Nordic Asia Investment Group - Newsletter January 2023

Dear Investors,

Hope all is well and that the new year has started off in a good way,

As we entered the new year, although a more buoyant start of the year – on a global level in 2023 inflation and geopolitics will remain the two key uncertainties that we need to navigate through diligently throughout the year in 2023.

First of all, if inflation is a monetary phenomenon – as per Milton Friedman’s quote – then one could argue that the core issue for the inflation observed today is caused by the rapid M2 growth since 2020 when M2 in the USA grew from 16 trillion to 22 trillion USD in the past two years. M2 peaked around May last year in the US and has fallen by approx. -2.3% to date from its peak. It is encouraging to this measure declines, but if the total amount of monetary growth created continues to stay elevated as compared to the “real” production of goods and services then inflation as the “gap” between monetary growth vs product growth could remain elevated before the “gap closes”.

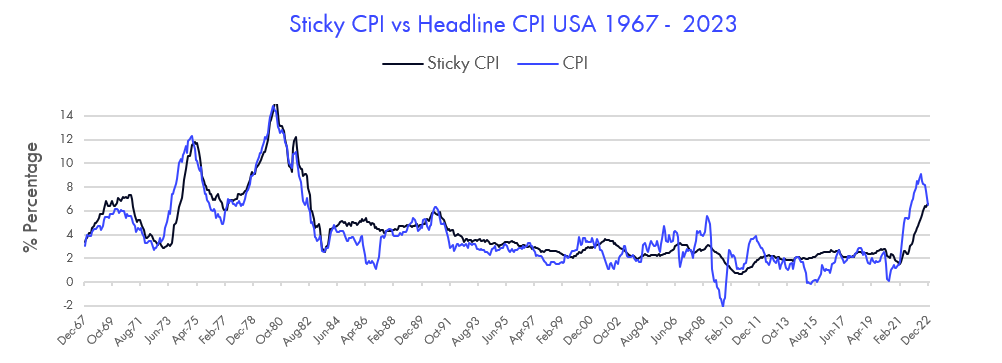

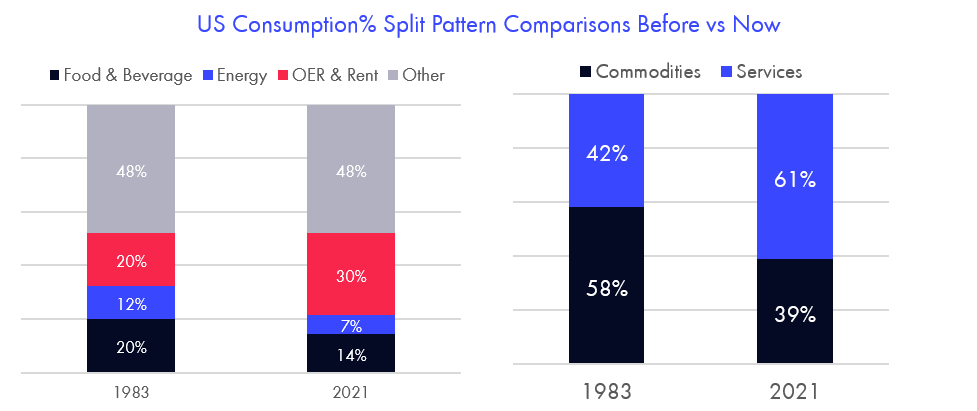

Furthermore, it is encouraging to see that headline CPI has started the come down a bit – but core inflation and especially service inflation remains elevated even as of the latest US CPI print. But the latest published CPI print in Jan showed December numbers and as per custom most price increases will be passed through in the new year – therefore as we are entering Feb / March, we will be more able to better observe the actual inflation print in 2023 post annual pass-through effects.

As the economy has changed structurally in the past decades, both rental costs and services spending stands for a higher proportion of total disposable income today than before. And these two items are the main components of the “Sticky CPI” subsets and they are more sensitive to the tightness of the labor market and mortgage rate cost changes. Hence, we might need to see more subsequent declines in the “Sticky CPI” components before we can be confident enough to see a clear disinflationary trend. Therefore, despite more positive vibes in the year new, we need to take into consideration the possibility of inflation surprises on the upside during the course of 2023. If it occurs, overall risk-premia and longer-term inflation expectations might adjust upwards, affecting the overall market liquidity, sentiment, and expected rate paths ahead.

