Nordic Asia Investment Group - Newsletter June 2022

Dear Investors,

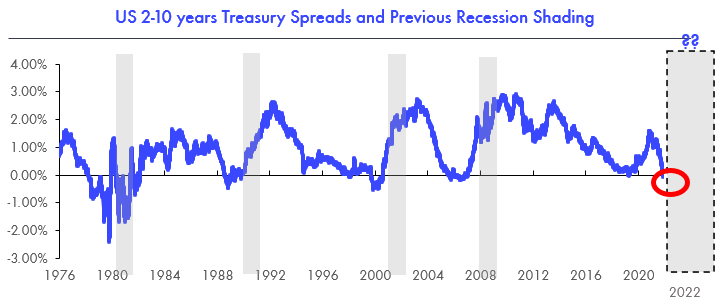

The complex economic environment continued in the month of June as we continued to see inflation rates exceeding forecasts in the month of May causing an accelerated pace of rate hikes across major developed economies countries. Further accelerating the increase in financing costs and mortgage rates among consumers and corporates. Still the current observed ”gap” between inflation and interest rates are still high which continues to put pressure on central banks to continue their path of accelerated rate hikes. This “dual effect” of inflation pressure and increased interest costs will continue to hamper consumption purchasing power which is now further reflected in consumer confidence leading indicators. This caused another observed inversion of the 2-year and 10-year yield curves in the US during the month of June as well as a continued widening of bond spreads and mentions of possible recession pressure going forward.

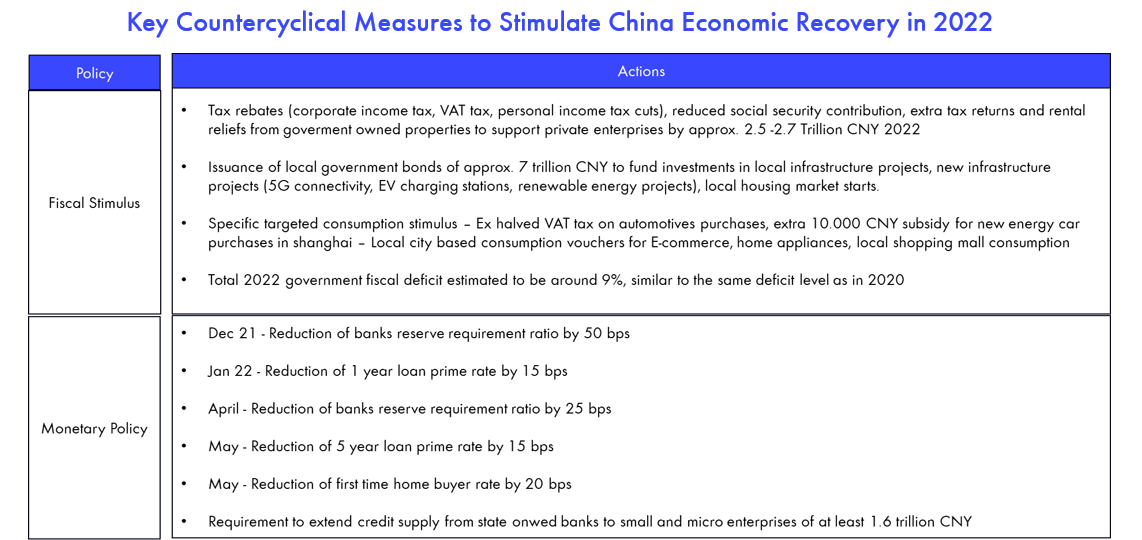

On the other hand, China’s economic recovery continued to gain momentum in June as Shanghai´s reopening started on the 1st of June showing a quick rebound in economic activity and recovery of offline consumption. Subway passenger traffic in major cities across the country continued to rise, reflecting the gradual economic recovery under the "normalised Covid-19 prevention via mass testing+ normal resumption of work and production" model. When looking at the passenger traffic volume of Shanghai towards end of June, the weekly subway traffic rebounded to approx. 7 million trips per week, roughly equivalent to the level at the end of February. EV car sales surged back and grew by +113.9% YoY in May and due to continued stimulative policies the property market has now had 9 consecutive weeks of sequential square foot sales and grew YoY for the first time this year in Tier 1 and Tier 2 cities. To stimulate the economy for a faster rate of growth in H2 2022 the government has announced ca 2.5 trillion in tax relief subsidies for companies and people severely impacted by the Covid-19 lockdown along with a further approx. 7 trillion CNY in local government bond issuance in order to fund infrastructure projects along with VAT exemptions and consumer subsidies for purchase of cars to stimulate a quick recovery in the automotive industry. These policy triggers have been effective and retail cars rebounded to +30% YoY in the final week of June.

