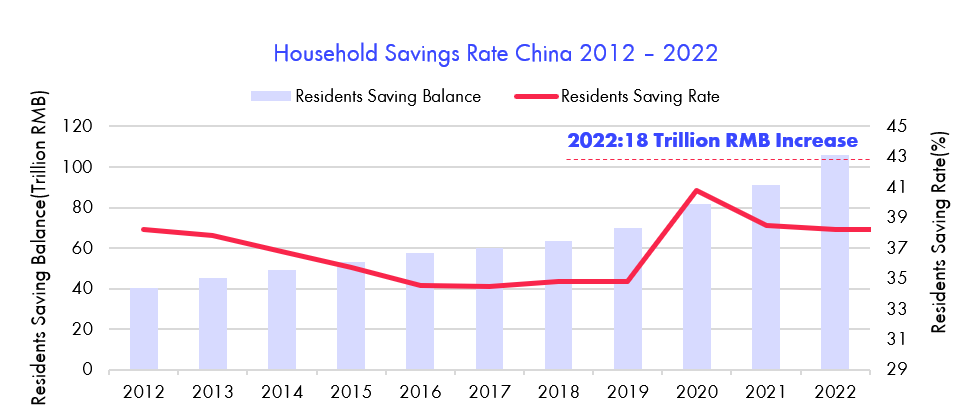

However, despite the faster-than-expected economic recovery, the central government announced a more prudent level of GDP growth for 2023 at 5%, citing risks from external demand. Thereby the key source of growth for this year, needs to continue to come from domestic consumption demand and especially service sector rebound that stands for around 48% of overall employment. During the Covid-19 years, the Chinese average household savings rate has increased further implying a total savings growth of approx. 18 Trillion CNY. As economic activities continue to normalize “post-covid-19” this increase in spending power along with lowered mortgage costs should be a positive driver to support discretionary consumption and service spending in 2023.

Therefore, despite global economic uncertainties and short-term liquidity-driven market adjustments, the core underlying business fundamentals of our portfolio companies are improving as most of our companies have expanded their businesses and sales channels even during Covid-19-years. Therefore, as the earnings season for 2023 Q1 starts to kick in from April, we should see a recovery of earnings momentum in our portfolio companies driven by both top-line recovery and bottom-line operating leverage.

Furthermore, the Chinese consumer market is large and still vastly fragmented, for example, the largest hot pot restaurant chain in China still only holds less than 1.0% of total China catering market share. Similarly, our portfolio companies such as Juewei, Anjoy Foods are market leaders in their niches, with their market share of respective markets of only 7-9%. Therefore, in the long-term, well-managed businesses in niche market segments that grew stronger post-covid-19 should be in a more favorable position to further consolidate their market via a combination of organic and M&A growth. Although growth via M&A consolidations is still in its early stages in China vis a vis Europe, but as the market matures and generation shifts accelerate among smaller players, growth via acquisitions should pick up over time. Presently, our pipeline of niche discretionary consumption investment targets are plentiful at this moment, and we see many companies still in the early phase of Post Covid-19 recovery at the same as we aim to further concentrate and consolidate our portfolio holdings.

Therefore, our journey to own niche market leaders in the Chinese consumer market is finally beginning to gain momentum as we enter a “Post Covid-19” domestic economic recovery phase in 2023. However, the task on hand will not be straightforward as we need to be aware of global market risks and actively pursue favorable market opportunities that arise during this period.

Thanks again for your support and we look forward to sharing more insights and updates in Nordic Asia ahead.

Best Regards

Yining / Jason and the Nordic Asia Investment Team

China Catering Industry Overview

China catering industry is currently sized at +4 TCNY with CAGR by 6.6% in the past 10 years. We see the major industry trend in the recent years is increasing percentage of restaurant chains and industry consolidation across all tiers of cities due to the pandemic and the standardization of traditional Chinese cuisine.

In 2020, only ~11% of restaurants in China are restaurant chains indicating large room to increase and a significantly more fragmented market as compared to US’ 54.5% restaurant chain market share. However, the China catering industry is a sector with constant competition due to the complexity of Chinese cuisine. The number of restaurants in China is more than 10 times of those in US despite similar industry size between two countries. On top of the intensive competition, even the better performing fragmented restaurants can at the most achieve a 10% net margin due to limited economy of scale, growing staff cost and high rental burden. Therefore, a similar trend of industry consolidation where restaurant chains with a more standardized store operating model, strong brand recognition with the economics of scale should be able to further gain market share in this yet highly fragmented market.

