Nordic Asia Investment Group - Newsletter October 2023

Dear Investors,

Hope all is well in the past month,

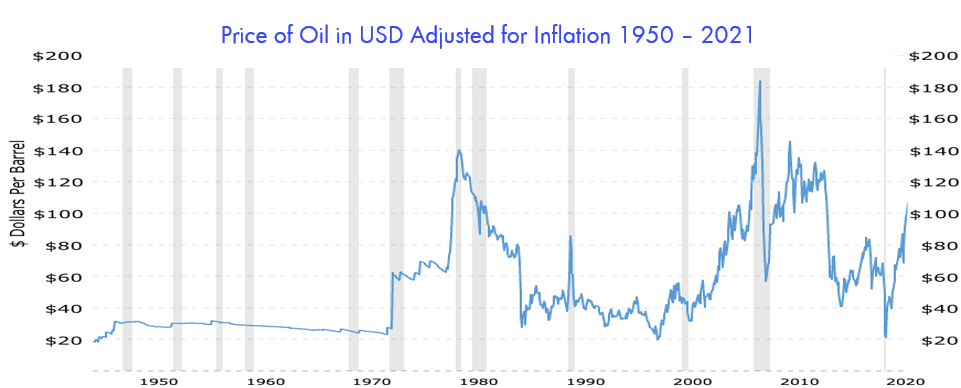

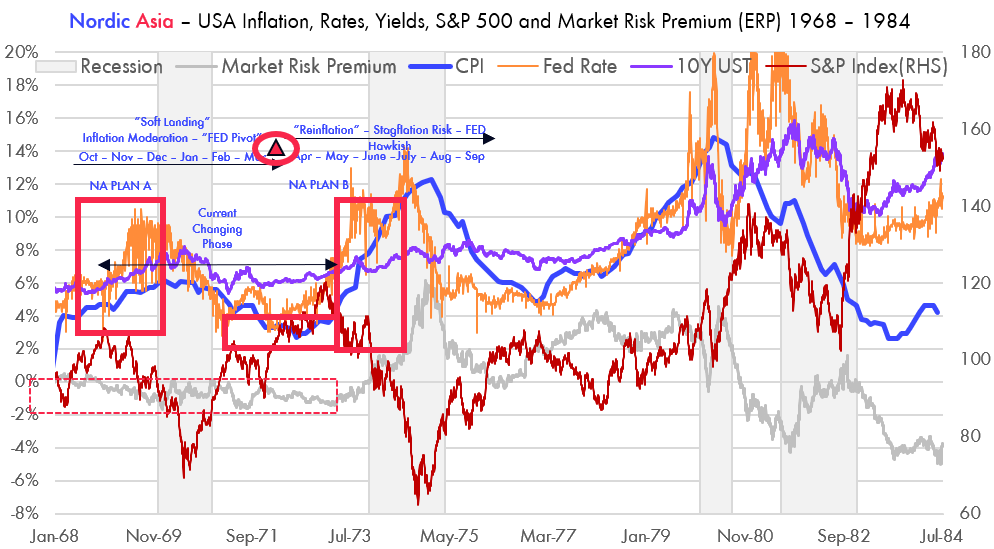

The past month has been highly eventful, to say the least, especially recently with the shocking geopolitical Israeli-Palestine conflict after the sudden and devastating attack by Hamas on the 50th anniversary of the 1973 Yom Kippur War. We are now again facing a highly complicated economic and geopolitical market environment as we enter Q4 2023. Global inflation outlook is the most important parameter to global market trends in this cycle, and even before the Pandora box of the Israeli-Palestine conflict, oil prices (WTI) during the month of September surged to a year high of 95 USD per barrel. We know the oil price base effects from US headline CPI will decline further from September onwards, and any changes in current WTI oil prices will significantly change the trajectory and the market view of inflation outlooks ahead.

