Nordic Asia Investment Group - Newsletter November 2022

Dear Investors,

Hope all is well recently and wish you all a nice upcoming holiday within soon Following the 20th party congress, the leadership in China has pragmatically during the past month stepped up its efforts to convey the key objectives of the 20th party congress of continued high-quality development and opening up. Thereby, the past month has been quite eventful in terms of policy guidance for the Chinese economy going forward.

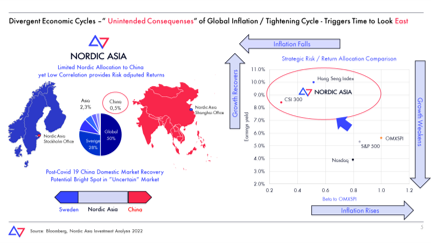

However, firstly, at a global level, the consequences of continued rate hikes are now even more visible in the US and the EU, where the combined effect of high inflation and increased mortgage costs continues to damp real purchasing power. Mortgage costs are now by approx. 2.1x times in the US and 1.9x times in Sweden compared to the same period last year and in real purchasing power terms for a 10 MSEK house with 80% LTV monthly interest cost has risen from approx. 18,000 SEK per month to now over 35,000 SEK per month. This elevated interest costs have caused a decline in the property market transaction volumes and a significant slowdown of the new construction market. Unfortunately, with continued elevated inflation levels, especially in the EU area, central banks will need to continue to raise rates well into 2023. Although the pace of rate hikes could slow down a bit heading into the next year as real interest rates improve. Global recessionary pressures continue to build up for 2023 as the combined effect of inflation and higher interest rates will continue to weigh on consumption purchase power.

On a domestic level in China, the economic activity in the short term continues to be subdued due to a combination of Covid-19 resurgence and weaking export demand while the new built construction market is recovering gradually. In the month of November, the index of Covid-19 restrictions measures continued to climb to levels reaching that of March / April 2022 earlier this year. Thereby recent economic indicators such as retail sales -0.5% and composite PMI fell to 48.3 in the month of October and remained in contraction with continued weakness in November.

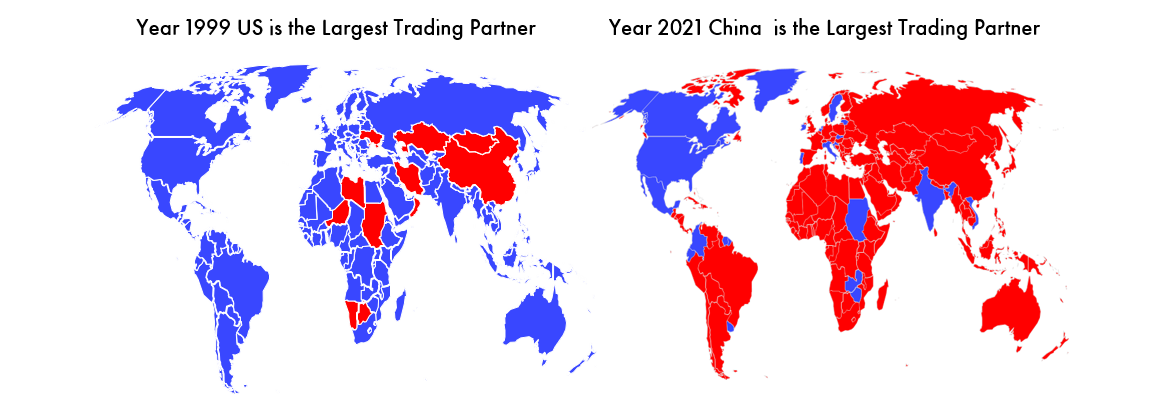

However, despite these subdued economic indicators, the market has been more focused on the changes in economic policies both internationally and domestically. First internationally, China continued to reiterate its commitment to continued market reforms and opening up to global leaders during Hong Kong global financial leaders, G-20 and APEC summits to reinforce its commitment to high-quality development, global economic participation & cooperation to reduce some of the previous “de-coupling” concerns. China is today the world’s largest manufacturing country and also the top trading partner for more than 150 countries globally and this changed quickly since 1999 as shown in the maps below. Therefore, as China continues its path towards modernization, China is also dependent on its global investment and trade relationships globally and the global economy is also dependent on the integrated value chains in China and needs to participate in its growing domestic market. Therefore, it was pleasant to see the more pragmatic approach and dialogues of Chinese and global leaders during the summits last month.

