Nordic Asia Investment Group - Newsletter September 2024

Rational Answering the call for China “Reflation”

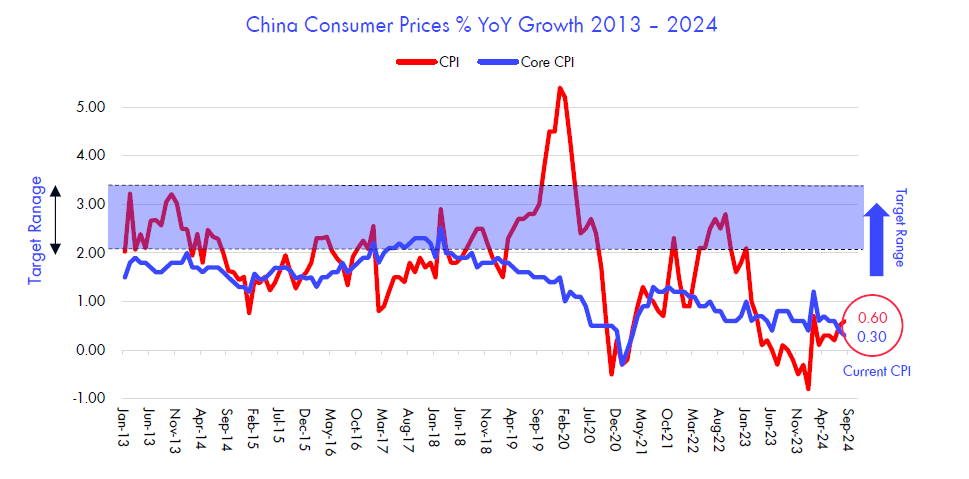

The recent combined measures from both the PBOC and the statement from the politburo indicates a resolute target to “Reflate the Chinese economy” and lift domestic inflation back to its 2-3% target to lift nominal wage growth, stabilize real-estate prices and boost domestic consumption.

To understand the recent market rebound and recent packages of stimulative measures, it is important to study the background / context in which these measures were introduced and the objectives of these measures and the rationale behind them by the leadership in China.

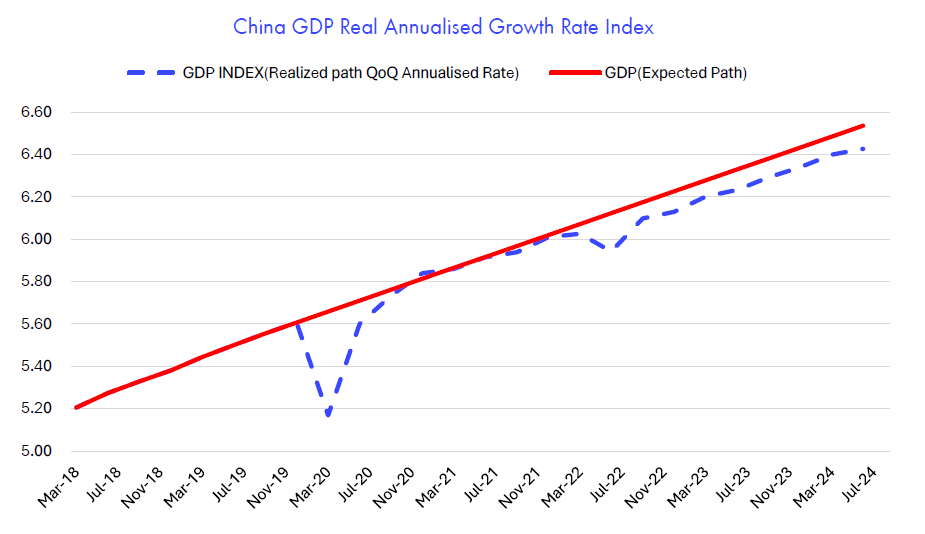

First of all, as mentioned previously, since the “re-opening” of China in 2023, the economic recovery back to Pre-Covid-19 trend has been uneven, both affected by base effects, a continued decline in the new construction real-estate market and conservative countercyclical fiscal & monetary policy. Therefore, despite a strong rebound in Q1 2024, Q2 GDP came in again below expectations and further widened the gap to “Pre-Covid 19” Growth trends.