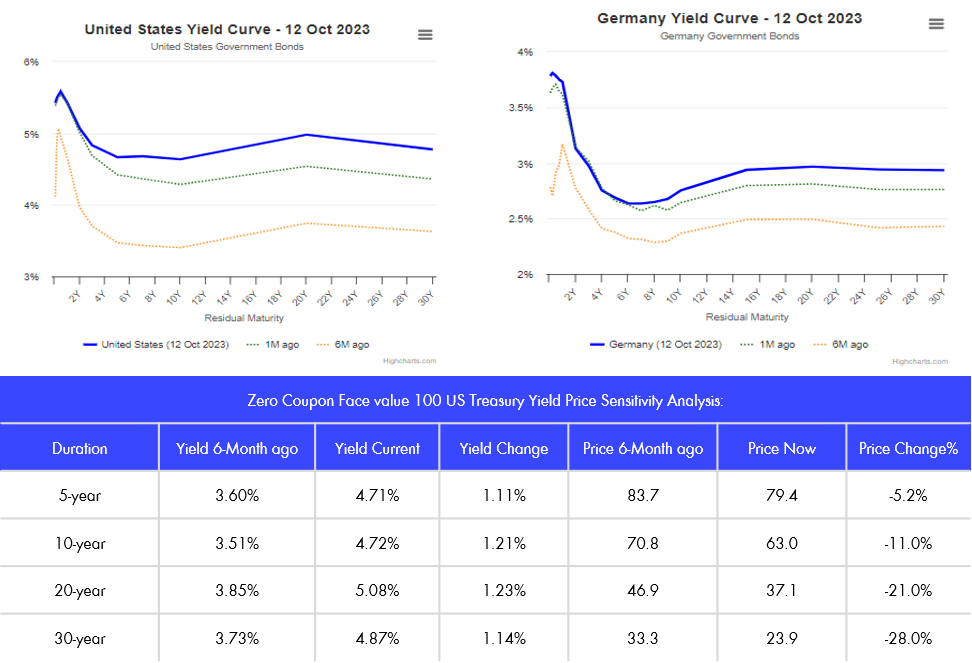

Therefore, as oil prices climbed in September (even before the Israeli-Palestine conflict), this led to a continued increase in longer term global government yields. The increase in longer-term bond yields, in turn, prices in a more prolonged inflationary environment. However, due to the longer durations, incremental yield changes will have a significantly larger impact on bond prices, as seen in the table below:

So far, systemwide at least, we have not seen anything break yet, but given the rapid changes in yields, there are unrealized losses for those holders of longer-duration bonds that previously were “spared by” raising yields mainly in the short-term durations of the yield curve.

Now back again to the sudden geopolitical conflict and looking at this from a pure economic point of view. First, the Israeli-Palestinian conflict is nothing new, and six wars have already occurred since 1948. Globally, the Middle East accounts for approximately 31% of global oil production and 48% of global oil reserves. As Mark Twain wrote, “History does not repeat, but it rhymes,” and the aftermath of the 1973 Yom Kippur War was the key reason leading up to the Saudi Arabia oil embargo back in 1973. Due to the enforcement of the oil embargo, oil prices suddenly increased by more than 300%, driving up the to high double-digit inflation rate in 1974.

Currently, in the event of a devastating Hamas attack, it is likely that Israel will enter Gaza in a counterattack. The key uncertainty now is that if Israel enters Gaza and the degree of its actions causes unjustifiable civil causalities, then the counterattack could cause a broader regional conflict in which the neighboring countries will join in military action to defend the counterattack. If this conflict is not well “contained” and a broader regional crisis occurs, then we should not rule out another type of “oil embargo” or a blockade of the Straits of Hormuz (each day, approx. 20%–30% of global oil consumption ships through that channel). If this does occur, then we will need to prepare and brace ourselves for significantly higher oil prices than those of today and a renewed uptick in global inflation levels for a longer period of time.

Domestically, in China the National Day Holiday recorded 826mn tourists and 753.43 BCNY tourism income, or +71.3% YoY and +129.5% YoY, respectively, or +4.1% and +1.5% vs. 2019 same period in 2019, implying a 97.5% of average tourism spending recovery vs. 2019. Outbound tourism was also strong, with 3.9x of 2022 level or 85.1% of the 2019 level which surpassed ~50% recovery of outbound flight capacity, possibly due to more HK/Macau visitors. However, the movie box office came in much lower than expected at 54% of 2019 level, due mainly to lack of blockbuster movies launched during this holiday.

This week, China Q3 GDP will be released along with a series of September macroeconomic data points. Based on our internal tracking, we think GDP could come in slightly above 4% in Q3 with some possible upside potential as manufacturing has been recovering slightly better recently. But when Q3 GDP comes in, and if it comes in line with the +4% estimate which includes the current drag from real estate and exports, then hopefully it will clear out some previous doubts about the current state of the Chinese domestic economy and its baseline GDP growth rate. Thereafter, due to base effects from last year, seasonality and the timing lag of the recently announced policies effective in September, China's macroeconomic data should further improve in Q4. This should give further support and confidence to the foundation and the trajectory of the Chinese economy.

