Nordic Asia Portfolio Insights: Jiangsu Hengrui Medicine

Jiangsu Hengrui Medicine - Company introduction

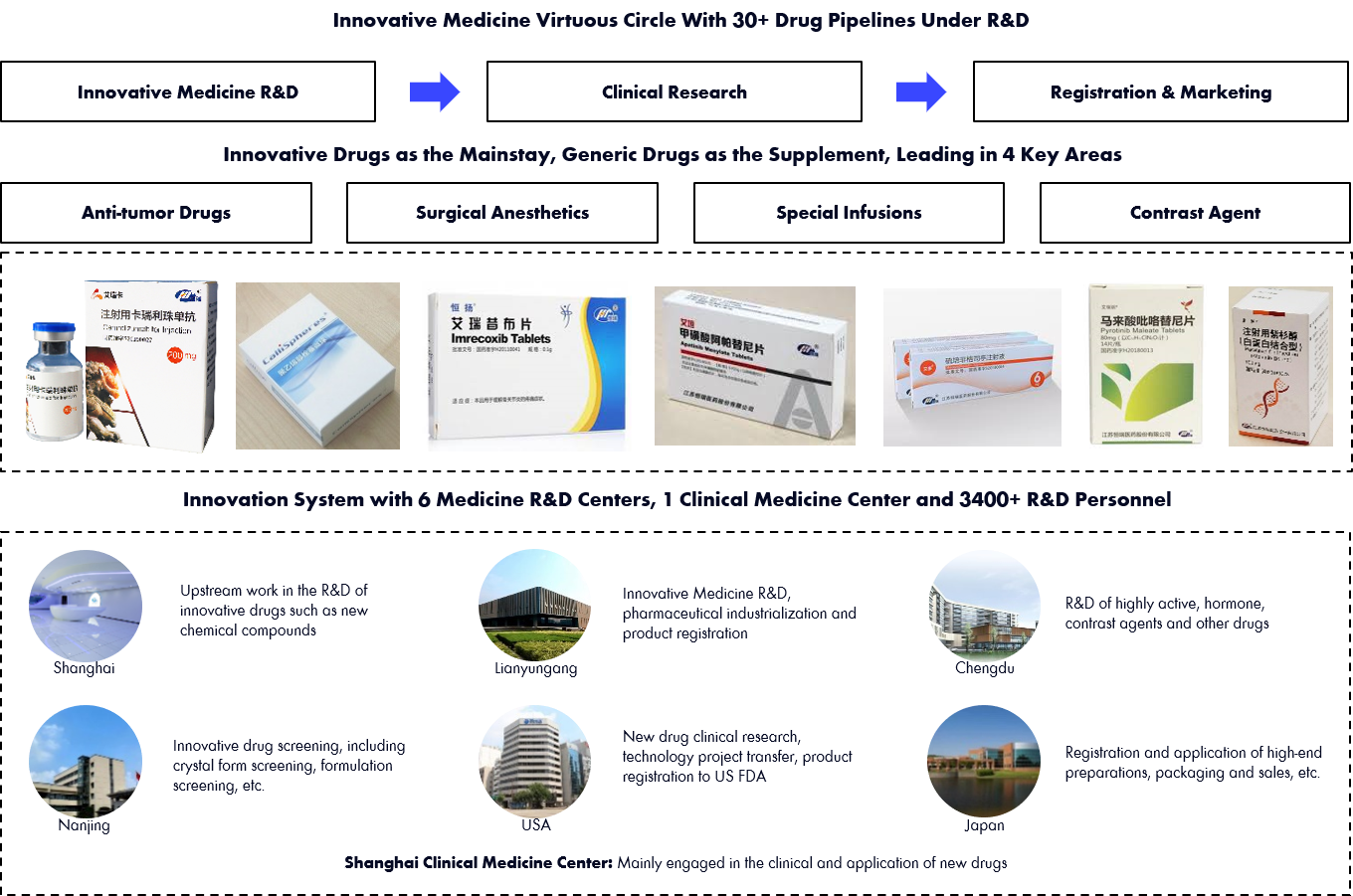

Established in 1970 and listed on Shanghai Stock Exchange in 2000, Jiangsu Hengrui Medicine is a leading domestic pharmaceutical company with a full industrial chain covering R&D, manufacturing, and commercialization of innovative and high-quality medicines. The major medical pipelines of Jiangsu Hengrui include anti-tumor drugs, surgical drugs and contrast agents, and the market shares of these innovative medicines are among the best in the domestic market. The company has invested about 15% of its sales in R&D to intensify its competitive advantages in new drug innovation. Hengrui has applied for 894 domestic invention patents and has 487 authorized patents worldwide. At present, 6 innovative new drugs were approved for marketing, several drugs are under clinical research. It also has 19 products that have realized large-scale sales in the overseas market. The company has abundant R&D pipelines and has formed a strong drug portfolio with new drug clinical trial applications every year.

