Nordic Asia Investment Group - Newsletter October 2024

Signs of Economic Recovery in Oct with More Stimulus Measures Underway

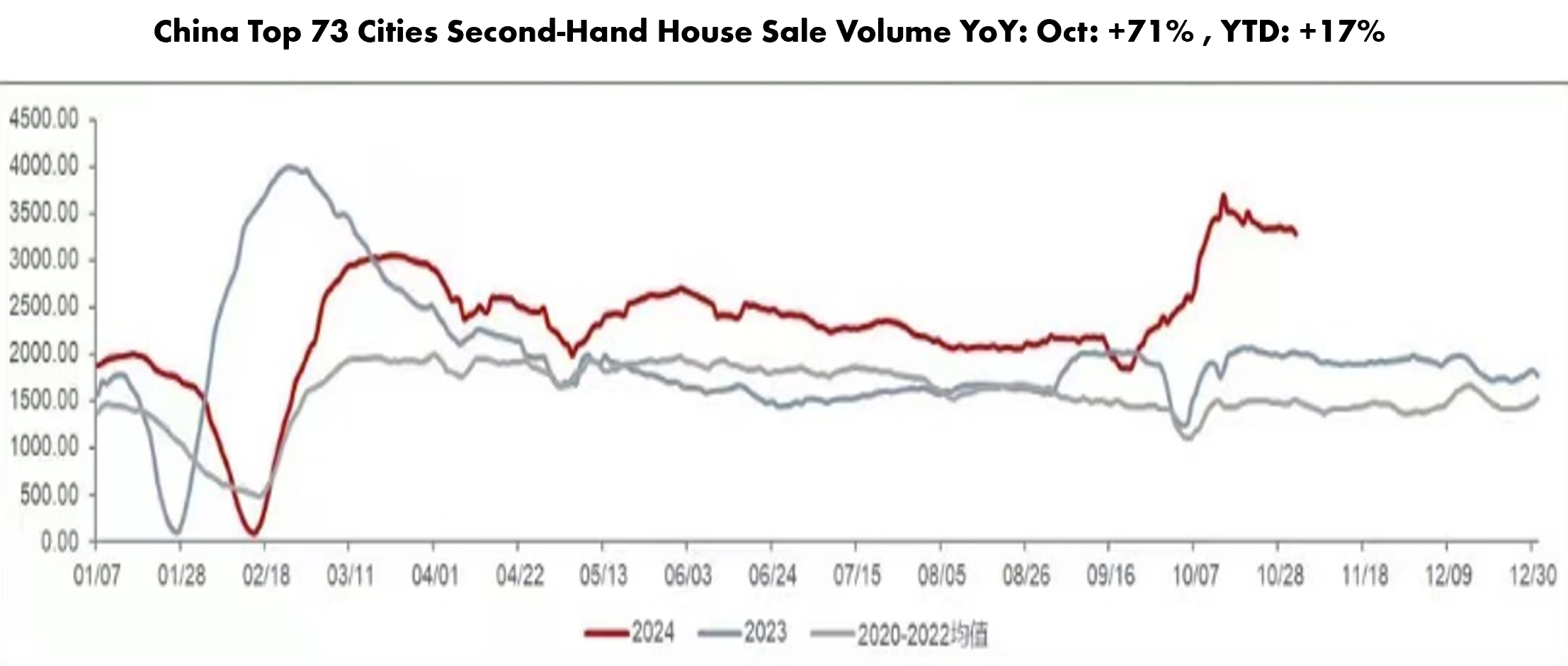

Early signs of economic recovery from stimulus packages in Sep visible in the domestic Real Estate sector (+71% Second-hand estate sales volumes and +7% new residential sales for the first time since Q1 2023). Singles' Day shopping campaign hits a new record of 1.4 Trillion CNY and an additional 10 trillion CNY in debt swap for local government announced with further fiscal measures underway

Global Macro

As the US-election has been a focal point of global markets recently, the background for the upcoming second term of the Trump presidency is different to that of 2016 and to that of the previous Biden-administration from 2020. First, for the incoming Trump presidency the US total debt has grown to above +35 trillion USD with a debt to GDP ratio of +120% and interest payments on government debt over 1 trillion USD and stands for approx. 17% of total fiscal expenditure YTD.

Given the continued stickiness of the US core inflation rate, especially continued high service inflation and declining base effects from goods inflation, the US inflation rate might still require further monetary tightening before the deflationary trend can show a continued sustained path down to 2% inflation rate.

Therefore, for the incoming Trump presidency, the room to further expand the fiscal deficit might be more limited due to the current state of the fiscal imbalances and continued inflationary pressure. Furthermore, the proposed tax cuts, increased tariffs on US imports, and continued “reshoring” are likely to add to the inflationary pressure above. Thereby, despite the equity rally, yields on US government bonds have continued to climb in the past month and the bond yields on 10-year US treasuries at approx. 4.3 - 4.4% are now higher than the expected earnings yield (1/ PE) for the S&P 500.