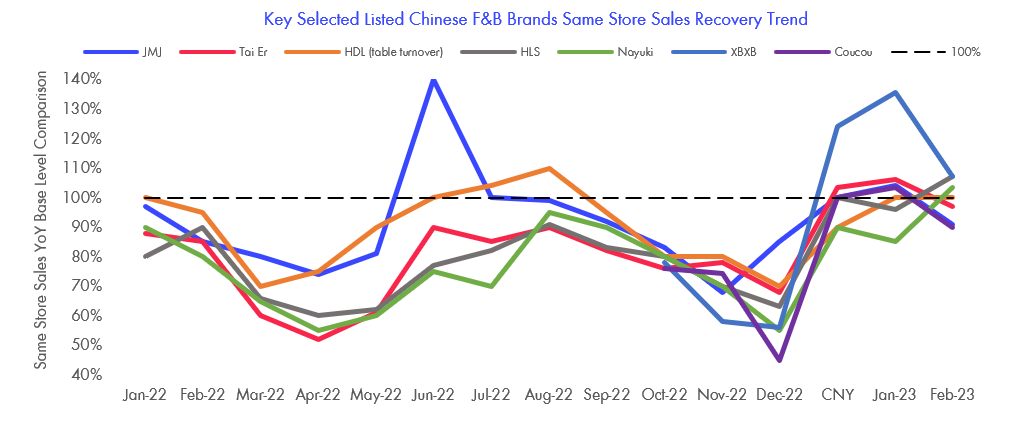

In this space, there are plenty of new upcoming players such as Jiu Mao Jiu and Tims China both with strong management backgrounds from Mcdonalds & Burger King in China to develop a new standardized restaurant chain concept in China. Jiu Mao Jiu is a restaurant group that has demonstrated its capability by expanding its Tai Er restaurant into no.1 sauerkraut fish Chinese cuisine restaurant chain in China. Jiu Mao Jiu’s practice of standardization which enhanced storefront efficiency largely and achieved operating margins like quick service restaurants. Tims China is a growth opportunity given the low penetration of coffee in China. Tims China has acquired the rights to develop the well-known Canadian coffee chain brand “Tim Hortons” in China. Currently, Tims China has +600 stores in China vs +6.000 Starbucks stores. Recently Tims China also acquired the rights to develop Popeyes Chicken with currently approx.10 stores vs 9.000 KFC stores in China. As the service sectors recover Post Covid-19 in 2023, most listed F&B chains same-store sales have recovered well since Q4. In this process, there will be multiple interesting new catering chain concepts with the potential to further standardize and consolidate a vastly fragmented domestic catering market.

Anjoy Food

During our meeting at the recent spring strategy conference in Chengdu, Anjoy Food indicated an optimistic growth outlook in the 1Q22 with 20% YoY growth for the first two months of 2023 despite only high single-digit growth in Feb-2023 due to Spring Festival Holiday.

Also, Anjoy Food is a leading domestic supplier of frozen packaged hotpot ingredients, meat & seafood products to the catering industry. During the Covid-19 years, its distributors focused most of its sales towards B2C segment as the B2B was subdued due to Covid-19, but recently its focus has redshifted back to the B2B segment products since Spring Festival to capture the catering industry recovery post-pandemic. In 2023, Anjoy Food will put in more sales and marketing resources in a reasonable manner if they see strong momentum in the retail end. On the margin side, IR delivered a positive message with declined cost on main raw material while also improvement due to overall consumption recovery.

In terms of ready meals, Anjoy Food indicated strong demand from catering recovery in the first home-returning Spring Festival since 2020. Furthermore, to enhance Anjoy Food’s competitiveness, it will maintain the key product strategy of higher value-add premade / readymade fish and meat-based product portfolio. Finally, Anjoy made a keynote that they intend to take the production of key products in-house if capacity is reached in the future to further optimize efficiency.

We maintain our positive outlook over Anjoy Food on its nationwide production capacity establishment and channel penetration. We believe that Anjoy Food will enjoy growth upward in the next few years majorly from recovering catering industry and the increasing rate of the restaurant chain. In the longer term, Anjoy’s brand name on the consumer side and readymade segment will provide a further growth driver.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.