Nordic Asia Investment Group - Newsletter October 2022

Dear Investors,

Hope all is well in the month of October.

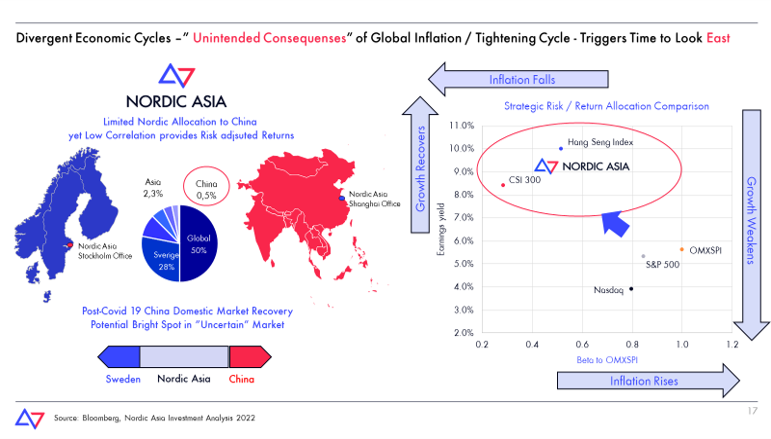

On a global level, during the month of October, despite quite decent on target GDP growth numbers in Q3, the trend of continued high inflation and gradual economic slowdown continued. As Euro zone composite PMI came in at 47.1 in Oct vs 48.1 in Sep and US composite in Oct PMI fell to 47.3 vs 49.5 as inflation remained high in both the EU area of 10.7% and US inflation for Oct is expected to remain above 8%.

A good support to markets came when longer duration treasury yields increase leveled off first in the UK, US and then more broadly in other developed countries. This is a positive sign to the markets that longer term inflation expectations remains anchored, and fiscal discipline can push down longer duration treasury yields. But going forward, if the balance sheets of major central banks remain at historical high levels, then short term interest rate hikes alone might not be sufficient to contain current inflationary pressure.

Shortly, the US midterm election will be finalized and current the polls are predicting the republicans will regain control of the House of Representatives, leaving congress and the two legislative branches split again between the two parties. Going into next year, if fiscal discipline would be required to anchor long term treasury yields and if the republicans would control the House of Representatives, then another heated discussion around fiscal budget and debt ceiling negotiation could occur, possibly limiting fiscal stimulus support to the real economy in the US in 2023.

Overall, on a global level, inflation remains the key market concern and unless inflation can be structurally contained then persistent reduction in real purchasing power will continue to put pressure on economic growth outlooks in major economies in 2023 ahead.

On a domestic level in China, market volatility in the Chinese A-share and HK shares remained high during this month caused by both domestic and external factors.

Domestically, the Covid-19 situation is still uneven in the month of October as the of nr of local outbreaks remained high and more stringent Zero Covid-19 tracing and travel restrictions implemented before and during the 20th of party congress meeting, thereby limiting both inter-city and intra-city travels as the daily average volume of domestic flights (excluding Hong Kong, Macao and Taiwan) fell by -22.0% month on month and the daily average passenger traffic volume of metros in the top ten cities in China was 35.78 million, down -19.8% on a month on month basis. China composite PMI in the month of October came thereby in at 48.3 vs 48.5 in Sep while service PMI slowed to 48.4 vs 49.3 in Sep. Thereby the more stringent Covid-19 control measures in Oct, continued to slowdown the recovery consumption and business activities. The overall property sales in October remained weak. As of end of Oct, the average daily trading area of 30 large and medium-sized cities was 341.000 sqm meters down -11% YoY and slowed sequentially as the daily average turnover from August to September this year was 397.000 sqm and 439.000 sqm respectively. Despite subdued transaction volumes in October, due to the stabilizing domestic property policies, actual project completion rates gradually improved in the month of October and benefited companies in the new built sector.

More importantly, in Oct, the 20th party congress was held from the 16th -23rd of October reaffirming a clear blueprint for China vision and development priorities for the next governing period. Please see our extra section below on the key takeaways from the 20th party congress. After the conclusion of the 20th national party congress, the focus will now gradually shift back to prioritize economic activities and preparations for next year.

Going forward as export slows and real estate sector at the best will stabilize at neutral growth rates, then in order to achieve an annualized growth rate ahead of approx. 5% real GDP growth – the key growth lever would be the recovery of the domestic consumption market.

