Nordic Asia Investment Group – Newsletter March 2022

Dear Shareholder / Subscriber

Thanks again for supporting us and taking part of our journey in Nordic Asia Investment Group as the first Swedish Investment Company focused on China’s shift towards a consumption led economy.

Last year we completed our IPO on Nasdaq OMX First North and started our first fiscal year in 2022 as a listed investment company. We would like to again take the opportunity to thank you for your support and for your partnership with us for your China allocation.

Since the beginning of the year, we have been active in a re-investment phase post the IPO and despite global turbulent market conditions, our sector and market fundamental is in a relative favorable starting point

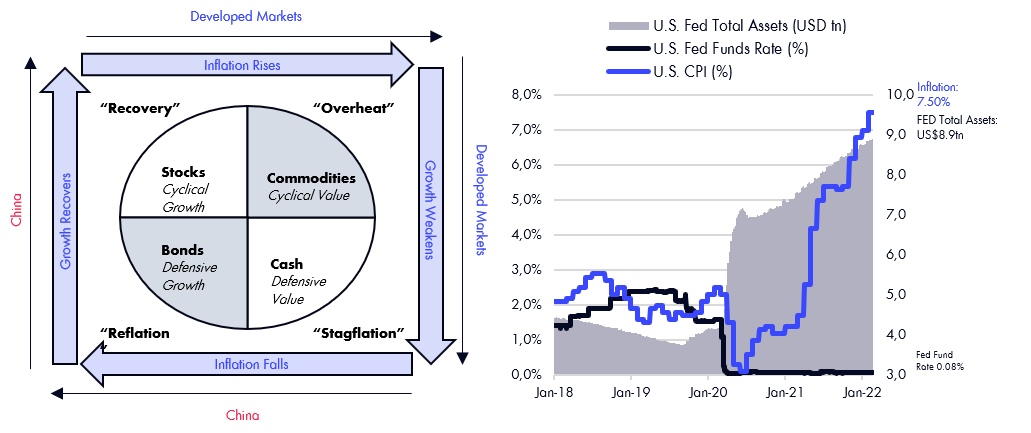

First of all, China just released its growth target for 2022 which came in at 5,5% i.e. on the higher spectrum of the forecast while inflation numbers in Feb came in below expectations at 0.9% as compared to the higher inflation rates in US, Europe. However, this years targeted growth target will be a challenge for China since recent Covid-19 omicron outbreaks will continue to slowdown domestic discretionary consumption and particularly the domestic service industry. Thereby contrary to the tightening cycle of international central banks, the PBOC has signaled for further monetary easing measures and the government has signaled more stimulative fiscal policy to support growth in targeted infrastructure, new energy sectors as well as tax reductions for both personal income and corporate taxes.

In terms of domestic policy. On March 16, Vice Premier Liu He presided over a special meeting of The State Council's Financial Stability and pointed out the following five aspects of work at the meeting:

First of all on the macroeconomic conditions the central committee, needs to proactively stimulate and invigorate the economy in the first quarter, proactively respond to monetary policy, and maintain appropriate growth in new loans. Second, for real estate enterprises, it is necessary to timely study and put forward strong and effective risk prevention and mitigation solutions and put forward supporting measures for the transformation to a new development model. With regard to Chinese concept shares, the Chinese and American regulatory authorities have maintained good communication, made positive progress and are working on a concrete cooperation plan. The Chinese government continues to support all kinds of enterprises to list overseas. Finally, on the regulations of the platform economy, the market needs to improve and stable, transparent and predictable regulatory environment for the long-term healthy development of the platform economy and improve its international competitiveness.

Based on the statements above, it is clear to us that the regulatory environment is “bottoming out” as of now and the government is now more focused on economic growth and the previous regulation rounds of both the real estate and internet sector is coming to an end. However, experience shows that it usually takes a couple of quarters for policies transmission to be effective in the real economy.

Secondly, although the recent Covid-19 omicron outbreak in China is accelerating and the daily new infections have topped more than 2.000 new locally transmitted cases per day the tone in the response of this new round of Covid-19 containment. The overall strategy has changed from a “zero-tolerance” strategy towards a “Dynamic-Zero” strategy which implies to “achieve maximum prevention and control effect at the least cost and minimize the impact of the epidemic on economic and social development”. Shenzhen has already been reopened after a 7-day lockdown where mass testing was carried out and the identified local cases of infection were isolated. Which shows a more pragmatic and fast approach to balance these two dual priorities of social stability and limiting economic impact. In the conversation with a health expert earlier, it was mentioned that it is not feasible for China to continuously apply a "lockdown" strategy for Covid-19 in the long term, especially when new variants of the virus such as Omicron has higher transmission rate but lower case severity. However, it is currently too early to change the "strategy" for the country as vaccinations of dose 3 amount to about 46% of the population and dose 2 about 88% while the communication and preparations for a gradual change to "live with Covid-19" is not in place yet.

