Nordic Asia Investment Group - Newsletter August 2024

**Dilemma of Japan Carry Trade & Gradual steps toward China Re-inflation **

The spillover effects of an extraordinary period of monetary loosening were on display during the summer, as the Japan carry trade is starting to change course due to the risk of higher import CPI. Showing an example of the challenging path ahead towards monetary policy normalization

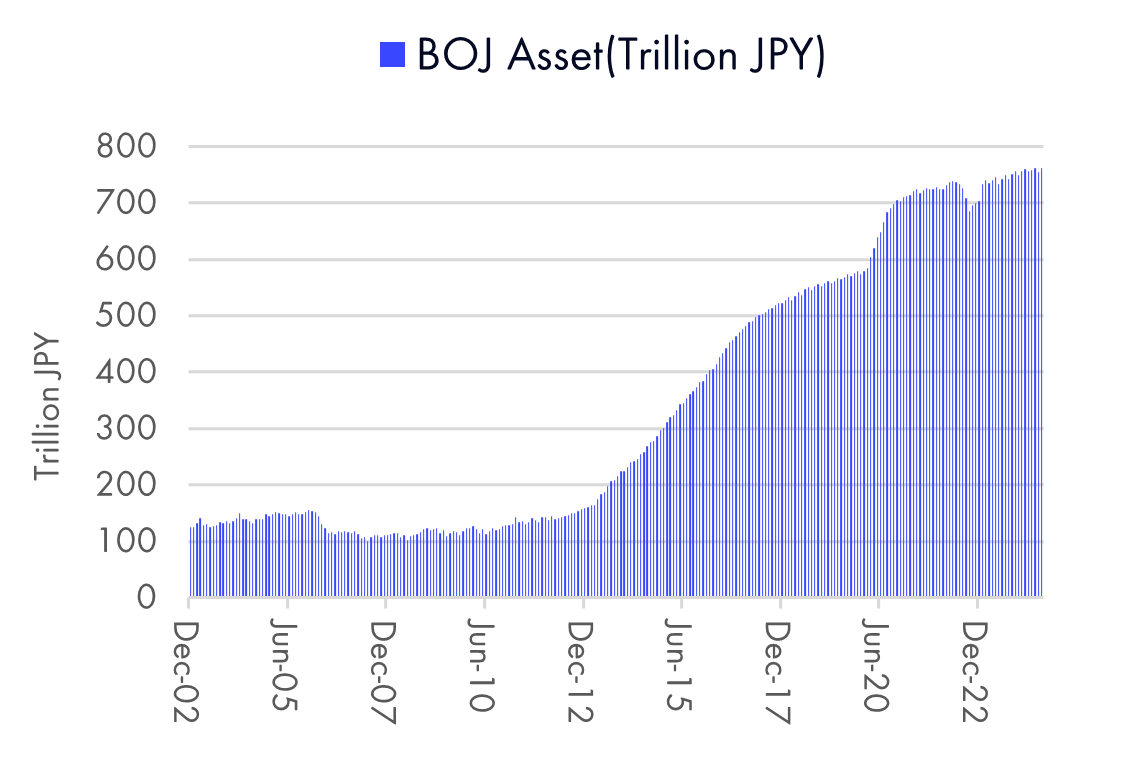

Globally, the increased volatility during this summer is a sign of the difficult path back to a normalized monetary policy. During this cycle, the extensive monetary policy easing effects have finally “helped” Japan out of its deflationary cycle, but the extent of QE in Japan vis a vis other developed countries is quite astonishing during these past years.

Despite the inflationary cycle that began globally in 2021, the BOJ continued with its stimulative monetary policy and QE expansion, meanwhile keeping rates at -0.1% from 2016 to Feb 2024. This “inversion” of monetary policy vis a vis the tightening cycle in the US caused a significant devaluation of the yen. For many domestic investors and lenders in Japan with deposits or lending in yen, they could significantly benefit from this “yen carry trade,” as they can borrow in yen at ultra-low interest from depositors to invest overseas and benefit from both higher interest and a devaluation of the loan denominated in yen. However, Japan as an economy is highly dependent on imports, and as the yen continues to depreciate, this causes a negative cycle of imported inflation.