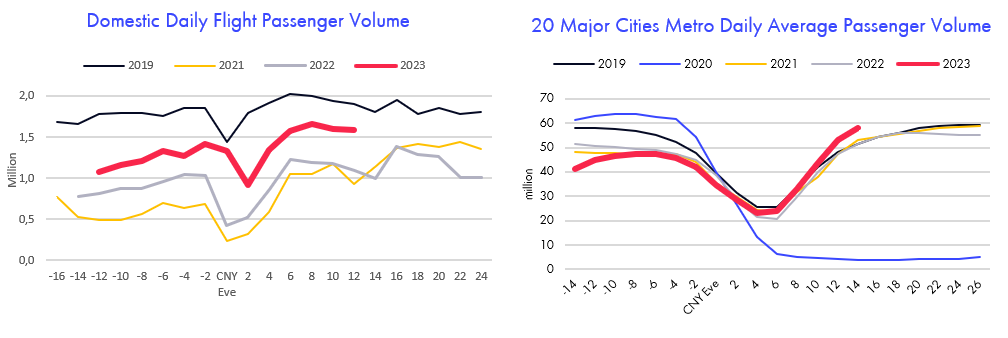

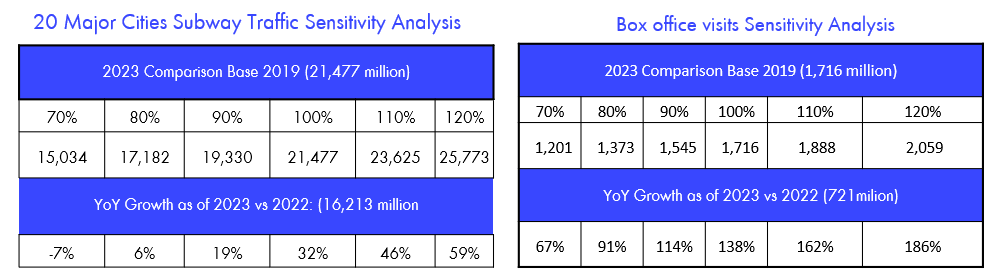

On the other hand, as China is starting to come back after the Chinese new year celebration, we are seeing encouraging signs of a possible quicker foot traffic rebound than previously expected in December. When benchmarked against the “reopening” process against other Asian peers previously, we found the rate of recovery from the first Covid-19 widespread infection phase until the rebound of foot traffic activity, which took approx. two months’ time I.e., it took one month until “peak inflection” and another month until the foot traffic recovered to “pre-infection levels. Therefore, in December as Beijing and some other early-stage infection cities were showing signs of recovery, the pace of peak “infection” could wary across the country and it could take slightly longer for the entire country to start its normalization process post Zero Covid. However, recent data suggest the rebound of foot traffic and economic activity have rebounded faster than expected and despite “Chinese new year” calendar effects, the rebound in overall passenger traffic since CNY is trending well above that of 2022. Although still below the levels of 2019 (Pre-covid) but it is well above the past “Covid-19” years and specific cities, leading foot traffic indicators are already showing a recover rate that is above of 2019 already in Jan 2023. Therefore, in Jan composite PMI (Caixin) numbers showed an encouraging and quick recovery back to 51.1 vs 48.3 Dec 22 and service PMI back to 52.9 vs 48 on Dec 2022.

A further sensitivity analysis shows that if subway passenger traffic levels in 2023 would reach approx. 90% of 2019 full-year levels, then the rate of recovery would be +19% vs 2022 and if recovered to 100% as of 2019 level it would imply a growth of +32% vs 2022. These numbers and rate of recovery vs 2022 are further amplified when looking at more sensitive sectors with an even lower base such as movie box office numbers, catering, and other local services, tourism, etc. Although we are still early in the new year 2023, if we continued to see continued favorable momentum in foot traffic and offline recovery here in Feb / March, then despite fast-growing infection rates at the end of 2022 - It could be possible that Q1 2023 might surprise on the upside and drive subsequent improvements of earnings revisions for the full year 2023.

Although valuations in the market have recovered quite well recently among large-cap companies listed in HK market - The next phase of the domestic market recovery will depend on the degree of earnings recovery which will become more visible in the coming months. During this recovery process, those companies who are more exposed to the offline, service industry and those who have gained market shares by diligently investing long-term in their businesses during the “Covid-19 years” are likely to be rewarded more as China gradually normalizes from Covid-19 in 2023.

Therefore, despite global uncertainties in 2023 and possible changes in global inflationary and geopolitical sentiment during this year – The post-covid recovery of the domestic consumption market in China is just getting underway. In this environment, we look forward to following our strategic investment focus on the domestic Chinese consumer market, improving our toolbox to “Make capital serve wiser” and focus to serving you well in the “Year of the Rabbit”.

Wish you all good health, good fortunes, and prosperity in the new year!