But a shift in strategy is expected and may be launched towards the summer when third dose of vaccination rate reaches a higher acceptable penetration rate, more antiviral treatments products available and a plan to isolate / treat milder Covid-19 in makeshift hospitals and only treat seriously ill patients. Thereby reducing the social costs of reopening under a more “controlled transition” when the social and economic cost / benefits of continued long-term lockdown cannot be supported. However, based on previous ”Covid-19” flare ups since 2020 the strategy of quick response to control the virus spread and cutting off transmission chain, although sudden and dramatic in the short term. It is usually accompanied with a quick economic rebound in the subsequent period. Already now, expect for Jilin and Shanghai other key regions in China is already reporting a decline in new confirmed cases and high frequency data is showing a moderate stabilisation of economic activies.

Thereby despite somewhat higher than expected YoY retails sales figures in Jan-Feb of +6.7% YoY we do expect this figure to drop in the short-term and further in Q2 2022 due to above mentioned conditions and gradually rebound again towards Q3 / Q4 given a stabilization of the current outbreak. But a final decisions and clear shift in “Covid-19 Exit Strategy” is needed for consistency in the rebound of the domestic market development.

However, looking outside China, we continue to see inflationary pressure and together with more interest rate hikes to come and recently the US 2 year and 10-year treasury yields have inverted –indicating a signal of concern for a potential growth slowdown / decline caused by a combination of high inflation rates and increased interest rates to reduce consumer purchase power externally.

Therefore, despite the sporadic Covid-19 flare ups and in waiting for a clear ”Exit policy” – China remains a key contributor to global growth in 2022 with low inflation, room for more proactive fiscal and monetary policy and additional upside when Covid-19 Exit strategy is clear to reach its +5.5% explicit growth target for 2022.

In the meantime, as the market is waiting for a clearer ”Exit policy” and reversal of leading economic indicators in the domestic consumption market. Equity valuations in both Shanghai and Hong Kong are trading at historical low levels. For long term investors who can patiently wait through the current externalities of Covid-19 a process of gradual earnings revisions and inflows could be rewarded as the China recovery case is expected to attract inflows as a bright spot in the otherwise rather complicated global economy.

For Nordic Asia our strategy remains intact, and we have been active since beginning of this year in our re-investment process at same time as we have been evaluating new target firms to further complement our strategic portfolio composition. Our portfolio companies are well positioned in structural growth market segments with favorable long term growth outlooks. Therefore, despite some short-term pressure caused by Covid-19 and external market sentiment, we’ve seen the resilience of our portfolio companies' ability to continue take market share and adjust their business models into new growth models and online sales. During this period, we have also taken the opportunity to bring in a couple of new companies with leading market positions in structural niche markets at entry levels these include Will Semiconductor (Leading domestic camera image sensor for smartphones, IoT and automotive applications), East Money Information (Leading domestic internet broker platform) along with Angel Yeast (Domestic food ingredients market leader for yeast products for the bakery segment) and Juewei food (Braised delicates retail F&B snack franchise chain).

However, we need to remain steady and patient in the current “dynamic Covid-19” process that will continue to have a drag on our domestic discretionary consumption sector in the short term and follow the developments of external market environments related to the observed high inflation rates, rate hikes and possible risks of external growth slowdown in the global economy.

Thanks again for your partnership in Nordic Asia and for supporting us in our journey ahead as the first public Nordic Investment company focused on China’s shift to a consumption led economy.

