Nordic Asia Investment Group – Newsletter April 2022

Dear Investors,

Thanks again for your support and following Nordic Asia as the first Nordic Investment company focused on Chinas shift to a consumption led economy.

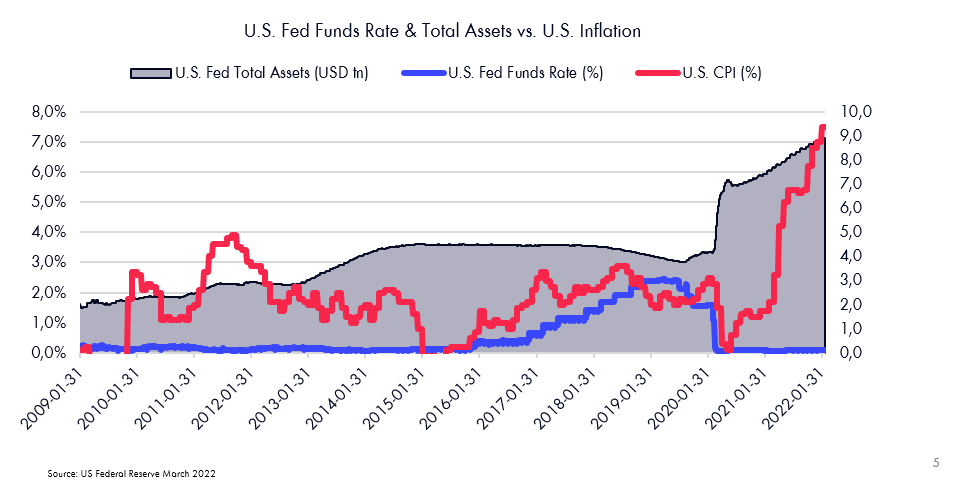

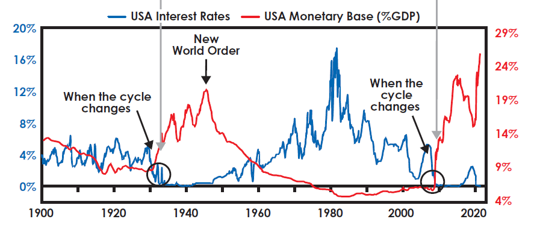

In the month of April, globally we are continuing to see what we have been concerned about for a long time - which is the reversal of the monetary accommodative policies that we’ve been enjoying since the great financial crisis. As shown in the chart below, the FED balance sheet has expanded from around 1 trillion USD by end of 2008 to almost 9 trillion USD as of April 2022 at the same time as interest rates globally has remained accommodative for most of this period. These expansive monetary policies have stimulated economic activity and lowered yields in financial markets, but these monetary policies do have a “cost” and the current wave of historical high inflation is now a showing as a “unintended consequence” of the previous monetary policies.

The current situation puts the global central banks in a very difficult position – on one hand central banks are concerned of too quick monetary tightening that could drag the economy into a recession and further tightening of financial market conditions – on the other hand if tightening does not occur now the inflation cycle might become more abiding and more stringent monetary tightening measures might be needed at a later point in time.

If we look at longer term time horizon previous cycles of monetary expansion have led to latter period of prolonged tightening cycles and inflation rates. Currently market participants are calling central banks for a “soft landing” i.e a middle way to solve the puzzle of recession risks yet containing inflation. This would be the most optimistic scenario but a difficult challenge for policy makers.

In this environment, China’s battle with Covid-19 during the month of April has continued and April PMI fell to 47.4, showing a significant reduction of economic activities in April due to the restrictive measures, partial lockdowns, and supply chain distortions. However, despite the short-term hardships caused by the strict pandemic control measures – the number of new Covid-19 cases started to moderate in Shanghai towards the end of April and new definitions of the policy were introduced as “community dynamic zero” implying that it is difficult to achieve absolute zero Covid-19 cases therefore the policy should be adjusted to limit uncontrolled community spread of virus infections by cutting off transmission chains via early defection, testing, and isolation. Based on our dialogs with experts in this field, the current turning point of gradual loosening up in Shanghai is a leading indicator for a possible turning point in Chinas battle with this current wave of Omicron outbreak and a further step towards a gradual adjustment of the dynamic zero policy. The preparation of loosing up in Shanghai despite not have achieved an absolute Zero clearance is already a signal of policy adjustments.