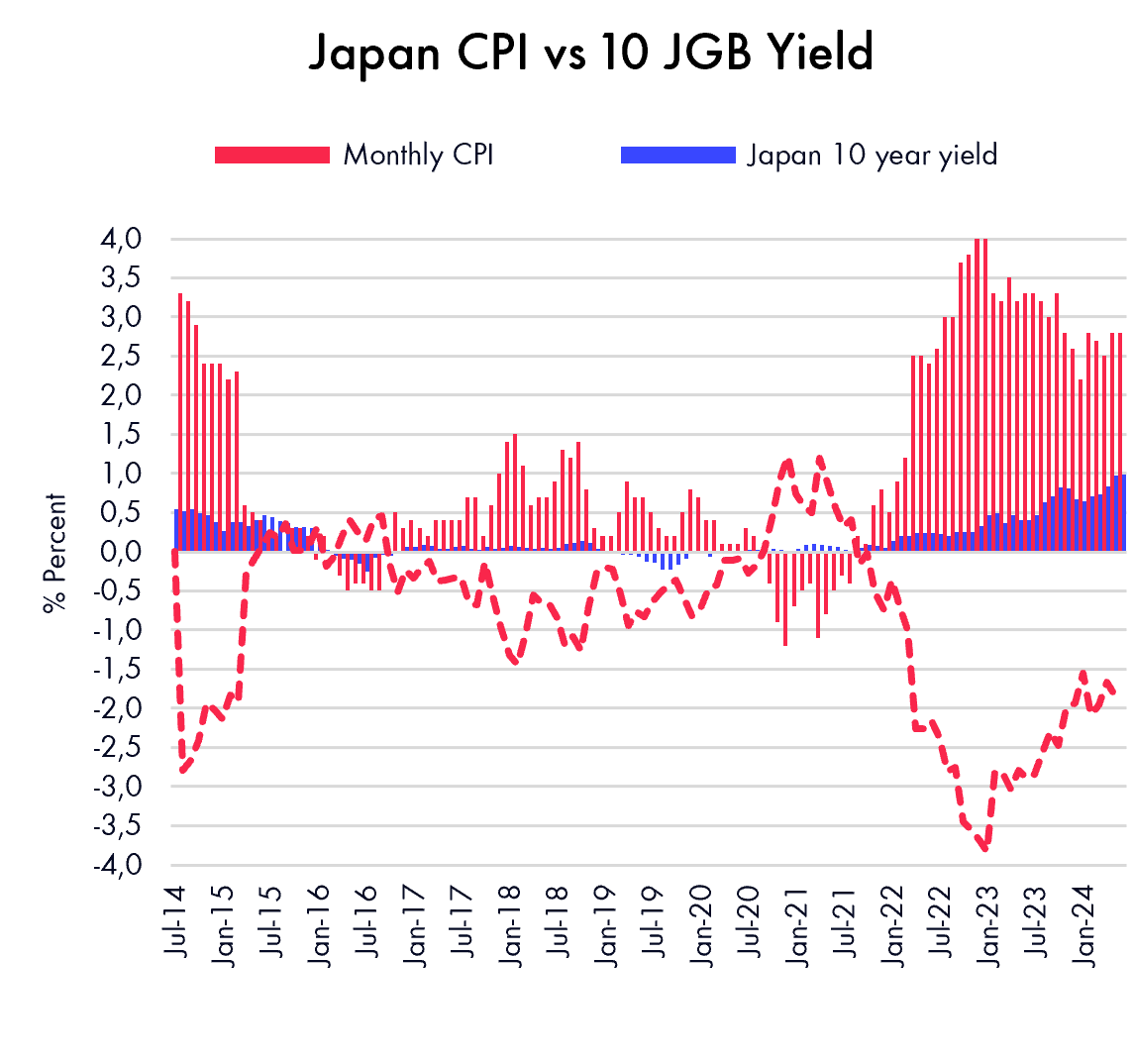

Currently, Japan CPI is 2.8% (Jun) but its 10-year benchmark yield is around 0.89% thereby implying a negative real interest rate in the short term. Meaning that the bond market expects long-term Japan inflation to come down from current levels. To achieve this, a strong yen is required to dampen the effect on imported CPI. Due to this, the BOJ went forward with an above-market expectation rate rise to 0.25% in July. This, in combination with slightly weaker job data from the US together triggered a rather rapid strengthening of the JPY vs USD causing a market liquidation of the “carry trade". However, this hurts its domestic institutions and lenders, since they all lend in JPY and own a significant amount of overseas assets. Thereby, if JPY strengthens vs the USD, and the interest gap narrows, these institutions will need to revalue their oversea assets due to JPY appreciation and pay an increased interest rate to their depositors in JPY.