Additionally China PMI in June rebounded back to 50.2 from a low of 47.4 in April, the rebound was stronger among SMEs and the service sector PMI which climbed back to 54.3 up 7.2 points from May continuing a similar post-covid-19 economic recovery trend in H2 2020.

Given the base scenario of normalised Covid-19 prevention in H2 2002, the economic growth is forecasted to reach between 4% - 5% for the full year, likely to come below the 5.5% target and gradually recover to “pre-covid” long term growth rates in 2023 with a forecasted inflation rate range of approx. 2.5% ahead.

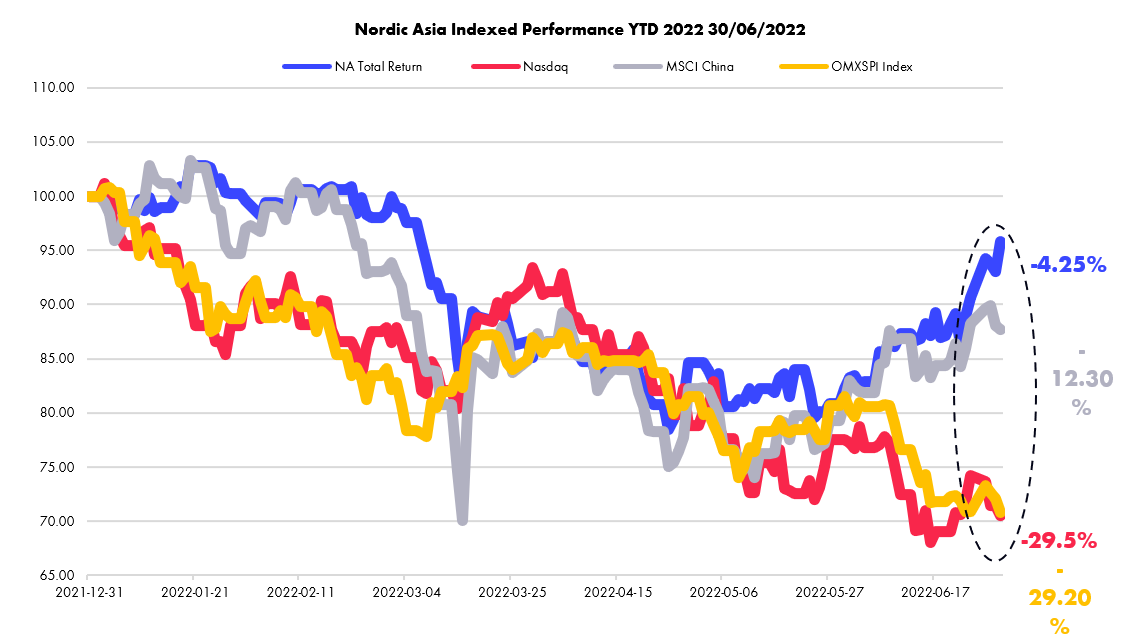

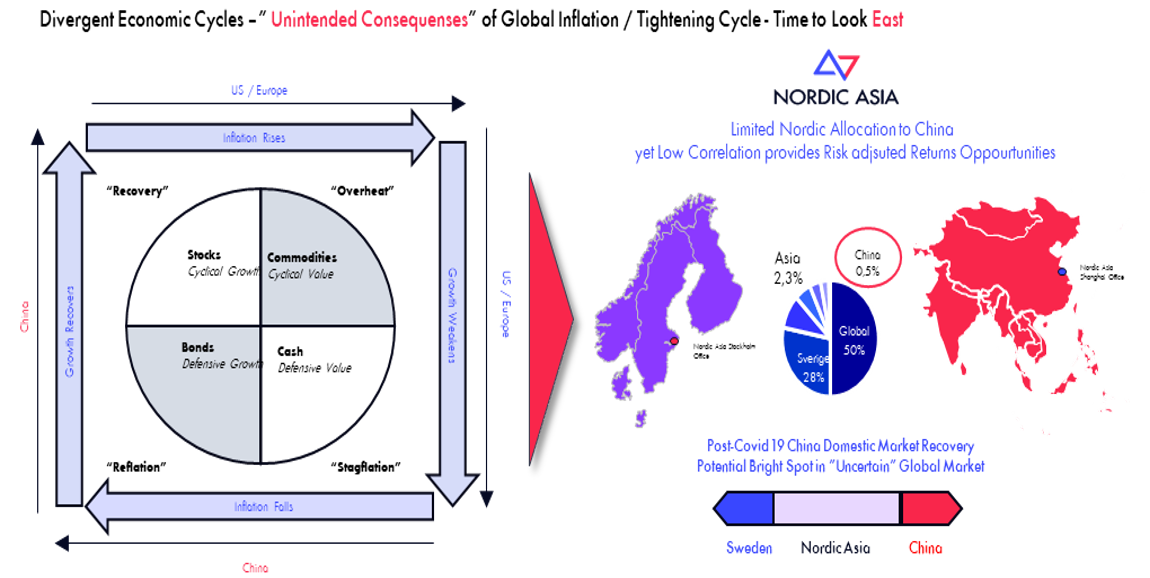

As this “divergent” economic cycle continues and the Chinese economy has started to show progress, we’ve also started to see a more visible “divergence” in the equity markets in China as more capital is returning to China as domestic trading volumes, right issues, foreign fund flows and market sentiment improved in the month of June despite a turbulent external market.

The recovery in the domestic equity market is a first a recovery of equity valuations and gradual adjustments in the earnings expectations ahead. However, the economy is still on a recovering path and more significant improvements in business fundamentals led by the domestic consumption is to be expected towards the latter part of 2022.

Going forward, there are also a couple of uncertainties both domestically and abroad. First of all, we expect that interest rates will continue to hike upwards in the developed markets that will both put a ceiling on global equity valuation levels as well a possible slowdown of export demand. Secondly, in the domestic market, there’s still an uncertainty in the long term Covid-19 strategy, risks for further localised flare ups and the speed or pace of the economic recovery could be uneven at times.