More importantly on Friday the 29th of April, the central government issued a clear statement around the state of the economy and its importance of the coexistence of the dynamic zero policy and economic development to both defend against the virus and ensure stable economic development with the least economic impact. Thereby, actively promoting the recovery of production and logistics and adopting more scientific means to prevent and control the epidemic may be a positive change in May. However, in the short term, the possibility of a comprehensive shift of the dynamic clearing policy is small but we should expect gradual adjustments to its current policy to moderate the economic impacts of the current Covid-19 dynamic zero policy. However, if we can restore the social operation state before the outbreak of the epidemic in Shanghai, it will help the next step of restoring the normalization of social activities with improved policy coordination.

The meeting on the 29th of April also iterated the need of greater use of fiscal / monetary support to stimulate and stabilize the economy towards achieving the previous guided annual growth target of approx. +5.5% GDP growth in 2022 which is in line with the growth requirement for China to reach its mid-century goals of becoming a middle-income economy by 2035 and high-income economy by 2050.

Finally, the meeting also clarified the purpose of the previous platform company regulations is to ensure a healthy long-term development of the market-based platform economy and normalization of stable policies to ensure continued platform company development.

The statements from this central government meeting on the 29th of April are the most clear and strong signal to the market that indicates stable economic development is of almost high priority to the central government. Thereby clarifying many of the previous doubts around the more conservative approach related to the dynamic zero policy, market regulations last year and flooring a growth guidance of at least 5% per year as accepted by the central government with the main growth contributor to come from domestic market demand.

Thereby if we look into this years GDP numbers, Q1 came in at around 4.8% we all know Q2 will need to guide down from previous approx. above 5% growth due to the Covid-19 outbreak. Therefore, if the current Covid-19 economic impact is higher than expected in Q2, then the government will need to push for stronger measures to achieve around +6-7% growth in Q3 and Q4 to reach the guided 5,5% annual growth rate for 2022.

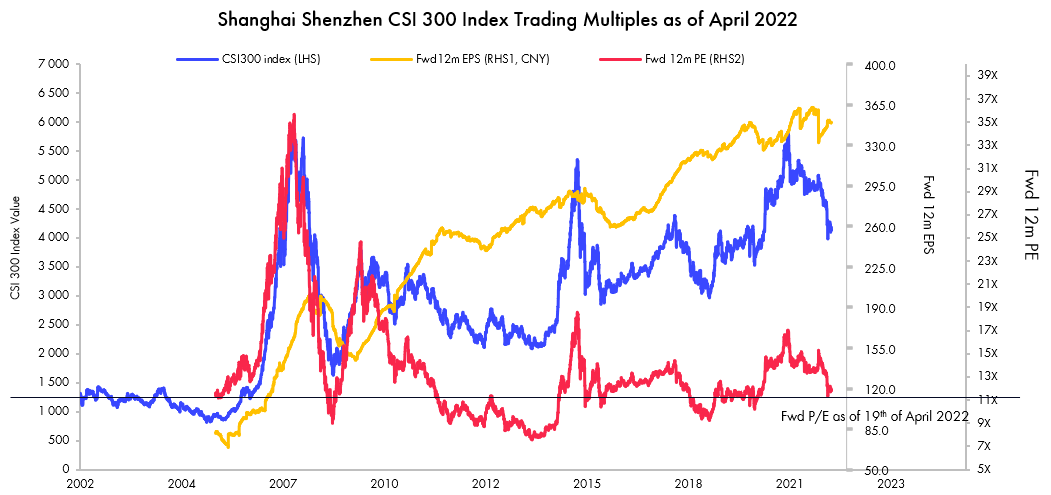

Finally, looking at market valuation today – we can see the market multiple in the broader market is trading at a historical low point – especially if we would look at ROE to P/B measures that both considers the improvement in the company’s earnings yield in relation to its current valuations. Thereby after the statement came out on Friday the 29th of April, the market quickly rebounded up as fund flows started to flow back into the market as the economic guidance became clear.