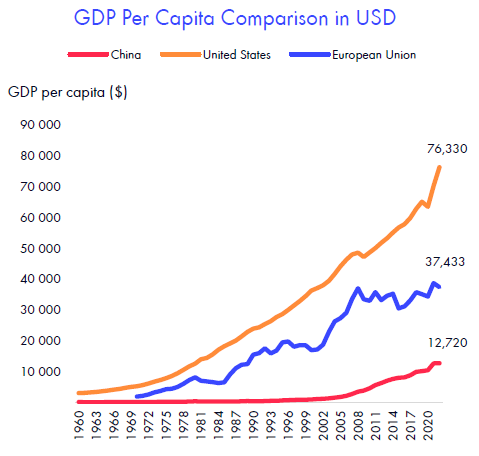

However, as reemphasized during the third plenum this summer, the long term primary objective of the economic policies is to achieve a mid-income economy by 2035 (which requires a more than doubling of the current GDP per capita in USD terms compared to current level). Therefore, the current trajectory of below trend economic growth is incompatible with the long-term growth target set by the leadership in China.

Due to the above, during this period, we’ve observed a below trend and target inflation rate in China since reopening and even signs of deflation pressures at times. As mentioned before, China is in a divergent economic cycle in which inflation is positive to drive an economic rebound.

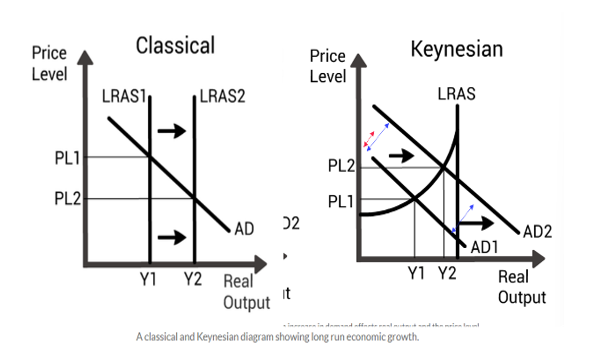

From an economic perspective it can be explained as of the charts below:

i.e. if price remains too low or deflationary for too long margin squeeze will require further cautious spending and a lower level of wage growth, or, in the more extreme cases, output capacity needs to be reduced for the “surviving” market participants to raise prices to a new market equilibrium but with reduced total output (I.e. GDP) below its potential.

Therefore, to counteract this “deflationary” trend, an increase in aggregate demand and increase in M2 needs to be introduced to both lift demand and prices to the output capacity of the economy.

Currently, the Chinese economy is predominately driven by domestic consumption, as domestic consumption stands for more than 2/3 of total GDP growth but only approx. 39% of total GDP.

Domestic consumption is in turn highly correlated with nominal wage growth and to certain extent correlated with consumer confidence (ex wage outlooks, asset prices, real estate prices etc).

Since the private business sector in China, today's stands for approx. 60% of GDP and 80% of all employment, the margin squeeze caused by price pressure and spending cuts by companies will directly affect nominal wage growth and consumer confidence outlooks.

Despite previous rounds of stabilizing efforts and loosening of real estate purchasing limits in earlier this year, the weaker inflationary environment remains predominant and caused a lower-than-expected economic output in Q2 2024.

Furthermore, a below target inflation or weak inflation is also a headwind to the total debt to nominal GDP ratio. Therefore, despite reduction of debt in sectors such as real estate and local government financing vehicles, if the reduction in debt is less than the growth of nominal GDP, then the ratio of total debt to nominal GDP will increase despite debt reduction efforts.

Therefore, to break this trend of reinforcing negative price pressure cycle, the central government needs to “reflate” the economy and bring inflation back to a sustained target of 2-3% per year.