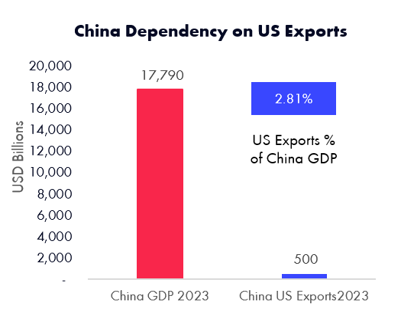

Since the election, many have asked about the potential negative effects on China due to the potential tariffs of up to +60% from the US that could be announced after the inauguration in Jan 2025. Of course this will impact China exports to the US negatively, but since US as % of total exports have declined due to the first phase of the trade wars in 2018 and also exports have also been reduced as % of China GDP due to the going shift to a domestic market development, the current share of US export as percentage of China GDP is now at a historical low of approx. 2.8%.

However, the global macro- and geopolitical environment is likely to change quite significantly during the Trump administration. The Trump administration could be supportive of more stable global oil prices, but increased protectionism and trade frictions will affect global trade not only for China but also for the EU and the rest of the world.

China Macro

Domestically in China, a greater sense of optimism and improved sentiment can already be observed during the month of Oct since the announcement of the combined stimulus packages in late September.

Firstly, since the lowering of down payments and reduced mortgages rates in September, residential apartment sales both for the first and secondhand markets improved strongly in the month of Oct with second hand transaction volumes surging by +71% for the full month in Oct and first-hand apartments by top 100 developer also turned positive +7% for the first time since reopening in Q1 2023.

As a result of the increased activity and transaction volumes, the price trends for secondhand apartments is improving especially prices in tier 1 cities are improving at faster rate and household CNY loans climbed in Oct vs last year as the real-estate market improved and mortgages rates reached new lows of approx. 3.3% vs 5.5% in Jan 2022.

Furthermore, due to the trade in policy programs launched in Sep both sales of household appliances and automotive improved in the month of October and were up by: +11% and +50% respective in the month of Oct on a YoY basis.

Additionally, both the Caixin and official PMI numbers for Oct came in above estimates at 50.3 and 50.1 mainly driven by improved demand and business outlooks. But the weaker inflationary environment remained in the Oct and core CPI remained at only +0.2%.

Finally, the annual E-commerce shopping festival Singles' Day concluded on Monday, and GMV was up robustly (+26.6% YoY) as compared to single digits' growth last year. The final figure came in at 1.4 Trillion CNY during the prolonged promotion period from mid-Oct to 11/11 2024.

Thereby, despite the early days of the policy announcements in Sep, the real estate market is starting to show clear signs of stabilization and recovery, and the stimulus policies announced in Sep seem to have also improved consumer confidence in the month of October.

Furthermore, at the conclusion of the most recent NPC meeting in November, a 10 trillion CNY debt swap program was announced as part of the first fiscally related stimulus actions. The policy implied an increase in the “debt ceiling” for local government by 6 trillion CNY over three years and 4 trillion over five years of prolonged special local government bond issuance that was announced earlier in 2024 to refinance local government previous debt issuances from non-financial institutions, so-called “hidden” debt. This measure is essentially a measure to monetize the higher interest rate “hidden debt” through the issuance of government debt. Based on estimates, this measure would reduce the yearly amortization burden by 2.5 trillion CNY per year and save 600 billion CNY in reduced interest rate payments as a result of the debt swap for local government.

Additionally, towards the end of the press briefing, the finance minister reiterated the statement from mid-October reinforcing the central government’s current fiscal debt % vis-à-vis other developed countries and the government’s considerable room to increase borrowing and ability to increase the current fiscal debt deficit. Thereafter, he also mentioned that the ministry is currently finalizing further fiscal policies, such as: 1. Property market tax support 2. Issuance of specialized bond to strengthen tier 1 capital for state own banks 3. Issuance of specialized bonds to finance government purchase of affordable housing projects are all under the coordinated work between each government department and the and the ministry of finance to finalize the details of those proposals.

Finally, the finance minister stated that to support the growth target for 2025 further measures are under review, such as 1. To increase the fiscal deficit 2. Expand the scale and broaden the areas of investment for special-purpose bond issuances 3. Issuance of ultra-long-term bonds for special government projects 4. Step up supportive measures for equipment upgrade and enlargement of consumption trade in programs product inclusions and size.

- Increase transfer payment programs from central government to local government for transfer payments and local investment projects.

Thereby, the announcement on 8/11 was focused on the debt refinancing measures for local provinces the scale and amount of the measures of 10 Trillion CNY was above many of the earlier projections on this specific action point. But the other fiscal stimulus actions were mentioned and provide an update to their previous guidance but was not announced last Friday.