However, towards the end of June, China reduced the quarantine time of inbound Chinese travelers from 14 days to 7 days and encourages local governments to prevent local flare ups more accurately and prohibit one-size-fits-all measures. Given external uncertainties and possible weakness in the export sector ahead it is important for the government to maintain a balance and focus on economic stimulus to ensure a sustained economic recovery and stronger domestic market (internal circulation) to offset potential external market uncertainties. In this global economic environment, China continues to stand out with a lower level of headline domestic CPI inflation rate of 2.1 and continued decline in PPI giving the PBOC continued room to conduct more expansive monetary policies ahead.

To balance these opportunities and global uncertainties we will continue to focus on the domestic market economy (internal circulation) especially in those sectors with high growth certainty, policy support and visible demand improvement. At the same we need to continue to follow the complex global market developments as the current high inflation levels along with more aggressive rate hikes could trigger further imbalances in the economy and financial markets both in the US, EU and also in Japan. Again in this complex global market environment, the trend of this “divergent” economic cycle in China vis a vis developed markets could very well continue for a period going forward as China continues its domestic market recovery in its own economic recovery "cycle".

Thanks again for your support in Nordic Asia. Our portfolio companies are well positioned to capture the domestic market demand in its respective niche sectors. We look forward to review the Q2 reports coming up as well as continue to focus on our acquisition pipeline to further improve our overall portfolio exposure to help us own key assets as the Chinese economy continues its gradual reversion to “normalcy”.