Many thanks in advance for your support

Best Regards

Yining / Jason and the NA Team

Nordic Asia Investment Group 1987 AB

China E-commerce Market Outlook 2023

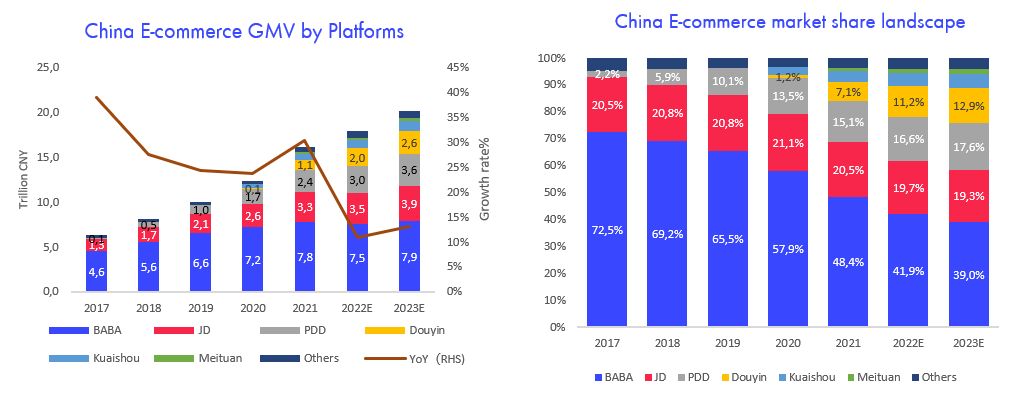

According to NBS’ full year statistics about total social retail, China 2022 online physical retail recorded a 10.7% YoY growth to 11.96TCNY while total social retail declined by 1.2% YoY to 45.8TCNY. Online penetration increased by 2.8ppts to 26.1%. The increased penetration after a slight drop in 2021 was due to more restrictive COVID control in China since 2Q22. China 2022 e-commerce was estimated GMV at 17.87BCNY, +10.8% YoY. Among the major platforms, we expect Alibaba GMV (gross merchandise value) declined by 4% YoY to 7.5TCNY, JD grew by 6.7% YoY to 3.5TCNY while PDD was stronger at ~20% YoY growth to 3TCNY, which thanks to its value offering and sales and marketing spending amid weaker marco envrioment. Short-form video platforms who are rich in traffic and strong in first time conversion led the growth of 2022 GMV. For example, Douyin, the no.1 short-video platform in China, is now enjoying the benefit of19bn daily average video views on its platform and ~120mins average daily time spent per users. As Douyin allocated 10% of its daily video views into e-commerce segment, its GMV surged from only 0.1TCNY in 2020 to 2TCNY in 2022. Hence, Alibaba, who was the dominate player of China e-commerce industry, experienced another year market share decline from 48.4% in 2021 to 41.9% in 2022.

Looking into 2023, the removal of COVID restriction in China will support the E-commerce platforms as consumer spending improves and obstacles for deliveries / fulfillment removed. Overall GMV growth is expected to improve amid the marco recovery. However, we see universal problem across the platforms are the limited upside from user growth as they are well penetrated in China in the past 3 years. For Alibaba, as its AAC exceed 1bn milestone, the user traffic growth contribution to GMV growth will be minimal while the average spending per user is more likely to improve due to consumption recovery given that Alibaba is still the no.1 platform in China. For JD, will focus more on growth given the top-down initiatives from Chairman Richard Liu. JD management indicated to increase its marketing spending in order to boost user growth. We see that JD could also attract more 3P merchants with less logistics disruption and hence category expansion. Hence, we forecast that JD could achieve a combination of those user growth and higher average spending in 2023 thanks to the conversion of low-tier penetration in the past 3 years. Finally, for Douyin’s and Kuaishou’s e-commerce, although the rapid growth rate of the live-streaming subsector, their weakness is in terms of product diversity, less favorable pricing, and weaker fulfillment, and their consumption behavior on those platforms are more impulsive (promotion based) with higher return rate (>30%). Therefore, although they might continue to gain market share in 2023 as more sellers see Douyin and Kuaishou as a new market channel, due to their disadvantages above there could be a market share ceiling for their overall market position in the longer-term. In conclusion, total China E-commerce GMV is expected to rebound by mid-teens as a result of improved consumption sentiment and provide favorable top-line growth for these market participants and operational leverage might further support bottom line growth in this sector during 2023.

