Nordic Asia Investment Group - Newsletter May 2024

The FED Pivot: Higher for Longer

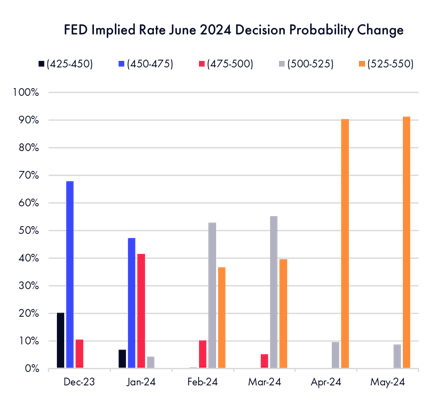

The FED's stance on rate cuts has undergone a significant shift. Data indicates inflation to be higher than anticipated, increasing the chances of the “Higher for Longer” scenario. Amid diminishing oil price base effects, uncertainty looms over the trajectory of inflation slowdown and pace of rate cuts ahead.

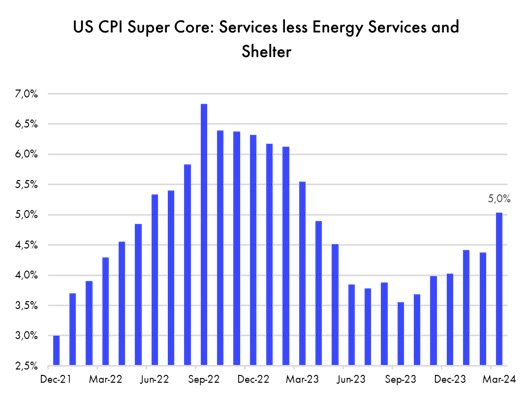

As we continue to point out, the stubbornly high core inflation in the US is driven by 1. Slower than anticipated reduction in Shelter inflation 2. Rising service inflation due to a tight labor market. Thereby, as the favorable oil price base effects fade out further after April, it is highly likely that headline CPI will gradually converge higher than Core CPI. Therefore, it is not unexpected that the current rate cuts by the FED will be pushed forward, and rates will most likely be “higher for longer”. The change in tone by the FED from last December is fascinating. The FED guided the markets of the start of rate cuts in 2024 to now back down and turn more restrictive. Therefore, it is more important for market participants and for the FED to analyze and follow the data since the inflation data will decide policy and not inversely.

Despite the current geopolitical tensions in the Middle East, oil prices have been quite stable or trending slightly lower, and the labor market in the US is starting to show signs of a slowdown. But with the current uptick in service inflation and declining oil price base effects going forward, the path or visibility towards a 2% inflation target is currently still unclear or low.

- US core inflation remains high due to slow shelter inflation reduction and rising service inflation.

- FED changed again a more restrictive stance and may delay rate cuts, indicating prolonged higher interest rates

- China's Q1 GDP exceeded 5%, fueled by domestic demand, investments and rebound in exports, likely to achieving the full-year growth target.

- Growing investor interest in Chinese markets stems from concerns over Western inflation, attracting global portfolio managers.

China Macro Overview

As mentioned to multiple investors during our recent road trip back in Sweden, if USA CPI and rates stay higher for longer, it will also put additional pressure on the USD / SEK exchange rate. Therefore, despite a quicker slowdown of Core CPI in parts of Europe or in Sweden, the central banks in Europe might need to consider the potential consequences of FX vis a vis the US dollar and future import inflation effects. Despite the positive news of QT “tapering” for the markets, in the long run, it might prove less favorable to combat the current elevated levels of inflation.

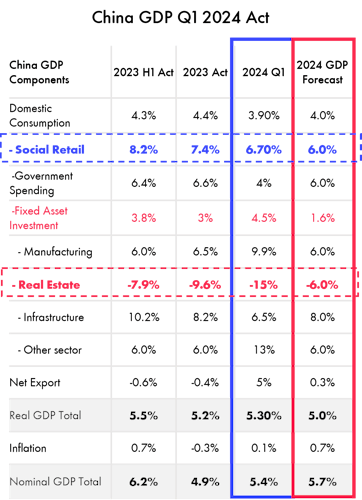

Turning the page towards the domestic economy in China, we observed the official Q1 Chinese GDP numbers that came in at 5.3%. This number came in higher than our and overall market exceptions mainly due to 1. Continue rebound in domestic consumption 2. Stronger fixed asset investments in all areas excluding real estate (i.e., Manufacturing, infrastructure, energy infrastructure, mining equipment, etc.) 3. Positive contribution from exports. During Q1, domestic consumption was quite in-line with our forecast and including retail of service grew by 6.7% and stood for more than 70% of GDP growth contribution.

However, the real estate sector’s new constructions continued to contract in Q1 2024. This was well anticipated due to both weak sales in Q1 2024 as well as a high base in Q1 2024. However, secondhand market transactions remained at high levels, and the gap between rental yields of the secondhand market, even in tier 1 cities, started to converge to that of the 10-year yield as a sign of further price stabilization in the secondhand or rental market. Additionally, we’ve continued to see further announced policy loosening of purchase restrictions in Chengdu, Hangzhou, Tianjin, and in non-core areas of Tier 1 cities such as Shenzhen, Shanghai as well.

Looking ahead, since we know the GDP base of Q1 2023 was the highest during 2023 (due to a strong rebound and pent-up demand from Q4 2022 COVID-19 re-opening) if China managed to achieve an above 5% GDP growth in Q1 2024, then it is highly likely that China will be able to reach the full-year 5% growth target in 2024.