´By “reflating” the economy, this one key objective will also stimulate domestic demand, increase consumer spending, create conditions to stabilize the real estate market prices and lower the total debt to nominal GDP ratio.

Therefore, the coordinated measures announced by the PBOC and by Politburo last week are a combined effort to “reflate” the economy and, through a “reflation” of the Chinese domestic economy, break the negative trends mentioned above and lift the GDP nominal growth trend back to its growth trajectory towards its long-term 2035 growth target.

Rational targeted measure towards China “Reflation”

Based on the context and the background above, we can further look a bit more specifically at the announced measures thus far and also what we should anticipate going forward.

First by looking at the PBOC measures of RRR cut by 50 bps is to mainly provide liquidity to the economy, but instead of increasing M2 it instead aims to increase the money multiplier effects and give banks more room to provide bank lending. The rate cuts of 20-30 bps are, however, slightly more conservative, which is mainly because the PBOC wants to protect the interest net margins of its banking system. While the mortgage cut of 50 bps for existing mortgages aims to reduce the gap between new mortgage financing costs vs existing mortgages and to boost consumer spending via a direct mortgage interest cut.

The other measures for lowering the existing down payment ratios for second homes and further loosening of purchase restrictions that have even started in Tier 1 cities are further confirmation of the determination to stabilize the real estate market.

Additionally, the PBOC also announced a 500 million and 300 million low-cost financing collateral programs for insurance, securities companies and non-financial entities using investment securities as collaterals to increase their capital market asset allocations and share buybacks.

All in all, the specific measures announced by the PBOC on the 24th of Sep is focused on:

- Increase overall liquidity in economy

- Improve consumer confidence and disposal income

- Stabile the real-estate market

- Increase confidence in capital markets and increase participation of longer-term investment capital

In addition to the above, the politburo meeting announcement on the 26th of September vowed to further increase counter-cyclical adjustments, stabilize the real-estate market, improve private enterprise business conditions, stimulate domestic consumption, improve income sources for low- and middle income groups, boost confidence in capital markets, guide more long-term capital participation into the market, and introduce policies to encourage increased childbirth.

The politburo meeting announcements are usually a guide to which areas of further policies we can anticipate and actions going forward to be announced subsequently. The key going forward is the anticipation of further details of fiscal stimulus announcement measures to complement the monetary actions earlier. I.e. to achieve “China reflation” it is not enough to only guide and provide the economy and market with liquidity supply but to also create demand for the liquidity.

Based on the above, it is anticipated that the central government will need to run a larger fiscal deficit in the short term to act as a “catalyst” for the “reflation” efforts. Therefore, there is a high likelihood that the current fiscal deficit of 3.0% will be lifted further in the short term and use the increase in fiscal deficit to stimulate domestic demand via possible transfer payments, tax reductions or enlargement of current trade in consumer rebate programs / subsidies ahead.

More notably, and maybe of more importance ahead, is the anticipation of the annual growth targets for 2025. Based on the actions now and distinctive measures to “reflate” the economy, it would not be a surprise if the central government were increasingly guiding the economy's growth based on the “nominal GDP growth” target in 2025 of 5% real & 2-3% inflation instead of the current real GDP growth target of 5%.

Thereby, continuing to support / steer the economy via the PBOC and the politburo towards a sustained trajectory back to the pre-Covid-19 nominal GDP trend. But the methods will be more tactical, rational, and aligned with the long-term strategy of improving GDP growth potential through structural reforms and productivity upgrades, i.e. “high-quality development”.

Summary and Implications:

Based on the decisive actions above and despite the recent years of below-trend nominal GDP growth since Covid-19, it is still fair to conclude that the domestic market in China remains a highly important part and contribution to the global economy. Despite the rapid development and growth of China to become the second-largest economy in the world since its opening up in 1978, its continued economic growth potential remains unchanged due to its size, population and continued growth of the middle class. Still today GDP per capita is approx. 12.700 USD as compared to Sweden at approx. 56.000 USD per capita or EU average of 37.400 USD.