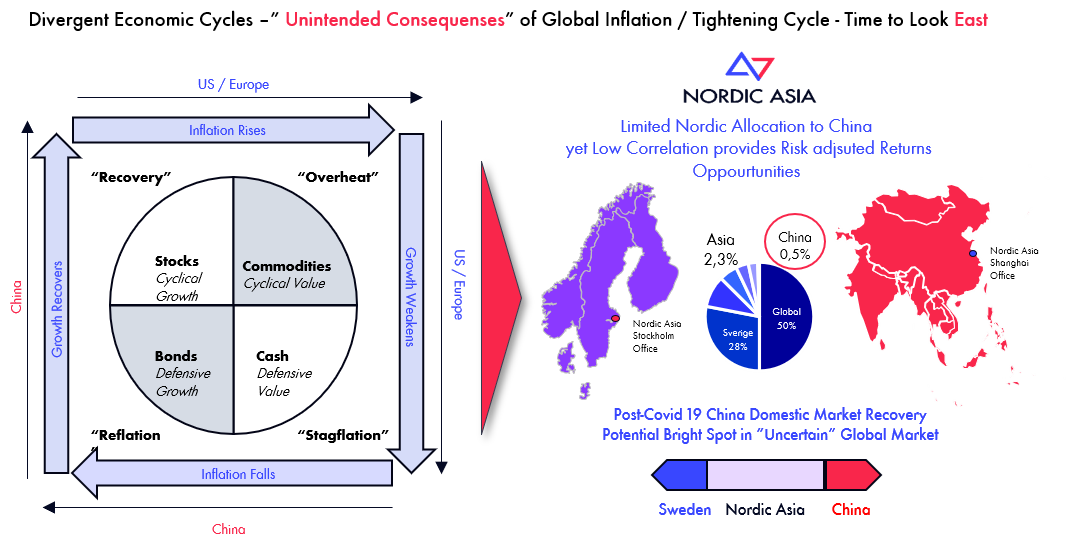

As we wrote in the previous newsletter in March, the outlook of the global economy is becoming even more complicated as a result of a structural reversal of previous expansive monetary policy – However in this environment – what we’ve seen during the end of April is a clarity for China central governments guidance and objective towards economic growth in 2022 and further recovery/expansion of domestic market demand. Thereby as guidance will now start to lift market expectations, fundamentals should follow sequentially gradually in Q2 and improve further towards H2 2022.

Could we now be “bottoming” out here in Q2 2022 both in terms of economic slowdown and market sentiment? Fundamentally it is still a bit early to say here in the beginning of May, although we can see a gradual stabilizing of economic leading indicators so far this week. But as long as the policy as per the announcement on the 29th of April follows through in the month ahead, we might be on a path of increased economic activity prior to the 20th party congress in Q4 and the recovery of the domestic market economy in China could stand out as a bright spot in the otherwise continued complicated global economy.

For Nordic Asia, with some tactical cash in hand we will continue to implement our strategy focused to invest in our portfolio companies within the three strategic themes in niche technology growth verticals, commercial platforms, and local consumption brands at the same limit our portfolio correlation low towards the global markets as we continue our emphasis on low beta correlation targets with high IRR certainty with key focus on the domestic market recovery.

Thanks again for following us and partnering with us for your interest in Chinas shift towards a consumption led economy.

Please see below for more specific selected portfolio company highlights during the first quarter of 2022.

Best Regards

Yining, Jason and the NA Team in Stockholm & Shanghai 30th of April 2022

Semcorp

Semcorp domestic leader of lithium battery separator, released its financial results for first quarter 2022 late last March: revenue was 8.0 BCNY and net income was 915.7 MCNY, growing 79.6% and 111.9% YoY, respectively. Gross margin of 48.5% and a net margin of 37.4% both show consistent compared to margins from year 2021. The total production from the quarter was ~1.1bn sqm which corresponds to a price of CNY 2.1/M2 and net income of CNY 0.83/M2. The SG&A and R&D expenses accounted for 3.4% and 4.1% of revenue compared to 2.8% and 5.3% from 4Q21 mainly because of the new year and overtime bonus of CNY 100mn. If adjusted, the net income per square meter would be CNY 0.98, a 10% improvement compared to 4Q21. The results met the market expectation.

As of the end of 2021, revenue from lithium battery separator film products accounted for ~87% of total revenue, up from ~81% in 2020 as the fast growth in EV market and renewable energy market continues to push the demand for lithium battery higher. Major clients of Semcorp are expected to expand their annual battery output to 1,396 GWh by 2025, 1,000GWh higher than the capacity from 2020. This corresponds to 15bn M2 of lithium battery separator film demand annually. Semcorp is best position for this industry tailwind due to the strong advantage over competitors in manufacturing know-how, production line advantage, and strong client relationships. The production equipments are still tight in supply as they are ordered to make and only come from a handful of suppliers such as Japan Still Work, Brueckner, ESSOP, and Toshiba. For a new competitor, the install of production line and client verification process can take 3-4 years. As such, the industry leader thesis continues to play out with Semcorp’s domestic market share increased 39% in 2021 from 31.5% and the global market share increased to 27%. The company aims to reach a global market share of 50% in 2025.