Kind Regards, Yining, Jason and the NA Team in Stockholm / Shanghai

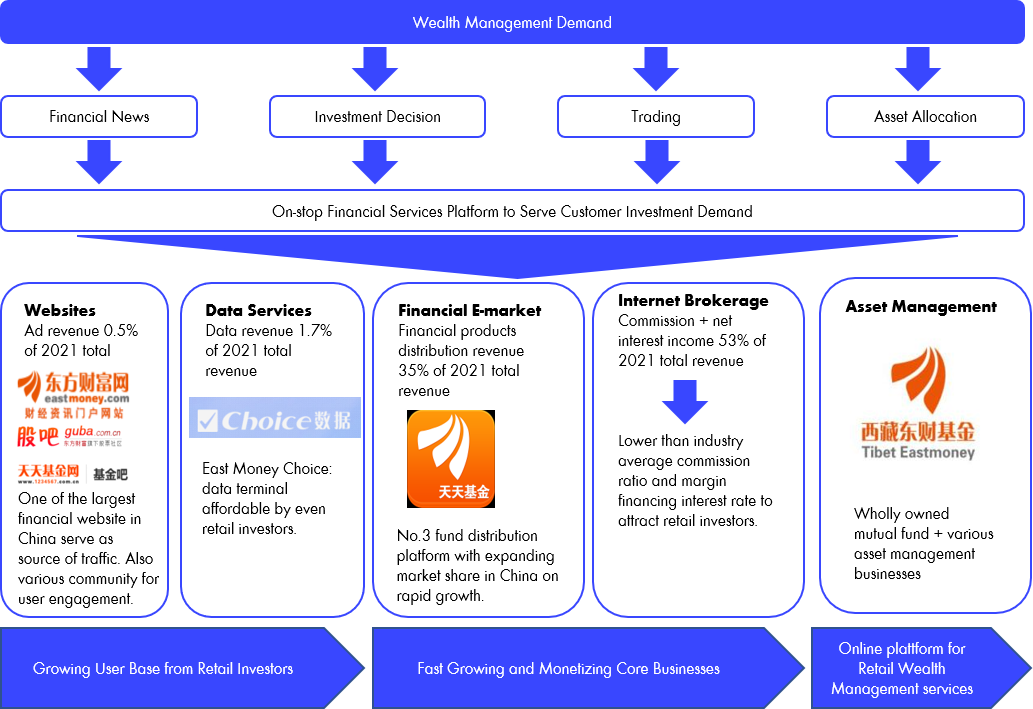

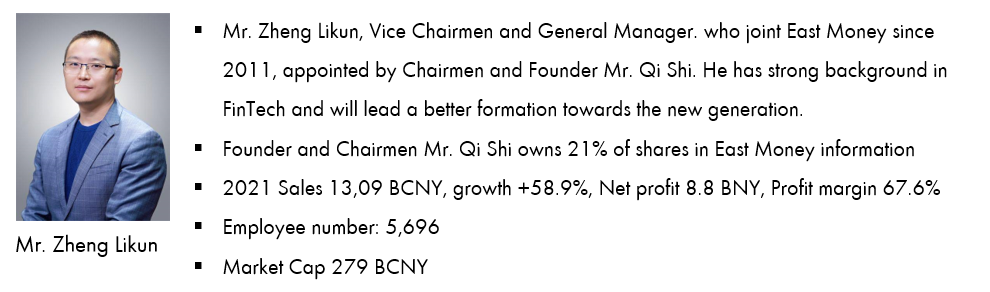

East Money

East Money information is a fully domestic licensed leading online retail investor stock-broker platform with fund distribution and margin financing services with low brokerage fees. China’s personal investable assets had been growing by 14% CAGR in past 10 year to +200TCNY due to the overall GDP growth. However, more than 60% of household assets are real-estate while investment mainly consisted of deposits and others. Only small propotions are traditional insturment including stocks, bond, funds, etc. Ease Money’s onlie fund distribution and brokerage platforms are easily accessable platforms with low cost to use. East Money accounted for 3% of overall securities industry by revenue but grew by 28% CAGR from 2015 to 2021. In 2021 revenue grew by 58.9% YoY to 13 BCNY while net profit up 84.6% YoY to 8.8BCNY. Its main growth driver fund distribution fee up 71.2% YoY benefited from the strong new fund issuance and retail investment demand driven by the liquidity boosted market performance in 2020. Fund sale value was 2.2TCNY up 72.5% YoY with 12,777 fund products available. East Money’s fund distribution platform, Tiantian Fund, ranked the third place by hold of fund via the platform. Brokerage fee & net interest income were +55.6% and +51.1% YoY respectively thanks mainly to active trading engagement from retail investors. However, due to global inflationary environment, rate hikes and geopolitical conflicts that has impacted global markets in the beginning of this year, the overall market sentiment is dampened in the short-term but East Money continues to gain market share as the only internet based fully licensed broker platform that is user-friendly to retail investor as a partner and provider of wealth management products and services.