This situation causes a dilemma, putting the BOJ on a difficult path to normalized monetary policy. On one hand, if imported inflation is not contained by the continued devaluation of the yen, then domestic Japanese bond yields are likely to continue to increase and the value of JBG will decline. On the other hand, if the JPY strengthens too fast vs USD, the reversal of the JPY carry trade will hurt the balance sheets and capital ratios of its domestic banking and financial institutions.

The dilemma above is likely to continue for a period going forward, and is an example of the consequences caused by extensive monetary policy easing and its difficult path back to a normalized policy.

Furthermore, the path to normalization for the JPY and its possible hiccups along the way are also dependent on the monetary policy and inflation in the US. Recently, we have observed a slight decline in the overall US CPI numbers, mainly driven by a decline in goods inflation while service inflation and rent remain elevated.

However, despite the uncertainties and heightening tensions in the Middle East, oil prices remain subdued for now. Therefore, the market currently expects the FED to cut rates starting in September. But, if the FED cuts rates too fast or slightly more than expected, then there is a risk of inflation reverting higher again in the coming period, especially when the lower base effects kick in further.

Therefore, the path to “normalization” remains challenging.

Macro China

Domestically in China, despite a stronger than expected Q1 and a strong start to 2024, the final Q2 numbers came in below expectations at 4.7%, mainly due to 1) the continued slowdown of the real estate new construction market and 2) slightly weaker than expected domestic consumption in Q2, while exports were in general stronger than expected.

However, since the real estate policies announced on May 17th, we’ve seen a continued pickup of the overall transaction volumes in the second-hand market along with a gradual stabilization of the first-hand market. Despite this, nominal GDP remained lower than expected in Q2 as Chinese domestic inflation is still below target at 0.5% in July. Therefore, as mentioned in our IR meetings, China is currently in an inverse economic cycle with low inflation and needs inflation to pick up for a more sustained economic recovery to Pre-Covid-19 growth levels.

During this summer, the Chinese politburo used the third plenum to describe the longer-term economic objectives and key development areas ahead.

Firstly, the Third Plenum reemphasized the goal to reach a mid-income economy by 2035 (which implies a more than doubling of the current GDP per capita in USD terms), and the main way to achieve this is through reform and upgrading of its long-term productive measures and by creating a further unified, expanded domestic market. Improve domestic market competitiveness, facilitate resource allocation, guide and support private enterprises, and strengthen overall market economy structures.

This implies a shift towards improving the longer-term GDP growth potential through structural improvements and productivity upgrades. i.e., continuing the previous emphasis of “high quality development”.

Although, this is a favorable direction for the longer-term development of the economic structures in China, in the short term, the economic recovery Post Covid-19 has thus far been uneven on a quarter-to-quarter basis, and nominal GDP is still below trend. This is partly due to the weakness in the real estate market and the more complex external environment Post Covid-19 but also partly due to more conservative economic policies and the absence of a more proactive economic stimulus Post Covid-19.

Therefore, during the economic Politburo meeting after the Third Plenum it was welcomed to see a stronger emphasis on expanding domestic consumption and the launch of a 300 billion CNY equipment upgrade and trade-in program for the white goods and automotive sectors to lift domestic consumption in the second half of the year. The Politburo clarified that private consumer consumption is the key to expanding domestically to offset drag from exports or real-estate new construction. However, for a more sustained path back to Pre-Covid-19 nominal growth path, domestic inflation in China needs to pick up further to its 2-3% target level.

Thereby, it is possible that a combination of further fiscal and monetary measures might still need to be introduced to lift inflation back to its 2-3% target.

At company levels, the low inflation environment has caused price pressure in certain industries with increased competition and market supply.