Jiangsu Hengrui Medicine – Business Overview

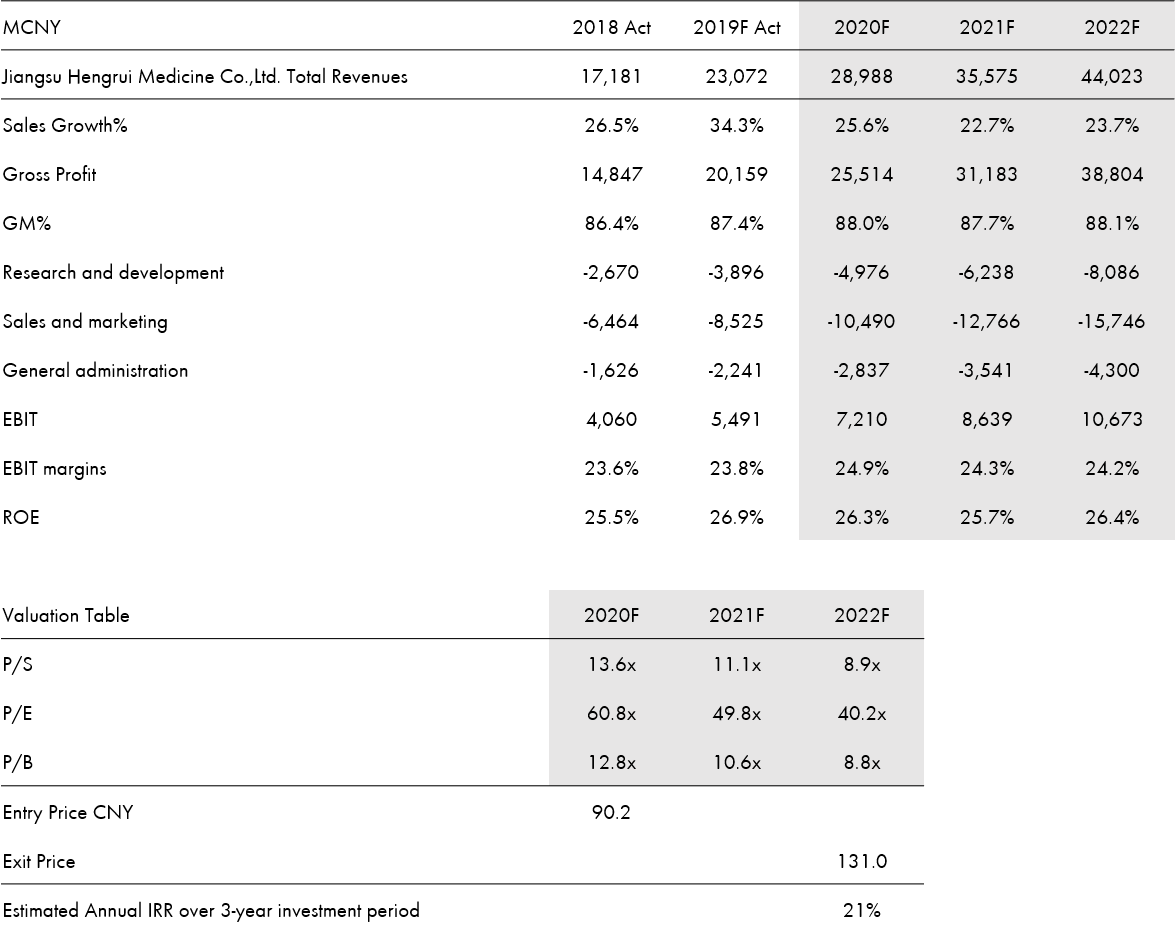

Jiangsu Hengrui Medicine – Financial Overview as of 23rd Feb 2021

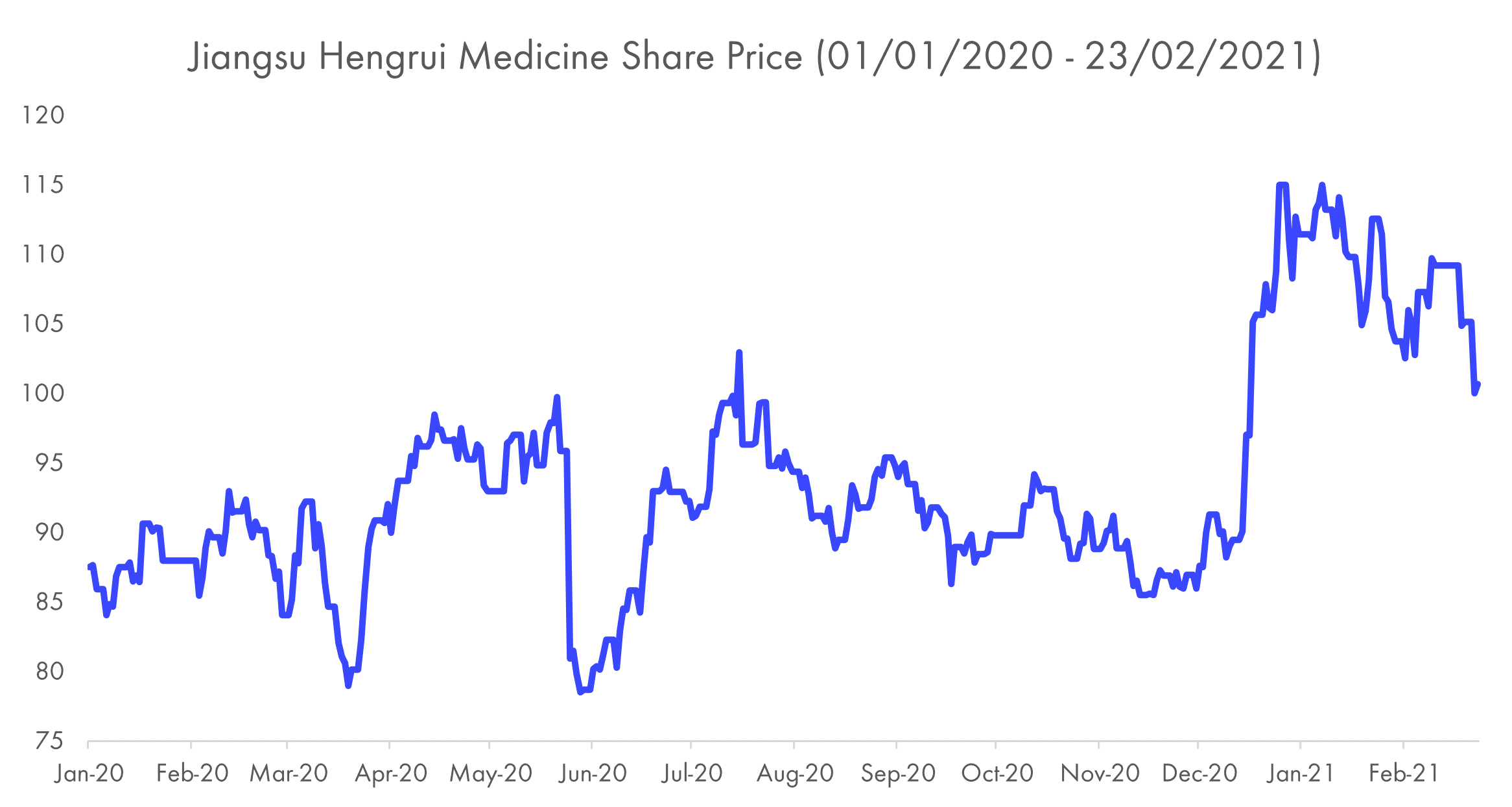

Jiangsu Hengrui Medicine – Share price performance from 1st Jan 2020 to 23rd Feb 2021

Interview with Nordic Asia Investment Research Director – Jason Zhang on his views on Jiangsu Hengrui Medicine

From Nordic Asia’s perspective what is the investment case for Jiangsu Hengrui?

The significance of our investment in Hengrui lies in the deployment of China's best innovative drug companies. Hengrui has proven itself as a company with excellent management capabilities in the past development. In the field of innovative drugs, companies have a large amount of research and development expenditures each year, especially in the field of PD1, the company is China's leading anti-cancer company, and a large number of new drugs are the first to enter clinical phase 3. With the gradual approval of new drugs in the future, the company's revenue and profits are expected to reach a new level.

How does Jiangsu Hengrui differentiate itself from its peers such as Qilu Pharmaceutical, Sanofi and AstraZeneca?

Qilu Pharmaceutical's main products are generic drugs, and there is still a big gap between its innovation capabilities and Jiangsu Hengrui. What Sanofi is famous for is its vaccine products. AstraZeneca is a world-renowned pharmaceutical company that can provide excellent products in the treatment of chronic diseases.

How did Jiangsu Hengrui perform during 2020 and how was it affected by COVID-19?

Judging from the data in the first three quarters of 2020, the company's business has grown strongly, with YoY growth at 14.57% on the revenue side and 17.11% growth on the profit side. During the epidemic, some of the company's products were negatively affected by the decrease in the number of doctors. However, most of the company's products are just-needed products for patients, and are generally less affected by the fluctuation of the epidemic.

Which are the key drivers and challenges for Jiangsu Hengrui that we should follow during the coming twelve months?

We will mainly focus on the following aspects: 1. The progress of its innovative drug products certification by the FDA in the United States, which represents its international team capacity building; 2. How the its products are affected by the risk of centralized drug procurement and price reduction, which represents its tradition changes in the level of product profitability; 3. The layout of the its biological targets and the progress of the approval of innovative products, which represent the company’s future profit development trend.