East Money: Retail Driven Internet Brokerage with Digital Online Edge

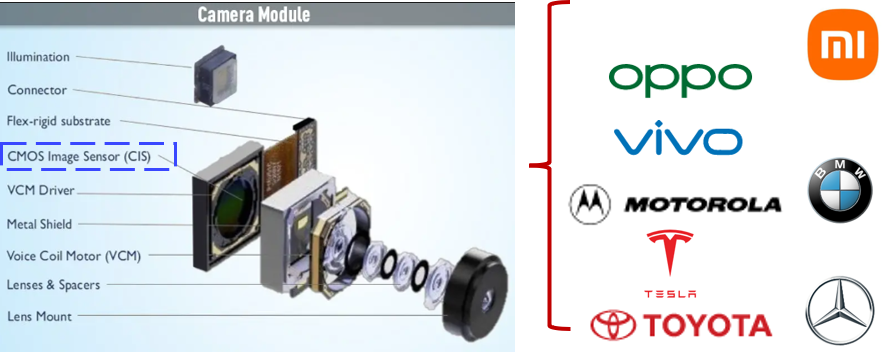

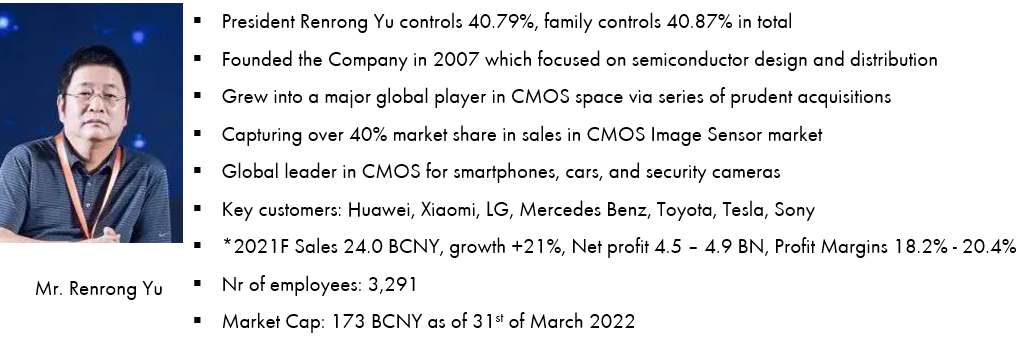

Will Semiconductor

Will Semiconductor Company is China’s leader in design of image sensing chips and distributions of semiconductor products. For the semiconductor design business which accounts for over 80% of revenue, the company operates in “fabless” model under which the company only focuses on the chip design, outsourcing the other parts of the chip production to foundries such as TSMC and SMIC. For the semiconductor distribution business which accounts for close to 15% of revenue, the company works with brands such as Sony and Samsung sell their products through experienced engineering teams across offices in mainland China and Hongkong. The company achieved a milestone in 2018 through the acquisition of Omnivision, transforming the company into a major designer of image sensing chips (Complementary Metal-Oxide Semiconductor, or CMOS) for smartphone cameras, vehicle cameras, security cameras, and medical-grade cameras. Omnivision was a leading image sensing tech company whose CMOS was used on iPhone 3G, 4 and 5. By 2020, Omnivision has ranked as the 3rd (10% market share) in smartphone CMOS market, 2nd (20% market share) in vehicle CMOS market, and 1st (32% market share) in security camera market. Per company’s 2021 announced profit earnings preview, revenue grew 21% to CNY 24bn while the net income is expected to be in CNY 4.5bn – 4.9bn range, representing over +65% net profit growth in 2021 driven by rapid growth in vehicle cameras segment as now vehicles need more cameras with higher autonomous driving / assisted driving capabilities. Situating in China with a strong product pipeline for consumer and EV (Electric vehicle) electronics in image sensing and touch & display fields, the company is well positioned to take advantage of its advanced technology and the proximity to the largest market for EV and consumer electronics as growth of cameras per device and vehicles will continue to drive demand for domestic manufacturer of CMOS sensors in coming years ahead.

Leading CMOS Designer Catering to Smartphone, Auto and Security Industry

CMOS sensors are used to create images in digital cameras, video camera and CCTV cameras