For the full year 2024, we still expect China GDP to reach its 5% real growth rate, given the composition of its growth factors and the continued stabilization of the real estate market. But nominal GDP will become even more important than real GDP, since nominal GDP not only accounts for the growth in volume but also the growth in price along with the growth in disposable income. However, despite this lower inflation environment, most companies continued to grow double-digit during the first half of 2024 with healthy margins and a strong cash flow, while multiple are at historically low level. At the same time, we continue to see trend of increasing total shareholder return (buyback and cash dividend) as cash levels at these companies reach historical highs. Therefore, we should see a quite meaningful reversal of the market valuations when inflation in China picks up and reverts to its target of 2-3% from current levels.

Despite the shorter term uneven QoQ economic development, we know that the government has significant room and tools to lift inflation back to Pre-Covid-19 levels. Furthermore, as we enter H2 sales of the base effects for the new construction market will decline further at the same time as the repurchase program announced in May is picking up gradually. Therefore, it is possible that new construction sales might turn positive on a YoY basis during a specific month in H2 2024.

Thanks in advance for this and look forward to a continue close dialog ahead

Best Regards Nordic Asia Team

Company Research Snapshots

361 Degrees 1H24 update

361 Degrees released an in-line 1H24 result with revenue at 5.1BCNY, +19.2% YoY, and net profit at 792MCNY, +12.5% YoY. Net profit margin was 15.4% in 1H24, -0.9ppts YoY, dragged mainly by fewer government grants. Adults segment revenue was 3.9BCNY +18.1% YoY, Offline sales grew by 20.3% YoY, and store efficiency improved by 16.6% YoY in light of only 6 stores net add from end-2023.

Online sales growth was 16.1% YoY driven by sale of online exclusive products, vs. a higher online retail sell, driven by both inventory cleansing via the online channel and the organic online sales.

Kids segment revenue was 1.1BCNY in 1H24, +24.2% YoY in-line with the growth trajectory in the past 2-3 years. Gross margin was 41.4% in 1H24, -0.3ppts YoY due mainly to higher sales mix of new products, which have a higher COGS%. Opex% was 23.9%, declining slightly YoY.

361 Degrees is expected to maintain its momentum in 2H24 given its strong value for money market and product positioning. However, the company guided for a slower store expansion plan amid market weakness, indicating retail desktop pressure and intensified competition. Nevertheless, its double-digit performance during H1 was significantly higher than the market's single-digit growth average. Since 361 only holds approx. 3-4% of total sports apparel market and is mainly focused on Tier 3 and below cities, it has significant room to expand its market share over time.

We expect 361 Degrees could still achieve mid-teens growth in 2H24, and we like the company’s continued outperformance vs. larger major domestic peers with strong cash flow and a cautious valuation.

Ke Holdings 2Q24 update

Ke Holdings (Beike) released a strong 2Q24 result with revenue at 23.4BCNY, +19.9% YoY while adj. net profit at 2.7BCNY, +13.1% YoY. Adj. EBITDA margin was 14.4% in 2Q24, +1.5ppts YoY, thanks mainly to operating leverage improvement. Revenue from existing home segment was 7.3BCNY, +14.3% YoY with GTV (gross transaction value) at 571BCNY, +25% YoY, in-line with the market. Take rate declined YoY due mainly to the decline of the Beijing take rate. Revenue from the new home segment was 7.9BCNY, -8.8% YoY with GTV at 236BCNY, -20.2% YoY, slightly stronger than market’s -21.5% YoY growth. Take rate in new home business increased both YoY and QoQ as Beike took market share. 60%+ of new home projects in the cities (ex. Beijing and Shanghai) with Beike operations chose to corporate with Beike vs. 48% in 2Q23. Home renovation maintained strong growth momentum, with revenue at 4.0BCNY, +53.9% YoY.

Beike achieved a good performance during this quarter with a strengthened market position and solid management. During this period, despite the continued the decline in new home sales, existing home sales (second-hand residential apartment sales) have continued to outperform and picked further since the policies were introduced on May 17th . Thereby, since more than 66% of Beike total sales come from existing home sales and home renovation, Beike has continued to solidify a strong market position as the main platform in the longer-term structural shift to second-hand transaction and renovation market needs.

Finally, Beike has a strong cash position of 59 BNCY (approx. 48% of market cap) and recently announced an increase of its share repurchase program from 2 BUSD to 3 BUSD until 31st of August 2025.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.