Externally, market volatility was high caused by a combination of both increasing yields in US and concerns about the new 20th party congress politburo. However, some of those concerns were a bit exaggerated as the past 10 years of economic development have increased China economic output from approx. 8.5 trillion USD to approx.18.3 trillion USD in 2022 since 2012.

At the same time, during the 20th party congress the party resumed to put high levels of continued opening-up on top of the national development agenda. Thereafter, German Prime Minister Olof Schultz was invited to China for a top-level meeting and the approval of COSCO Group's acquisition of Hamburg Port along with BASF committing to build a 10 billion euro new factory in China is a positive sign to continue cross-border FDI expansion and opening-up.

The core focus on economic development, continued market reforms and opening was further re-emphasized during the Global Financial Leaders Investment Summit in Hong Kong by top Chinese financial policy regulators and attended by global banking leaders. During the summit financial regulators vowed to continue the message from the 20th party congress that China’s future economic development and financial sector will only open more and more to foreign capital participation and that the goal of high-quality development implies the need to develop high quality capital markets.

Going forward, despite the overall clear long term development directions from the 20th party congress, we still need and expect more clarity around the key growth targets and growth measures for next year and the means to achieve a reversal of economic trends to a more sustained 5% annual growth rate level.

The current “on and off” situation of the Zero Covid-19 policy is still the biggest obstacle to China's economic recovery at present. We will closely observe the changes of epidemic prevention policies in the future, which will be the starting point of a new round of domestic economic expansion cycle.

When we get more concrete policy measures from the new politburo, then at current valuation levels and low domestic inflation rates, we would expect a combination of domestic and foreign capital might continue to flow back to the A-share and HK market at quick pace.

In general, despite complex global environment and inflation outlooks, the long-term trajectory, key economic opening up policies and economic fundamentals of China remains unchanged. Therefore, we remain patient in the short term yet confident in the long term.

Many thanks again for your partnership and support in Nordic Asia as always,

Please see below for more specific selected portfolio company updates in the month of October.

Best Regards

Yining, Jason and the NA Team in Stockholm & Shanghai

2nd of November 2022

The CCP 20th Party congress was held during the 16th – 23rd of October where the key opening speech by president Xi Jingping laid out the blueprints and key focus areas for the long-term development goals and focus areas to lead the continued high-quality development and modernization of China. Below are some of the key highlights from the opening speech:

- High quality Development is always the top priority of the party

During the 20th party congress, the two-step strategic growth plan was reemphasized to first achieve mid-income per capita country by 2035 and high-income per capita by 2049, further indicating that development is always the top priority of China Government. China GDP will reach approx. 18.3 trillion USD in 2022, and to achieve the 2035 goals the economy size would need to by 2035, implying a required growth rate of at least 4.7% per year. With GDP growth slowdown and increasing uncertainties after covid 19, it is expected that Chinese government would initiate relevant policies to stimulate economy after 20th congress meeting. Concerning the development pattern, China has become the world’s second largest economy driven by investments, low-cost manufacturing and exports, however, growth has moderated in the face of structural constraints, including declining labor force growth, diminishing returns to investment, and slowing productivity growth, requiring the government to make increasingly efforts to shift to a high-quality and sustainable growth path. Xi president highlighted “High quality development”, navigating the development direction to real economy, independent innovation and advanced manufacturing and expansion of the domestic market in the next growth phase. The congress also mentioned the emphasis of both quality and quantity of growth along with further measures to stimulate domestic demand along with supply-side reforms. Thereby the top priority of the coming mandate period and the key role of the CCP is to lead and ensure continued development of the China into a fully modernized high income country per capita according to its Two-Step Strategic Plan.

- Development Through Security Science, Education and “Ensuring Technology Self reliance

Compared with the 19th meeting, this is the first time that CCP highlighted these two topics into the report. On the one hand, high quality development is fueled by innovation and science, and on the other hand, with rising tensions and tightening technology export restrictions. Technology self-reliance is becoming one of the top priorities for the China government and will further encourage independent technology development including domestic substitution, Innovation on critical areas such as semiconductor, supercomputing and AI. Additionally, further emphasis will be put on food, supply chain, energy security along with continued emphasis on developing its renewable energy sectors.