Additionally, as the leadership needs to achieve its key objective for development, we continued to see more proactive economic policy support in November as the government rolled out both 20 new measures of further optimized Covid-19 policy adjustments and 16 new measures to restore financing channels for the real-estate sector along with an additional 25 bps reserve ratio cut to further release funding support and bank lending to the real economy. These policy announcements were above market expectations and well needed to bring the economy back to an approximate 5% organic growth rate with the focus on recovering the domestic market economy as export demand is expected to slow down in 2023.

The policy announcements above show a clear signal that economic development remains, as mentioned in the 20th party congress, the top priority for China and its leadership. Therefore as the economy remains subdued below the potential growth rate, recent policy advancements have shown its commitment to a more pragmatic approach to restore economic growth and developments for the upcoming year.

Noteworthy the adjustments of the Covid-19 relaxation measures came at a time in which the number of cases was on a steeply increasing process similar to that of Shanghai earlier this year. However, as discussed internally we think the rationale of this change is due to two main variables: 1. The current Covid-19 variant BF.7 has a transmission rate even higher than that of Omicron but the severity of the new variant continues to be less virulent than previous. 2. The implementation of the “dynamic zero” policy has shown to be less effective than expected and therefore the economic consequences have been less favorable compared to previous period when the virus was less transmittable and therefore more containable via the zero-covid strategy. But due to healthcare capacity restrictions, the government cannot via official channels convey a change in strategy more broadly at this stage, however if the surge in the news cases continues to raise and Covid-19 relaxation measures continue to be in place then China will not have any choice but to gradually allow a “controlled” spread of the virus via the “flattening of the curve” strategy and gradually move towards a strategy of “Covid-19 co-exist” instead of zero-covid-19. Therefore, if the leadership now decides to “move” forward, and the transmission of the new variant continues at a fast pace, it will be more and more difficult and eventually will not be able to “move” backwards towards a “zero covid-19” society strategy since the fast transmission rate of the virus will become so prevalent in society and will become more or less impossible to control the virus back to zero covid-19.

From an economic perspective, if moving forward is the option ahead, then the upcoming period of “controlled” spread and “flattening of the curve” strategy continues to weigh on economic growth potentials in the short term. But as the Covid-19 relaxation measures continue, underlying economic activities in the domestic economy will gradually improve during 2023 until the final state of “Covid-19 co-existence” where economic activities will finally normalize back to their potential growth targets.

In addition, the central government has begun to increase support for the real estate industry. This month, the Bank continuously released three major policies on the guaranteed delivery of real estate, supported banks to extend large amounts of credit to real estate enterprises, and liberalized the secondary market financing of the real estate industry, which has been closed for 12 years, demonstrating the determination of the Central Bank to stimulate the real estate market. Maintaining the steady development of the real estate market, ensuring the stability of the employment market, and protecting the vitality of economic entities will become the focus of the government's work in the next 1-2 years. We expect that China's real estate market will return to the normal development track in 2023 as stabilizing the real estate market will be a key component of China's economic stability in the future.

Based on the recent comments from the PBOC central economic advisor, the economy should aim to recover back to a 5% growth rate in 2023 and preferably achieve a growth average of 5% in 2022 and 2023. In mid-December, the Central Economic Work Conference will be held to set the overall growth strategy and economic goals for next year. Based on the progressive pro-economic policies announced so far and the continuing Covid-19 easing measures, we should expect further guidance and policy support to gradually lift growth back to ”pre-covid-19” levels. This is a gradual process but given the state of the world economy and the inflation rate in China is well anchored around 2%. The reopening of China in 2023 and the recovery of the domestic consumption market might be one of the few bright spots in the global economy next year. Nordic Asia along with our portfolio companies who have taken market shares and continued to invest during Covid-19 are well positioned to capture the growth recovery in 2023 and the long-term opportunities of the shift towards a consumption-oriented economy in China ahead.

Tencent

Tencent delivered an in-line result in 3Q22 with revenue -1.5% YoY to 140BCNY while adjusted net profit +1.6% YoY to 32.3BCNY. Tencent’s overall gross margin improved to 44.2% as the group further cut loss-making project and lowers content-sharing cost to live streamers. OpEx ratio was flat at 24% of revenue thanks mainly to a decline in S&M expenses (-32% YoY). G&A ratio (8.1% of revenue) was maintained after massive layoff since start-2022.