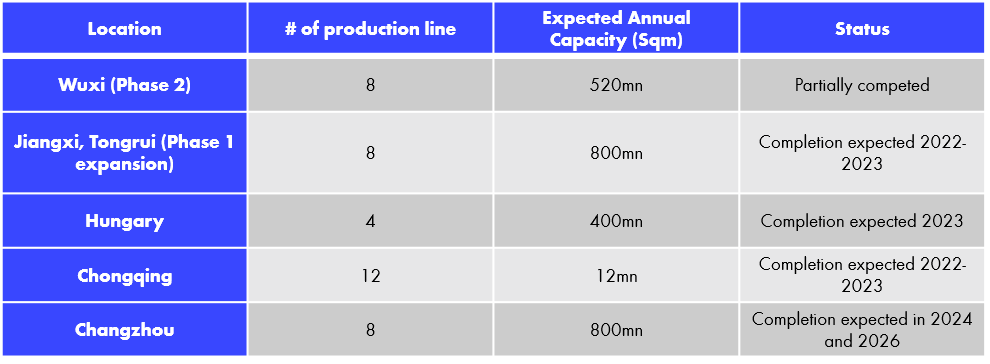

Semcorp’s output will reach 6bn sqm this year from 5bn in 2021 and is expected to produce over 8bn sqm in 2023 as production lines in Wuxi, Jiangxi, Chongqing and Hungary gradually come online to meet strong demands from clients. The company’s manufacturing facilities in Shanghai remain uninterrupted under the “close-loop” management and will be ready to ship out products once Covid control is alleviated.

Semcorp Production lines under construction

Eoptolink

Eoptolink, leader in optical transceiver modules for fiber optical data transmissions used in datacenters, achieved 739 MCNY in revenue and 132 MCNY in net income during 1Q 2022, growing at 18.3% and 17.8% YoY, respectively. On the cost side, gross margin increased 2.6% over same period last year to 33.1% aided by a higher percentage of revenue from high-speed optical module in the revenue mix. Meanwhile, SG&A increased to 6.8% from 6.1% and R&D expense grew from 2.8% of revenue to 5.0% of revenue last quarter.

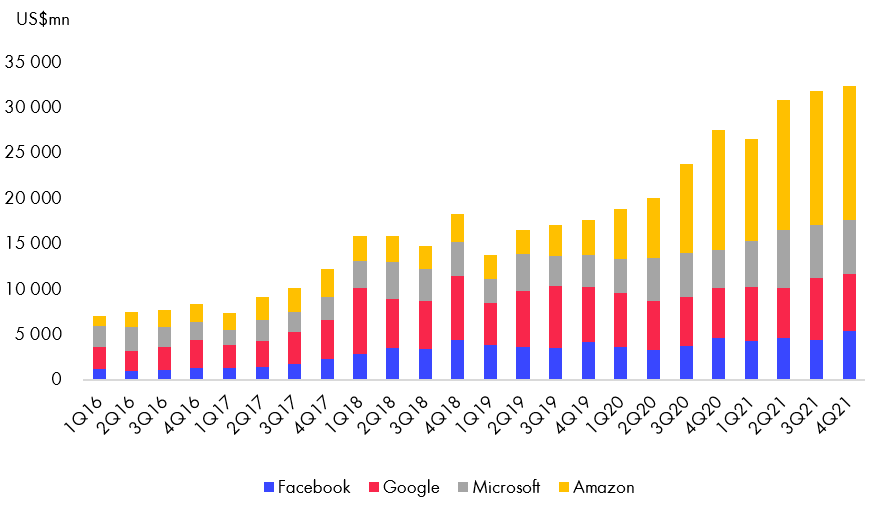

Eoptolink is a unique player compared to other competitors in China as the company has a higher portportion of revenue from bluechip clients such as Amazon cloud. Since oversea these clients typically have a larger budget and stronger demand for high-speed products at the same as the data center capex level are still high. Eoptolink was thereby able deliver industry leading gross and net margin. Capex for data center investments in China is also expected to pick up and grow by around CAGR of 25% till 2025 which should support domestic market demand for high end optical transceiver modules.