- High Standard Opening-up and Common Prosperity

Opening-up was one of the major drivers of China economy in the past decades. Foreign institutions were concerned about the continuity of opening-up before the meeting. 20th Party Congress reiterated that China will deepen opening-up through promoting all-round opening of agriculture and manufacturing, orderly opening-up of telecom, medical and other services sectors, creating an institutional opening-up platform and further improving RMB globalization. On the topic of Common Prosperity, it is implied that the government is supposed to make greater efforts on both supply and demand sides and expand middle-income groups by multiple means. I.e. to 1. Improve public services and ensure equal access to public service; 2. Improve the system of income distribution via incentive system to encourage “more pay for more work”, more equal opportunities; 3. Increase the income of low-income earners, expand middle income group, improve taxation system, social securities systems and lawful means of wealth accumulation well regulated.

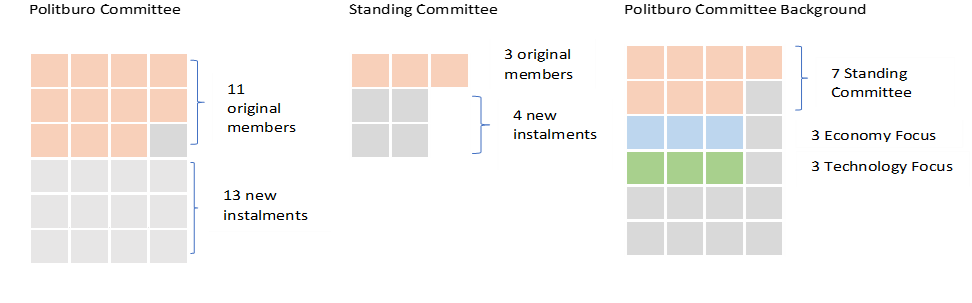

On Oct 23rd, CCP released member lists of Central Committee and Central Politburo. Unsurprisingly, President Xi consolidates his power in the CCP with a third five-year term, while naming key allies to the seven-member Politburo Standing Committee. Some of the changes in the top leadership in the politburo was mainly the retirement of Li Keqiang and Wang Yang and that Li Qiang (new premier, previous mayor of Shanghai) become premier instead of previously mentioned Wang Yang.

In summary, the 20th party congress mainly reiterated the policies and overall direction for Chinas development going forward to build on those areas and policies that have served China well in the past. I.e. CCP leading role to lead the continued modernization of China through market-based reform, continued opening-up, financial stability and provide equal opportunities, social safety nets for its vast population. On the Taiwan issue, the party congress further stated the nr 1 priority is to ensure peaceful reunification via the one country, two system structure but at the same time CCP would not rule out tactical intervention targeted at separation forces or foreign interference if threats to status quo or color revolutions would occur.

Robam Appliances

Hangzhou Robam Appliance is the no.1 Chinese kitchen appliance brand. Robam started its business in 1979 then developed the first generation of range hoods in China in 1987. After that, Robam gradually became famous in offering traditional categories including range hoods, gas stoves and sterilizers. By 2021, Robam’s range hoods achieved the record of no.1 domestic sales volume for 24 years and global sales volume for 7 consecutive years. According to AVC data, Robam was ranked no.1 within domestic kitchen appliance market in 2021 by 30.4%/23.1% market share in offline/online channel respectively. Robam is now known as one of the two high-end Chinese kitchen appliance brands with innovative products. Backed by the strong brand equity, Robam built its extensive network in higher-tier cities with its resourceful distributors. Robam’s product covers +10,000 POS across the countries. Robam also further deepened its penetration via e-commerce platforms (both high and low tiers), property developers, furniture retail and home renovation channels. Robam has secured a solid position by building an empire of kitchen appliance covering various distribution channels in China.

From industry perspective, a consolidation trend has benefitted the leading brands. Since 2018, Chinese kitchen appliance industry experienced weakness dragged by the headwind from the property sector slowdown and the disruption from COVID-19. The industry as whole suffered negative growth from 2017 to 2020 while Robam outperformed the industry and further diversified its sales channels. Its online channels and lower tier sales channel accounts for almost 40% of sales, offline retail shops accounts for approx. 26% of sales and B2B sales to construction projects accounts for 20% of total sales.

On top of the established market position in traditional categories, Robam is actively expanded into the trending categories with low penetration rates such as steam & bake ovens, dishwashers and integrated stoves. Robam has strong capability in new category expansions via its solid product quality, extensive POS network and strong brand equity. A good example would be Robam’s dishwashers market share gain in the past 3 years. Robam started its own dishwashers manufacturing in 2019 when the market was led by Siemens (+40% market share online or 80% market share offline). Robam’s entrance into the dishwasher market was also way behind its major domestic competitors Midea, Haier and Fotile. However, Robam rapidly grew the market shares of its dishwashers by leveraging its edges in the domestic market. Robam’s dishwashers online/offline market share expanded from ~1%/8% respectively in 2019 to 9.2%/20.7% respectively in 2021 while Siemens’ market share declined significantly. Similarly, Robam also expanded its categories into steam & bake ovens and integrated stoves for a better growth. Robam is strong domestic brand in kitchen appliance industry, and we believe that Robam’s current low valuation provides us safety margin in investment and good upside potential as the retail / renovation market recovers.