By segments, Tencent’s game revenue was 42.9 BCNY, -4% YoY, remained weak with its weak domestic game segment. Main reasons include weak macro, drag from China’s minor protection and Tencent’s slow progress of its gaming pipeline. Blockbuster “HoK” and “Peacekeeper Elite” suffered revenue decrease in the first summer under minor protection. We believe Tencent’s domestic game revenue should be more steady ahead as the China game industry lapping the impact from minor protection. However, growth upside on its gaming business will require a combination of continuous improvement of game license issuance and a stronger domestic gaming pipeline.

Online advertising segment beat expectations with 21.4 BCNY (-5% YoY) revenue which was helped by the introduction of Video Account (VA) in-feed ads and strong growth of mini-program ads. Management indicated that VA ads have robust ECPM and excess demand while mini program DAU surpassed 600mn with 30% YoY growth. The introduction of VA ads also enriched the overall ecosystem. We see Tencent’s online advertising segment should start to bottom out in 4Q22 helped by VA and mini program as a key new growth area as the economy starts to recover. In addition to its core business, Tencent holds an investment portfolio of approx. 100 BN USD or 25% of the market cap. Tencent will continue its shareholder value generation via either distribution in kind or share repurchase to repatriate the investment proceeds to its shareholders. Tencent is now trading at an attractive valuation of approx.~13x 2023E PE if we exclude the value of its investment. Looking ahead, Tencent’s fundamental should be gradually bottoming out as China tend to uphold the economy and ease the COVID control policy. However, Tencent would need a stronger recovery of the domestic gaming sector and a stronger domestic gaming pipeline in order to sustain its previous growth rates.

JD.com

JD’s 3Q22 result was in-line with revenue at 243.5 BCNY (+11.4% YoY) and adjusted net profit at 10 BCNY (+98.9% YoY) implying an adjusted net margin of 4.1% (vs 2.3% Q3 21). Non-GAAP fulfilled gross margin was 9.1%, +1.2ppt YoY. Both COGS% and OpEx% improved YoY thanks to cost/expenses reduction. User growth was 7.5mn net quarterly net addition. It was a slow growth but reversed from negative QoQ growth in 2Q22, which was in line with our expectation of limited user growth.

JD retail revenue +7% YoY with OPM improved by 1.2ppt. The margin improvement was driven by the slower growth of general merchandise revenue (+3% YoY) on a high base and COVID disruption, i.e. less margin drag. Electronics and home appliance revenue grew by 8% YoY thanks to better Air conditioning sales amid the unusual high temperature summer. JDL revenue +39% YoY with margin improvement trend (OPM:0.7% vs. -2.8% in 3Q21). JD continues to shrink its new business with revenue -13% YoY on loss cut initiative. Hence, New businesses recorded 276MCNY operating profit thanks to narrowing loss of Jingxi and gain from the first tranche closing of JD Property’s third property core fund in 3Q22.

Looking ahead, we believe JD’s margin expansion will continue to improve due to economies of scale and an increased share of services revenue. Despite Covid-19 JD.com has continued to take market share in recent years and will benefit from the overall ease of the COVID control policy.

Meituan

Meituan also delivered an in-line result with 3Q22 revenue of 62.6 BCNY (+28% YoY) while adjusted net profit at 3.5 BCNY (adj. NPM:5.6% vs loss of -11% Q3 21). Gross margin improved by 7.5ppts YoY to 29.6% thanks to improved cost efficiency across food delivery (FD), instant shopping, and retail business, i.e. less subsidy YoY. S&M declined by 4% YoY. Adj. EBITDA turned positive for the second consecutive quarter to 4.8 BCNY. The number of transacting users was 687.1mn, +2.9% YoY only, in line with our expectation of decelerating user growth. The number of active merchants was 9.3mn +12% YoY slower than 19.5% YoY growth in 2Q22 due to COVID resurgence.