Technological pipeline is critical to the ROE for optical module companies as higher-speed modules can be sold at a much higher premium. Eoptolink can now mass produce 400G modules and has released 800G product during OFC, the most important industry expo held annually in the US. Additionally, Eoptolink received approval from CFIUS to acquire Alpine Optoelectronics which will serve as a research hub in the US to develop the next generation high-speed modules that will use silicon as material. The company has confirmed the high visibility for orders in 2022 and is expected to deliver a 20-30% top-line growth this year.

CapEx by Major North American Cloud Companies

SF Holding

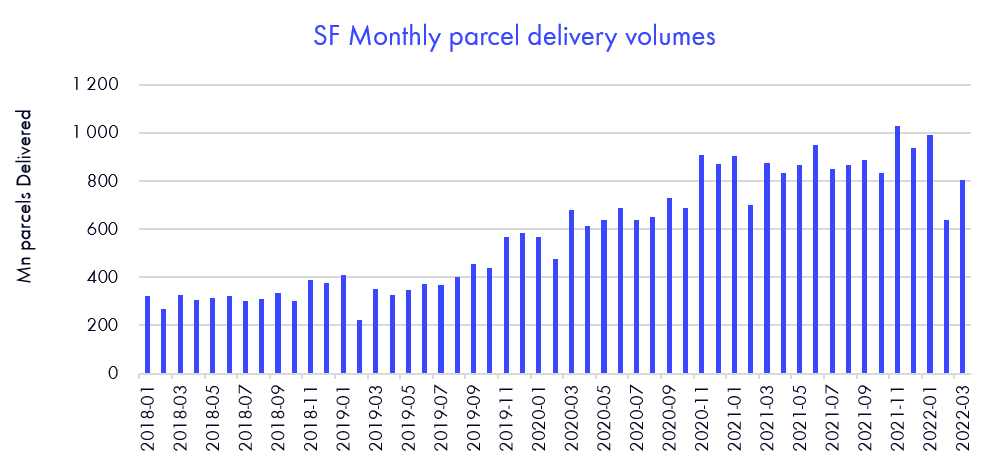

In the first quarter of 2022, top-line revenue increased to 47.8% to 63.0 BCNY while net income reached 1.0 BCNY compared to a 1.0 BCNY loss in Q1 2021. The price regulation implemented in late 2021 forced the industry to compete for operating efficiency rather than price, resulting in a net margin of 2.3%, an improvement compared to -2.7% in 1Q 2021. The +47.8% growth was supported by the acquisition of Kerry logistics, an addition in SEA for the SF platform. If we focus on SF’s express business, the revenue growth in 1Q22 was 2% with a 1.6% decrease in volume and a 3.4% increase in average price. The lower volume is caused by cutting down low-margin contracts as part of the strategy to increase operating efficiency. The result slightly exceeded expectation as the market was expecting a less profitable quarter due to the disruption of Covid control in certain regions. The strong performance is a continuation of the “optimization” theme from 4Q21 during which the revenue grew 60.1% to 71.3 BCNY and net margin improved from 3.62% to 3.72%.

Three factors contributed to the stronger than expected quarter: 1) continued optimization of product mix which prioritizes profitability; 2) continued reorganization of logistic routes to release cost synergies among routes and storage space for heavy freights, express items, and economical items; 3) a renewed corporate focus which prioritizes quality of earnings rather than top-line growth.

In the near term, the Covid control in China and high fuel cost will present a challenge to SF. However, if we look ahead, SF’s comprehensive infrastructure is still in place to make sure the company continues to maintain the leading position in quality of service once the control is lifted and economic activities resume. SF began this round of Capex cycle in late 2020 and invested heavily in land, storage facility, allocation center, and vehicles with a goal of being able to handle higher volume in China as total industry volume parcel grew by +30% in 2021. Moreover, SF’s new airport which locates at the central region in mainland China will serve as a transitional hub for airmails once put in use in late 2022. This will allow SF to be more flexible when arranging air routes and expand its service network. SF is currently the only logistic company in China that owns an airport. Internationally, the acquisition of Kerry extended SF’s delivery ability to the door steps for countries in South Eastern Asia.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.