Inovance

In 3Q2022, Inovance achieved 5.84 BCNY in revenue and 1.11 BCNY in net income, growing at +15.19% and +16.24% YoY, respectively. On the cost side, gross margin was 35.24% while the same period last year was 36.13%, caused by the increasing price of raw material. Meanwhile, SG&A of revenue decreased to 9.07% from 10.55% and R&D expense increased to 10.19% from 8.71%.

In 3Q2022, Inovance showed great resilience. Affected by the downturn of the macro economy and the Covid 19, industrial enterprises' willingness to invest has weakened. As a result, the growth of automation industry has slowed. Besides, product delivery has been affected. However, by virtue of its competitive advantages such as excellent product quality, rich variety, and timely delivery, the company can accurately meet the needs of downstream customers and ensure that revenue maintains positive growth. In addition, in 4Q, the capital expenditure of industrial enterprises will recover, thereby the demand of automation is expected to improve MoM. Inovance is expected to deliver a satisfactory performance this year.

China manufacturing shift towards industrial automation to improve efficiency and quality in its high-end manufacturing sector is a given trend. In this sub-market, Inovance has already established itself as a key domestic brand with first-mover advantage, high barriers to entry and solid customer base. With the continued development of China's industrial automation market and need to increase efficiency, we think Inovance is well positioned to capture the growth of this domestic market ahead.

Eoptolink

Eoptolink, as a domestic leader of high-speed optical transceivers, achieved in 3Q2022 0.94 BCNY in revenue and 0.30 BCNY in net income, growing at +61.85% and +112.42% YoY, respectively. On the cost side, gross margin was 37.59% while the same period last year was 29.79%, caused by the increasing price of raw materials. Meanwhile, SG&A of revenue decreased to 3.70% from 2.88% and R&D expense increased to 4.94% from 3.75%.

In 3Q, Eoptolink results exceeded expectations. The market was concerned about the telecom and datacom markets before. In the case of uncertain industry demand, the company can achieve positive growth of orders through its product quality advantages, cost advantages, quality advantages, delivery advantages, etc. This reflects the competitive advantage of Eoptolink. The development strategy of Eoptolink focuses on the high-end products of datacom market. In 3Q the company optimized the product structure and achieved a significant increase in gross profit margin.

As a fast-growing player in the high-end optical module industry, Eoptolink gradually penetrates into more top clients in this industry both domestically and internationally. The company is continuously following the most advanced technology trend of the optical module industry. Eoptolink is expected to continuously gain market share (especially high-end product) in both datacom and telecom market, with strong technology advantages, delivery capability, and cost control.

CATL

CATL is the largest manufacturer of power lithium batteries in China, achieved 97.37 BCNY in revenue and 9.96 BCNY in net income during 3Q 2022, growing at 232.47% and 160.80% YoY, respectively. On the cost side, gross margin was 19.27% while the same period last year was 27.90%, caused by the increasing price of raw material. Meanwhile, SG&A of revenue decreased to 5.52% from 6.27% and R&D expense decreased to 4.94% from 6.15%.

In 3Q 2022, CATL shipments beat expectations. The fast-paced expansion of capacity ensures the company‘s strong delivery capabilities as always, which highlights its competitive advantages. The expansion of capacity in Europe is smooth. The proportion of power battery exports has been further increased. Although the US IRA Act has a certain impact on the development of the overseas business, CATL is actively discussing future countermeasures with downstream customers. The company`s energy storage battery business is a new growth area for CATL. CATL has achieved competitive advantages in the field of energy storage by virtue of its products performance and high energy density. On October 18, CATL announced that it has entered into an agreement with Primergy Solar LLC, a U.S. utility and distributed photovoltaic + energy storage development operator, to exclusively supply batteries for the Gemini photovoltaic + energy storage project. The company is actively exploring the foreign energy storage market. The new-generation Kirin battery is expected to be loaded into vehicles by the end of this year. In the field of new batteries such as sodium-ion batteries, CATL has sufficient technical reserves, and related products are expected to be launched next year. Therefore, the continued global penetration of EV cars along with new applications within the energy storage segment will continue to drive market demand for CATL and its product solutions.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.