Core local commerce revenue was 46.3 BCNY (+25% YoY) with operating profit at 9.3 BCNY (OPM 20.1%, -2.4ppts QoQ). We saw growth rebound in both FD and in-store, hotel & travel (IHT) thanks to activities rebound after Shanghai lockdown in 2Q22. Instashopping maintained strong growth (+56.6% YoY) with a low base. However, UE declined QoQ in 3Q22 for both FD and Instashopping as Meituan increased consumer subsidy to ramp up order volume. On-demand order volume hence grew by 16.2% YoY in 3Q22, vs. only 7.6% YoY growth in 2Q22. New Initiatives revenue was 11.7 BCNY (+40% YoY) in 3Q22 thanks to higher demand and penetration of Meituan’s retail businesses. Operating loss ratio was -41.6% further narrowed from -48% in 2Q22 due to higher average order value of Meituan Grocery and Meituan Select and the reduction of marketing/promotional expenses.

Looking ahead, we expect Meituan’s result to be under pressure due to COVID in the short term. But in 2023 Meituan should be a major beneficiary as COVID measures finally started to ease, however, new user growth rates might slow down due to high base and we expect competition from Douyin will intensify in its IHT segment.

SF Holding

In 3Q 2022, revenue increased 45.39% YoY to 69.08 BCNY. Net income increased 111.79% YoY to 1.72 BCNY. Gross margin of 12.23% and adjusted net margin of 2.49%. The SG&A and R&D expenses accounted for 5.3% and 0.6% of revenue compared to 4.3% and 0.6% from 3Q 21.

The domestic express parcel volume and ASP changed by+10.5/-1.7/+5.2% YoY and -8.9/-4.0/-4.0% YoY in 1Q/2Q/3Q22 (per the State Post Bureau); whereas the company’s changed by -1.5/+1.1/+8.9% YoY and +4.2/+2.8/-0.4% YoY, respectively. It managed to top the industry by express delivery volume since 2Q22 despite external pressures.

In 3Q22, SF Holding achieved a volume of 2.82 billion express shipments, accounting for 9.8% of the market. With scientific Covid19 prevention and the restoration of the express delivery industry, the shipments have rebounded. 22M7 achieved 921 million shipments, +8.9% YoY; 22M8 942 million shipments, +9.2% YoY; 22M9 960 million shipments, +8.7% YoY. The monthly growth rate of the company’s shipments far exceeds the industry growth rate.

SF implemented the product structure optimization. Revenue continued to improve. The ASP of express business in 22M7-M9 was: 16.02, 15.61, and 16.05 yuan respectively, with +4.2%, +1.2%, -5.8% YoY growth rates. SF is committed to refined cost control, continues to deepen multi-network integration, and optimizes product structure. With the effective control of cost and the recovery of the consumer market, next year`s shipments and profits will both improve.

Xiaomi

Xiaomi released its financial results for 3Q 2022 with revenue at 70.649 BCNY -9.74% YoY and adjust net profit was 0.91 BCNY, -67.2% YoY. Gross margin of 16.63% and adjusted net margin of 1.29%. The SG&A and R&D expenses accounted for 8.7% and 5.8% of revenue compared to 7.9% and 4.1% from 3Q 21. In 3Q Xiaomi’s smartphone shipments were 40.2 million units down YoY -8.4% but improved slightly QoQ mainly due to general slowdown in the global smartphone market. In 3Q 2022, in the face of ongoing global macroeconomic headwinds, Xiaomi has demonstrated resilience, especially in Smartphone and IoT business.

According to Canalys, Xiaomi global smartphone shipments ranked No. 3 in 3Q 2022 with 13.6% market share. In overseas markets, Xiaomi market share in regions including Europe, Latin America, and the Middle East all increased YoY. Xiaomi ranked No. 2 in Europe with a 23.3% market share, an increase of 1.8% YoY; ranked No. 2 in the Middle East with a 17.6% market share, an increase of 1.3% YoY; ranked No. 3 in both Latin America and Africa, with 15.0% and 6.0% market share respectively.

In 3Q 2022, revenue from IoT and lifestyle products amounted to RMB19.1 billion. Revenue of smart large home appliance category (including air conditioners, refrigerators and washing machines) grew over 70% YoY, achieving another record high. TV shipments grew 9.3% YoY to 3.3 million units, outperforming an overall decline in the global TV market. Refrigerator shipments exceeded 340,000 units, an increase of over 150% YoY. Air conditioners shipments exceeded 1 million units, an increase of over 70% YoY.

Looking forward, Xiaomi is expected to rebound well in its domestic market as Covid curbs ease in 2023 and continue to stay highly competitive in its overseas business despite macro headwinds abroad next year.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.