Please see below for more specific selected portfolio company highlights

Best Regards

Yining, Jason and the NA Team in Stockholm & Shanghai

7th of July 2022

China Tourism Group Duty Free

China Tourism Group Duty Free (CTGDF) is the leading duty free retail chain for domestic consumption upgrade for leading international high end brands operating a 120.000 sqm duty free mall in Sanya city of Hainan province in China, a key destination for domestic tourism, leisure and shopping. Despite a gradual recovery rate in the beginning of the year, CTGDF was severely affected by the pandemic control in most of Tier-1 cities in China since mid-March to May 2022 in which their flagship shopping mall in Sanya was closed twice for Covid inspection. Starting from June, as Shanghai started to lift the lockdown measures and logistics were further recovered, Hainan actively advertised that most of Shanghai tourists will not be subject to quarantine traveling to Hainan and the local government issued 20MCNY duty free consumption vouchers to stimulate domestic duty free sale recovery. Since then and after the ministry of travel further eased travel restrictions, flight ticket sales increased by 200% sequentially within 2 hours after the eased flight restrictions, indicating strong domestic pent-up demand especially amongst the high-end consumer group. According to Qunar, a domestic OTA platform, Sanya hotel booking recovered to 2019 levels in the last week of June.

As Covid-19 control normalises, we expect to a see sequential recovery trend for CTGDF in 2H22 and high growth in 1H23 due to the economic recovery and lower base comparisons. Sales in Q2 2022 is expected to decline due to the pandemic in its offline channels partially offset by higher percentage of online sales, but earnings could start to bottom out in Q2 2022 as the negative effects from the pandemic wanes and foot traffic continues to rebound going forward. For the full year 2022 profit margins might still be affected by the higher amount of consumer discount promotions caused by the pandemic this year but should gradually recover to pre-covid levels as travel restrictions ease. During Q2 CTGDF also renegotiated a new rental lease for its DFS tenancy in Guangzhou’s Baiyun International Airport which is expected to lower rental charges and provide a one off profit boost in 2022. Additionally, CTGDF is expected to open its second major retail mall in Hainans capital Haikou City which is expected to open on Sept 30th and provide an additional approx. 100.000 sqm of retail DFS sales and double its sales capacity in Hainan province ahead. Finally, CTGDF is currently looking to perform a dual listing in HK as well to further improve its cash position, international brand recognition with the aim to become a global MNC in the duty free retail sales segment.

Hygeia Healthcare

China’s specialized oncology medical service revenue reached 371 billion yuan in 2019, with a compound growth rate of 12.5% from 2015 to 2019. The growth rate of tumor medical service revenue of private tumor hospitals is significantly higher than that of public hospitals, and the Tier-3 and other cities account for the largest proportion of China's tumor hospital market. At present, the domestic early screening rate is low and the radiotherapy penetration rate is low. With the aging of the population and the increase in the number of cancer patients, there is a shortage and uneven distribution of medical resources. With the continuous technological progress, the increase of disposable income and the expansion of medical insurance coverage, China's oncology private medical service market especially lower tier cities is expected to continue its market growth.

Hygeia Healthcare group is the leading private oncology medical service group in China. By 2021, the company has operated or managed 12 hospital networks with cancer departments as the core. Despite pandemic effects that have somewhat affected hospitalisation visits in Q2 2022, the underlying demand and growth of inpatient visits should be steady for the year. Furthermore, Hygeia is expanding its inpatient capacity with phase II projects of Chongqing, Shan county and Chengwu hospitals are expected to be completed and put into use by the end of 2022 and 2023 respectively to further meet the growing patient demand. Hygeia’s strategy is to continue its specialisation and focus on becoming the leading private oncology medical service chain in China via a combination of organic new self-built hospitals, M&As and capacity expansion in existing self-operated hospitals. For example last year Hygeia acquired Suzhou Yongding hospital and Hezhou Guangji hospital as well as invested back in its self-built hospitals in Wuxi and Dezhou which are expected to be completed in 2023 and 2024. In 2021, the company grew by +65% and its net profit by +156%. The number of available hospital beds reached approx. 5.000 as of end 2021 and Hygeia is aiming to increase its total hospital beds capacity to 10.000 by end of 2023.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.