The other fiscal policy measures mentioned above are likely to be introduced step by step as the details of those policies are approved and the size of each policy is agreed upon between the various departments. The next central Politburo meeting is held during mid-December and will provide further guidance to the growth targets and fiscal policy measures for 2025 prior to the two sessions in March 2025 when the official growth and spending targets for 2025 will be set.

In conclusion, the policy turning point at the end of September is very clear, and going forward, it is likely for us to continue to see a combined effort of monetary and fiscal policies from now until March 2025 to be announced and keep going at it until the job is done, given the considerable room to increase borrowing, especially on the central government level.

Thereby, from a domestic economy point of view, the turning point in this cycle is clear, and already in Oct we’ve seen a significant recovery in the real-estate market and improved consumer confidence, while at the same time, we continue to see more procyclical policies being introduced step by step.

We look forward to reporting the progress of the above more in detail, both on the incoming economic data and on continued policy announcements ahead

Best Regards

Nordic Asia

Robam Appliance Q3 2024

Robam Appliance reported a 3Q24 result as expected, with revenue at 2.67BCNY (-11.1% YoY) while net profit at 443MCNY ( NPM 15.6% vs. 17.9% in 3Q23) due mainly to drag from the real estate developer channel. Retail channels declined by 7.8% YoY, while traditional retail remained flattish YoY. E-commerce was only down by 0.7% YoY in 3Q24, vs. -3% in 2Q24, improved sequentially. The new construction Developer channel declined by 32% YoY, but current only stands for approx. 18% of total sales volume while retail and E-commerce stands for +80% of sales channel.

3Q24 gross margin was 53.2%, improved by 1.0ppts YoY that reverting the margin decline trend in 1H24, thanks mainly to channel shift toward retail under real-estate sector downturn. S&M% was 28.2% of revenue, up by 2.2ppts YoY, as Robam continues its promotional initiatives despite the weak market. G&A% deteriorated to 8.5% in 3Q24 due to operating deleverage. As a result, core EBITM was 16.5% in 3Q24 down by 2.1ppts YoY.

Robam was mainly impacted on the sales to developers which is directly related to new home sales (-19.2% for 1-9M2024 by volume). Nonetheless, Robam has maintained its market position in the retail market with traditional offline retail channel grew by 8.5% YoY and e-commerce channel declined by only 1.6% YoY for 1-9M2024. We believe that Robam’s gradual transformation into a more retail driven company is on the right trajectory.

Finally, Robam is enjoying supportive tailwinds from the launch of appliance subsidization policy since end Octt.-2024, which included kitchen appliances for the first time. We are seeing high double-digit growth (50%+) from Oct-2024 that could support a turnaround of Robam’s fundamentals from 4Q24 and its transition to more renovation focused end markets.

Luckin Coffee Q3 2024

Luckin Coffee released a beating 3Q24 result, with revenue at 10.2BCNY, +41.4% YoY while adj. net profit at 1.4BCNY +33.2% YoY. Total store number was 21,343 (1,382 QoQ net expansion) by 3Q24, with the number of self-operated stores at 13,936 and the number of partnership stores at 7,407. Luckin maintained its expansion pace that was similar to 2Q24 amid the 3Q high season.

Group GPM was 61.1% in 3Q24 vs. 56% in 3Q23 thanks mainly to introduction of low COGS products (tea based). S&M% was hiked to 5.8% in 3Q24 (+0.5ppts YoY) which was offset by decline of G&A% by 0.4ppts YoY and store preopening expenses by 0.3ppts YoY. Adj. OPM was hence at 16.3% in 3Q24 that strengthened from 14.2% in 3Q23, reversed the margin decline trend in 1H24, as expected.

Self-operated revenue was 7.8BCNY (+46.3% YoY) in 3Q24 with SSSG at -13.1% vs. -20.9% in 2Q24 or -14% for Starbucks’s China operation. ASP was 13.4CNY in 3Q24 (+3.2% YoY) that improved from 13.2CNY in 2Q24 thanks to seasonality, indicating 433 cups daily average volume per store, -15% YoY, vs. 394 cups in 2Q24 (-17.9% YoY). Self-operation GPM hence increased by 3.6ppts YoY to 64.4% in 3Q24, thanks to not only ASP growth but also the launch of low cost products. Nonetheless, 3Q24 store level OPM was only +0.2ppts YoY (to 23.3%) as OpEx% hiked YoY.

Luckin continued its solid operation improvement in 3Q24 thanks to the company’s strong control in supply chain (better product offering), extensive store network (no.1 in China) and improved market environment. We see no further price war escalation despite major competitor Cotti maintained its 9.9CNY pricing and store expansion. Luckin is expected to further improve in the coming quarters as the same store sales is on a gradual improving trend given the stimulus measures and ASP price recovery.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.