However, the key variable to lift the domestic economy to the trend rate of +5% will be dependent on the annualized property market sales sqm volumes. Looking at the current national data, YTD August new real estate construction sales sqm in 2023 is down -7.1%, and new construction work in progress (施工面积) is -7.1%. Based on our analysis, we might need new real estate construction sales in sqm to revert slightly above last year’s level (approximately +10% from now) as a benchmark for the decline in new construction work in progress to gradually bottom out. Therefore, if we do observe a continuation of improved new real estate construction sales sqm in Q4, then this alone factor should give strong confidence and consensus to the outlook for 2024 and its normalization back to pre-Covid-19 trend growth rates of +5% real GDP growth rate despite continued drag from exports.

Despite the continuation of the Chinese economic recovery post-COVID-19 and possible improvements in domestic economic numbers in Q4. The overriding, sudden Israeli-Palestinian conflict is likely to have a greater influence on global market volatility in the months ahead. Already in Sep US CPI energy commodity turned positive again after months of favorable “high base” effects from energy prices in 2022, but the effects are less noticeable now compared to that of December CPI print to be published in January 2024, since average oil price WTI dropped to 76.5 USD in December 2022. Therefore, if the Israeli-Palestinian conflict spreads into a broader regional conflict, then the oil price might go much higher from current levels and global inflation expectations might tick up significantly as a result.

Fundamentally, if this scenario occurs, then Europe would likely be the most affected economy due to its high amount of energy imports (+90% oil import), USA is a net exporter of oil, but inflation rates would sharply increase, leading to a renewed tightening cycle. China, on the other hand, currently imports approximately +66% of its oil consumption while inflation is at 0% in September (Core CPI +0.8%) Therefore, China will also be negatively affected by higher oil import prices, but due to a different inflation cycle and more cross-border payments settled in CNY, the overall fundamental effects might be less.

But at this moment, in order to achieve a pre-covid GDP trend growth rate of +5% or above , policymakers might need to stabiles new residential construction at least so that this sector is not a drag on the economy. Thereby, as per the guidance of the politburo meeting in July to optimize real market policies, two significant measures were finally introduced recently. 1. To allow existing mortgage holders to refinance existing mortgage rates from avg 5.1% rate down to current mortgage financing rate around 4.3% 2. Remove the history of previous mortgages (认房不认贷) to be classified as first-time buyers (to allow second time buyers the same down payment and mortgages as first-time buyers (for example Shanghai 35% downpayment for first time buyers, while the second time buyers down payment requirement is 50%). These two policies falls well in line with our consideration of counter-cyclical measures to lift the economy back to pre-covid growth rates.

Internally, we have actively concentrated our portfolio during this year and concentrated our portfolio to twelve niche consumption portfolio holdings primarily focused on the consumption services, retail, and residential second-hand / renovation aftermarket. In the short term, due to a more concentrated investment portfolio, the market pricing of our underlying portfolio holdings and NAV could be more volatile than that of broader market indexes consisting of more than hundreds of companies in more different industries. But in the longer term, the more concentrated investment portfolio has the premises to significantly outperform the broader market if the business development of the core portfolio holdings develops according to expectations. This is more suitable for investment companies with a longer-term ownership horizon and more in line with other Swedish investment companies holding approximately 12–15 portfolio companies. Our team needs to therefore focus and ensure continued alignment of business development and result delivery inline with our analysis, forecast and previous discussions with management. In the short term however, market pricing could deviate more and be driven more by external market liquidity factors.

Therefore, in the short term, if the Israeli-Palestinian conflict spreads and the oil price climbs further globally, then we should be prepared and brace for higher short-term market volatility. However, due to the continued shift towards the domestic led economy in China and the baseline GDP of approx. +4%, when market volatility increases, it could counterintuitively also create favorable entry conditions in the right geographic areas or sectors. However, market participants might still need to wait for more evidence that the Chinese economy is trending more firmly towards the +5% GDP growth trend during Q4 for a renewed phase of inflows to our market similar to that of last year.

Looking forward to discussing this more in detail and work together in this complex market environment.

Thanks again for this,

Best Regards Yining, Jason and the NA Team 13th of Oct 2023

Hygeia H1 2023 Update

Hygeia released its 2023 H1 interim report slightly below expectations. H1 revenue came in at 1.76 billion CNY with 15.3% YoY growth, mainly dragged down by a high base of outpatient services resulting from large Covid nucleic acid test revenue addition last year. Hospital business revenue was 1.7 billion CNY with 16.3% YoY growth, of which inpatient services revenue was 1.1 billion CNY, representing an increase of 22.1% YoY growth, while outpatient services revenue was 543 million CNY, representing 5.8% YoY growth. Excluding one-off impact of Covid nucleic acid test, outpatient services achieved 23% YoY growth, and group revenue run rate +21.1 % YoY growth. Hygeia's core business, oncology-related businesses, revenue came in at 798 MCNY, increasing by 18.7% YoY growth and stood for 45.3% of total revenue. Gross profit was 571 MCNY, with 14.7% YoY growth and 23.9% YoY growth (excl covid test one-off effect). Gross profit margin remained stable at 31.2%. Adjusted Net profit (FX loss impact excluded) was 347 MCNY with 15.3% YoY growth, in line with the group revenue growth. For the full year, we expected Hygeia top line growth to accelerate and come in at around +20% growth for FY 2023 as more hospital beds are put into operation along with the consolidation of newly acquired entities in the second half of the year.