Anta Sport Opeartions Update Q4 2022

Anta released an 4Q 2022 operating metrics that slightly better than what we expected after the sharp social activity decline in December due to the wide-spread COVID infection in China. Anta brand sell through declined by only high single digits while FILA brand only recorded low teens decline without deepening of discount and increase in inventory. As in start of 2023, Anta will still focus on channel clearance in 1Q23 which has a high base given the Beijing Winter Olympics. We believe a better sales recovery will start from 2Q23 when foot traffic recovers amid the low base vs 2022. On the margin side, we could see a gradual improvement on both gross margin and operating margin level on the outlook of lighter discount in 2023, improved operating leverage amid recovery and less account and payable spending without major sports event. Anta Sports also announced a management change that Chairmen Ding Shizhong will no longer be the CEO of the whole group. Instead, it adopted co-CEO metrics that allowing different CEOs focusing on Anta brand and FILA brand separately. Despite the management role shift, the BoD and key family ownership group remained unchanged. We see that such change could enable more operation focus over individual brands instead of one person overseeing the whole complex corporation. Anta’s new target will be making the brand international.

China Auto Industry Overview 2023

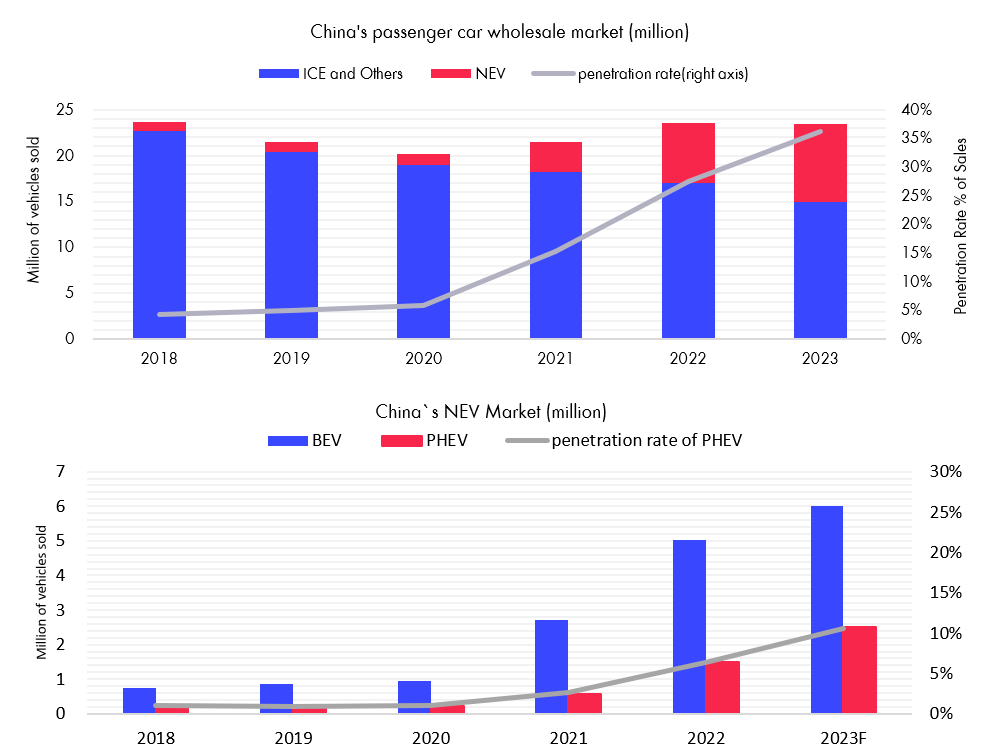

In 2023, China‘s passenger car market is likely to grow by mid-single to low double digits in 2023 with possible upside as the consumer market gradually recovers in 2023. However, the growth rate will differ depending on the underlying niche market segments as the new energy vehicles (NEV) will far exceed traditional fuel vehicles(or ICE). Currently, ICE car market in 2023 is expected to decline and new energy vehicles (NEV) will grow by +30% in 2023 and reach an overall penetration level of new car sales of around +35%.

The rationale to buy NEV will also gradually shift from policy-driven benefits (ex license plate priority) to demand-driven requirements as the purchase price for NEV continues to become more competitive vis-à-vis ICE. Among NEV, hybrid vehicles (especially PHEV (Plug-ing Hybrid)) has accelerated the consumer demand for new energy vehicles. On the one hand, PHEV has achieved a lower unit mileage cost and on the other hand, it has also solved the mileage anxiety of BEV (Battery electric vehicle). PHEV with the same price points will have a clear competitive advantage over ICE. Major automakers have also seen this development trend, and will focus on launching a variety of PHEV models for consumers to choose from in 2023. Current sales penetration rate of PHEV in the overall market is only 6.3% which is far below that of NEV in total. Therefore, the entrance of PHEV for car makers in the mass-mid consumer market within the price range of 150.000 – 250.000 CNY will have an opportunity to grab market shares in 2023.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.