Additionally, despite a weak real estate market, consumption and service consumption continue to improve. Some market participants in China have started to mention that domestic consumption is gradually “de-coupling” from the continued weakness in the real estate new construction sector. Thus, as the economic data continues to confirm a gradually improving trend and data proves the economic outlook is better than anticipated, therefore we’ve started to see a rather quick reversal of market sentiment in the recent months of trading.

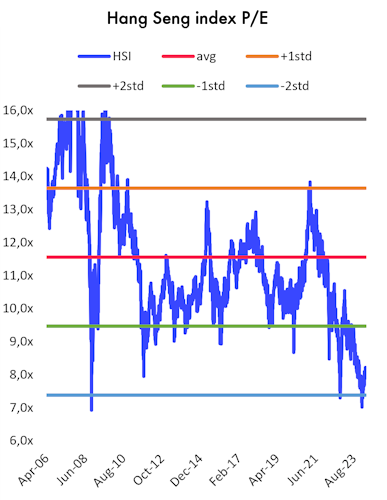

The Hang Seng index is now back to a market multiple of PE 8.2x and up +11% YTD and up +26% since its lows in Jan 2024.

At company-specific levels, we continue to see a lot of value since the multiple reversal is still in its early phase. The market multiples are still way below their historical averages of 11x-12x for Hang Seng, and the company cash levels are high and accumulating at a rapid pace due to operating leverage effects post-COVID-19.

Internally, in Nordic Asia, we are also starting to see a greater amount of interest and inquiries about the Chinese economy and market. This is currently mainly driven by professional investors managing a global portfolio, who are concerned about elevated inflation rates in the West and who have followed the economic development and cycle in China during these past years. For many, the valuation gaps and counter-cyclical nature of the Chinese economy are very attractive for either global diversification of their equities portfolio.

I.e. “Sell high” and “Buy low” strategy within their emerging markets portfolio where China has underperformed in recent years while India and other emerging markets have outperformed this sector. For us, the most important focus is to continue to deepen and further improve our internal research and company coverage abilities and “stay in our lane” to focus on our niche of Chinese consumption and follow the economic and company-specific data that ultimately will drive market allocation decisions and serve as a professional counterpart for our Nordic investors as a local expert with deep market expertise and market access to uncover and provide favorable complementary portfolio allocations to our Nordic global portfolios in the otherwise continued complicated market environment.

- The Hang Seng index is now back to a market multiple of PE 8.2x and up +11% YTD and up +26% since its lows in Jan 2024.

- Despite a recent rebound, the Hang Seng index remains below its historical valuation multiples of 11x to 12x.

- Investor interest in Chinese markets grows, particularly among global portfolio managers, driven by concerns over Western inflation, valuation gaps, and China's counter-cyclical economy.

Company Research Snapshots

Atour Lifestyle

Atour Lifestyle operates 1,210 hotels in China that focus on upper midscale class and Tier1-2 cities. Atour practices a franchise expansion model with 1,178 hotels opened by franchisees and 31% of 2019-2023 revenue CAGR despite COVID. The company charges high ADR by providing standardized products that are similar to midscale hotels but with services close to 4-star hotels. On top of hotel operations, Atour also provides lifestyle products via retail channels.

In 4Q23, Atour achieved 1.5 BCNY revenue, +140.4% YoY, supported by bonuses for hotel managers, continued hotel expansion, and strong retail sales. 4Q23 adj. net profit was 223MCNY with 14.8% NPM vs. 12.9% in 4Q22. Hotel number net add was 98 in 4Q23, in-line with our expectation. Nonetheless, 4Q23 RevPar was 358.2CNY at 108.8% recovery to pre-COVID time, slight weaker than 115-118% recovery in the first 1-3Q2023. In addition, their retail segment sales in 4Q23 come in at 412MCNY and grew by +315.6% YoY. As a result, Atour recorded adj. OPM of 14.4% in 4Q23, +0.9ppts YoY from 4Q22’s COVID base or -12.7ppts QoQ.

Atour will maintain its franchise expansion strategy with target of 30% hotel number growth in support of revenue. However, RevPar is more likely to stay flattish, given the still low levels of domestic business travel and increased new hotel openings. (Nr of hotels by end-2023 have reached 120%+ of 2019 (start of the last down-cycle). The target for Atour is to reach a net 2.000 hotels from current 1.210 hotels by end of 2025, mainly from adding new franchise to the Atour brand of existing non-branded hotels in Chinas mid-high tier market.

361 Degrees

361 Degrees is a China sportswear brand that focuses more on the lower-tier mass markets with positioning at valued professional products. The company consistently maintains the retail price at about 20-25% below major peers Anta and Li Ning with slightly declined product quality. 361 Degrees adopts a wholesale model in the offline channel while a self-operated model online with different products. 361 Degrees now has 5,734 stores for adults and 2,545 stores for kids by the end of 2023. Adults contributed 75% of revenue.

In 2023, 361 Degrees achieved 8.4 BCNY revenue, +21.0% YoY, supported by store efficiency improvement, strong online sales, and the kid's segment. Net profit was 961MCNY, +17.9% YoY. GPM was 41.6%, +0.6ppts YoY, thanks to an increased professional footwear offering and cost cuts from production outsourcing. The marketing expenses ratio further hiked by 1.5ppts YoY in support of retail sales. As a result, NPM declined by 0.3ppts YoY.

361 Degrees will benefit from the current consumption downgrade trend in China. The plan of 100-200 store expansion would also support 2024 revenue growth. On the margin level, we expect minimal margin improvement due to continued competition from Li Ning, who leads the channel inventory clearance. This year the company have indicated to increase their brand investments ahead of the French Olympics.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.