Hygeia Healthcare is currently the largest private oncology healthcare group (yet with only 2% market share of the private oncology healthcare market) focused on providing a private oncology treatment alternative focused on radiotherapy treatment in the lower tier cities in China. Currently, Hygeia is expanding their hospital landscape through a combination of organic growth, strategic acquisitions, and cooperation with hospital partners. Hygeia operated or managed a network of 14 hospitals, including 4 self-built and 8 acquired hospitals. Hyegia aims to acquire 1-2 hospitals per year and self-build 1-2 hospitals annually to reach a revenue growth at +30% per year and grow its current nr of hospital beds from 4.400 to +12.000 in the years ahead at 20% operational margin.

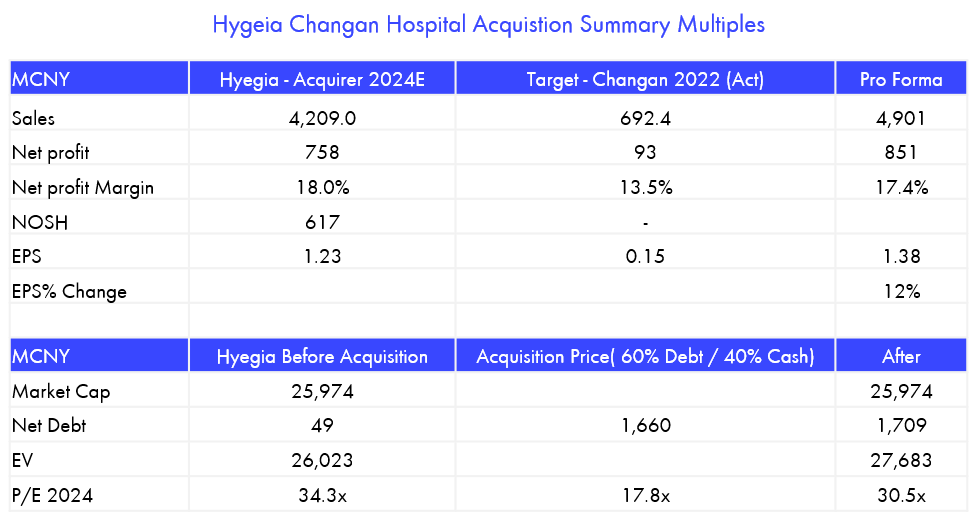

Hygeia accelerated its acquisition in 2023. In 2023 H1, it acquired an 89.2 % equity interest of Yixing Hospital for 268 million CNY and consolidated in Q2 2023. In 2023 H2, it acquired 100% equity interest in Chang’an Hospital (692 MCNY revenue, or approx. 16% revenue) at an acquisition price of 1.7 billion CNY. Those two acquisitions expanded Hygeia’s nationwide network and will fuel its hospital business and oncology-related business development. In terms of Yixing Hygeia Hospital, in July, its monthly revenue hit a record high of 20 million CNY. It is expected that it will achieve consolidated revenue of 140 million CNY at a 15% profit margin in 2023. By consolidating its group supply chain and operational improvements, managements have previously been able to lift the operating margins of newly acquired hospitals to reach group level within 12-18 month post acquisition. Furthermore Hygeia announced the acquisition of Chang’an hospital in July for purchase price of 1.660 MCNY. Chang’an hospital is a class III Grade A Hospital (Highest Level in China Healthcare System) whose oncology department is its the largest revenue contribution segment. Currently, Chang’an Hospital operates around 1.100 hospital beds, and with over 20 years’ local operation experience. Strategically, this acquisition enables Hygeia to expand their network into China Northwest region and strengthen their oncology-related business. In 2022, Chang’an sales was 692 million CNY, with a total of 630k patient visits for inpatient or outpatient services annually. It is estimated that the consolidation of Chang’an Hospitals will start in Q4 2023. Management expects cost synergies via group consolidation to lift Chang’an Hospital's net margin to group level within 12-18 month and expects Chang’an Hospital to continue to deliver top-line double digit organic sales growth. See summary below of Hyegia’s acquisition of Chang’an Hospital.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.