Therefore, China remains a highly relevant market for us to deepen our understanding of its social-political structures, current situation, objectives, and path towards its long-term goal of achieving a mid-income economy by 2035.

During this process, as long as the continued opening up and reforms in China continues, it will provide global investors and businesses with new growth opportunities to participate and grow alongside its vast domestic consumer market.

Thanks again for your support and continuous dialog, and we look forward to discussing more details on the measures, and reasonable scenarios and outlook ahead for 2025.

Best Regards

Nordic Asia Team

Company Research Snapshots

Meituan Q2 2024

Meituan reported another quarter of beating result with 2Q24 revenue at 82.2BCNY (+21% YoY, +12.2% QoQ), +2.4%/-0.6% vs. cons./house. Adj. net profit was 13.6BCNY (adj. NPM 16.5% vs. 11.3% in 2Q23), beat cons by 23% or house by 20% thanks to the 3.9BCNY loss cut for new initiatives and solid OP from the core commerce segmen Gross Margin was 41.2%, improved by 3.8ppts YoY thanks to better margin of goods retail businesses and squeeze of rider costs. S&M expenses grew by 2% YoY only with S&M% cut by 3.3ppts YoY, as Meituan optimized its marketing strategy in lights of Douyin’s strategic adjustment in local services. R&D% improved to 5.6% in 2Q24 while G&A% was 1.9%. As a result, Adj. EBITDA improved significantly to 15.0BCNY (adj. EBITDA margin 18.2% vs. 11.3% in 2Q23 or 11.0% in 1Q24).

Meituan did not see intensified competition in 2Q24 while indicated its consistent focus on quality growth with operating margin expansion in 2H24 instead of pure market share growth. Oversea expansion is still in early stage with financial discipline. Due to improved earnings, Meituan hence announced another round of 1BUSD buyback program making shareholder return at 4.9% of current market cap.

Despite a relative weak economic environment in Q2, Meituan delivered a solid Q2 result further proving the user stickiness of its food delivery services as well as continued strong demand for its In-store, hotel & travel services. Furthermore Q2 also confirmed managements rational decision to cut back investments in its community group buying business to more focus on profitable growth. Going forward the strategy for Meituan is to increase the total number of high frequency users within its more than +600 Million active users. As currently around 20% of users contribute for around 80% of total platform revenue.

Trip.com Q2 2024

Trip.com released 2Q24 result that beating on bottom line while in line top line for the 4thconsecutive quarters. 2Q24 net revenue was 12.8BCNY, +13.5% YoY. Adj. net profit was 5.0BCNY in 2Q24 vs. 3.4BCNY in 2Q23, beating consensus or house by 39.5%/34.9% respectively, due to 1.1BCNY equity income from make my trip and Tongcheng.

Adjusted EBITDA margin was 34.7%, vs. 2.7% in 2Q23, thanks mainly to operating efficiency gain that partly offset by the increase of S&M spending (within expectation). R&D expenses was -1.8% YoY with a R&D% at 20.9%, vs. 24.2% in 2Q23. S&M% was 21.8% of revenue in 2Q24 (vs. 20.5% in 2Q23), with 20.3% YoY growth in absolute growth. Gross margin remained above 80% while non-GAAP operating margin at 33.1% (vs. 30.9% in 2Q23).

Via its oversea platform, Trip.com grew by double digits and management reiterated the China inbound market opportunities with 200% YoY growth in 2Q24 accounting for 25% of oversea platform vs. 10% in 2019.

The company maintained its strong momentum backed by outbound and oversea expansion which offset the weakened domestic tourism industry (single digit growth). Its continued outperformance over peers is supported by its global hotel network and oversea booking services that contributes a much higher ASP despite price pressure in domestic market.

Trip.com is amongst the major beneficiary of continued strong travel, leisure and service demand among Chinese consumer despite weaker economy in Q2 2024. It is expected for Trip.com to maintain its margin improvement thanks to operating efficiency gain via AI adoption, economics of scale and continued strong demand for inbound and outbound travel to and from China.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.