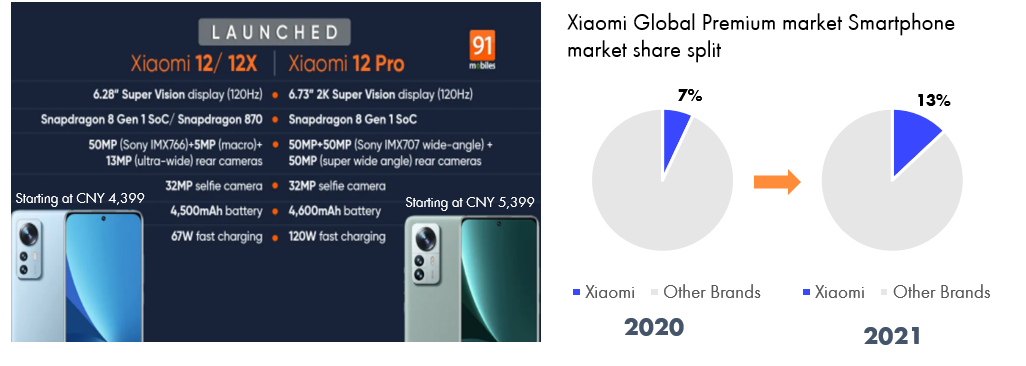

Xiaomi

In 4th quarter 2021, Xiaomi achieved CNY 85.6bn in revenue and CNY 4.5bn in adjusted net income, growing 21.4% and 39.6% year over year, respectively. Xiaomi made strides in multiple fronts by capitalizing on the fast rebound in oversea markets, a recovery in supply chain, and the consumption upgrade trend in smartphone markets globally. Specifically, the company maintained the leading position in smartphone market as the 3rd player in global market share, grew active user base globally and domestically by 28.4% and 17.0%, respectively, and increased AIoT connected devices by 40.4%. This helped Xiaomi achieved an outstanding year in 2021 with revenue up 33.5% to CNY 328.3bn and net income up 69.5% to CNY 22bn which exceeded market expectation. The growing revenue came with a higher gross margin which increased 3.2% to 11.9% in 2021 in the context of growing market share. Most notably, the smartphone business which accounted for ~64% of income in 2021, grew 37.2% with shipment up 30% and ASP up 5.6% year over year despite global supply shortage in chips.

At the release of Xiaomi 12 in late 2021, the company announced that it would start benchmarking its products against the iPhones and will put further effort in achieving breakthroughs in premium markets. Market data show that Xiaomi gained 5% market share in the premium segment above US$400 in 2021, trailing Apple (60%) and Samsung (17%). This shift towards the premium smartphone market will both drive new areas of growth as well as improve the companies overall ASP (average selling price).

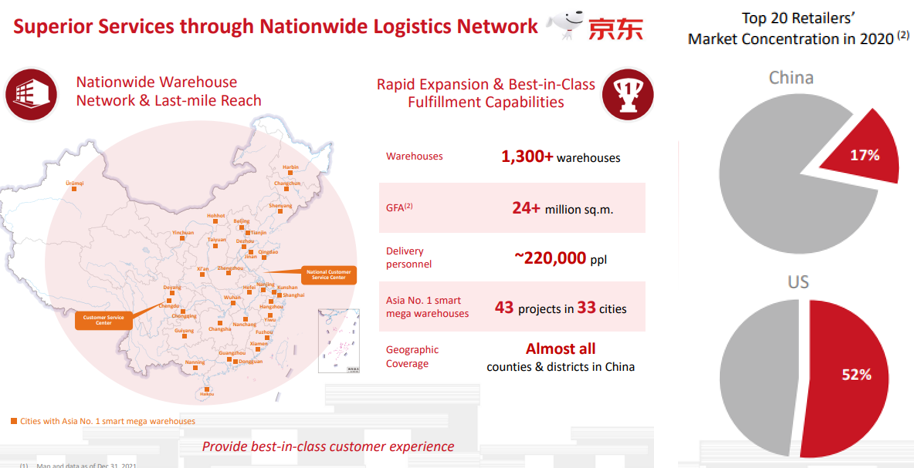

JD.com

JD delivered a 4Q21 result with revenue up 23% YoY to 276BCNY beating consensus by 0.8% amid an overall weak retail market in Q4 2021. Total GMV (gross merchandise value) grew by 26.2% YoY with average spending per user up +4.5% YoY to similar level of 2019. Furthermore, 4Q21 non-GAAP net profit up 49.4% YoY to 3.6BCNY beating consensus by 37%-. Operating margins of JD retail in increased by 0.2ppt YoY to 2.1% driven by overall efficiency gain and increased sales of third-party service revenue. However, new user growth slowed slighted and reached +97.8 mn user net add for 2021 vs expected 100 mn net add due to higher rate of user penetration during the year and reached a total user base of 569.7 mn active annual customers with most of the new customer acquisition in lower-tier cities. The overall E-commerce penetration in China reached 24.9% in 2020 and stabilized at 24.6% of total retail in 2021. Thereby the continued phase of E-commerce penetration of total retail might stabilize around these level and entered into phase that requires more sophisticated operation. This should be more beneficial to JD.com whose integrated E-commerce business operations with inhouse logistics and fulfillment center built on tangible business operations and a distribution platform with a user base close to 570 mn annual active users. Going forward we expect JD.com to continue take market share both via its direct to consumer and third party merchant sales along with continued margin improvement due to economies of scale and increase proportion of third-party platform sales in a yet fragmented overall retail market.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.