Nordic Asia Investment Group - Newsletter July 2022

Dear Investors,

In the past month, the complex market environment of high inflation and rate hikes continued globally as composite PMI fell below 50 in both the US and in the Eurozone in the month of July, while inflation in the US increased from 8.6% to 9.1%, and corresponding euro zone inflation climbed to 8.9%. Meanwhile as the FED hiked rates again by 75 bps to 2.5% i.e. the second consecutive 75 bps and a total of 250 bps in the past five meetings since beginning of 2022. Simultaneously ECB conducted its rate hike of 50 bps in July, the first-rate hike since 2011 to combat an elevated euro zone inflation.

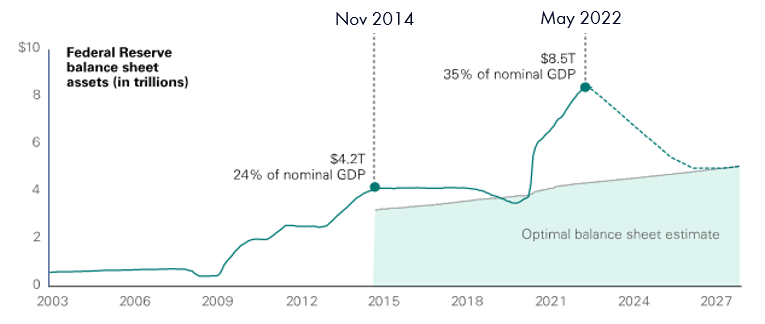

Although the “gap” between the inflation vs interest rates is still high and further rate hikes should be expected, a key consideration in this context is whether or the increased rate hikes will be effective enough to combat the higher levels of inflation? The issue is still the elevated balance sheets that more than doubled since 2020. Although the FED in US has started its “normalization” process but based on current announcement pace of the FED balance sheet reductions, it is estimated that it takes approx. until 2027 before the size of the balance sheet will revert to “pre-covid” levels of approx. 4.2 trillion USD from current 8.5 trillion USD. The key question to consider in this context is whether the long-term yields e.g the US 10-year yield currently at approx. 2.7% will be able to stay “anchored” around this range if inflation continues to stay at elevated levels going forward. Thereby heading into the fall of 2022, consumer real purchase power is expected to slow down due to the combined effects of high inflation and further rate hikes - yet the uncertain high inflation outlook could also significantly affect the long-term yields and thus overall global asset pricing going forward.

Looking more domestically in China during the month of July, the domestic market although in a recovering trend was uneven in July. First of all, during mid-July local Covid-19 flare ups continued – causing a short-term uptick in the number of cities affected by the Covid to raise from June low of 30% to 45% in mid-July. Secondly, the uneven pace of the property market sales especially during the early part of July affected the economic recovery. Thereby China composite PMI in the month of July reduced by 1.3 percentage points to 54 from previous 55.3 mainly driven by a slower manufacturing sector while service PMI continued to expand to 55.5 from previous 54.5. The overall property market was affected negatively by public resents of mortgage payments for still unfinished projects (unfinished projects demanding mortgage payments amounted to approx. 1.7% in H1 2022, estimated NPL of mortgage loans related to unfinished projects are limited to approx. 0.01%) that occurred in beginning of July but recovered after the government measures to stabilize the situation in mid-July via stricter monitoring of those projects, extending liquidity and land repurchase measures to speed up the finalization of those unfinished / delayed projects and to offset the public resent of stalled mortgage payments. Thereby towards the end of July total property market transaction volumes improved sequentially and returned to +50.000 sqm per day (week 31) – which is roughly in line with same transaction activity in the same period last year.

In terms of the monetary policy, in July total social financing continued in a positive direction and increased to 5.2 trillion CNY in June (vs 2.8 trillion in May) thus monetary policy remained expansive with reported CPI in China in the month of June came in at 2.5% up slightly from 2.1% in May. Towards the end of July, the government issued a statement regarding the economic development, emphasized on stable economic growth to ensure a reasonable growth rate by stimulating domestic demand and encouraged local provinces with adequate preconditions to achieve its local growth targets for the full year. But the domestic economy recovery is preconditioned on a more stable and normalized Covid-19 environment and sequential improvements in the domestic property sector of which both factors could be further stimulated or adjusted based on social-economic policies ahead. Thereby going into this fall, the fundamental of a continued divergent economic cycle remains unchanged abiet the recovery of the domestic market economy could be patchy at times.

However, a key uncertainty going ahead is the continued difficult Sino-US relationship and its complexed structure of economic integration yet different ideological governing systems. While no size fits all and the Chinese system of “state-capitalism” governed by one strong party has led to a rapid economic development and modernization since the opening up of China in 1970s, it’s rise to the global economic power and influence is considered a “competition” within the existing world order. Thereby, effective strategic efforts to contain the growth of China has been made previously in form of sanctions, export bans and trade tariffs etc. Therefore, the most recent state visit of Nancy Pelosi in Taiwan was a complex continuation of this “competition” within the broader scope of a complex Sino-US relationship.

The Sino-US relationship was much improved after president Nixon historical visit to China in 1972 where he addressed that “I have taken this action because of my profound conviction that all nations will gain from a reduction of tensions and a better relationship between the United States and the People's Republic of China” – thereafter both parties issued the clear statement of the one China policy and the three communiques 1.Acknowledging there is only one China and Taiwan is part of China. 2. US should end formal political relationships with Taiwan and 3. Reduce the sales of arms to Taiwan and military installments in Taiwan. The same “One China principle” is adopted in the UN resolution 2758. However, Taiwan is a self-governed administration with its own legal system and election process and thereby despite the globally adopted One-China Policy, the delicate “status quo” of self-governance yet adhering to the “ One China principle” although ambiguous / contradictory, has actually benefited economic trade and relationships from both sides China and Taiwan. Currently, China is Taiwan’s largest trading partner and nr 1 inbound tourism group prior to the Covid-19 pandemic.

From a domestic China strategy, the basic policy for solving the Taiwan questions is through a peaceful reunification via a policy of “one country – two system” principle. I.e. after the reunification of Taiwan – to let Taiwan continue its self-governance, legal system and administration of Taiwan but defense and foreign policy to be administered by China. As long as “status quo” is maintained – domestically in China they are not in a rush for a peaceful reunification and have stated that the peaceful reunification is expected to occur during Chinas goal of achieving full modernization by 2049. But China does not accept a deviation from the “status quo” i.e. any act of self-independence or external recognition of Taiwan as a sovereign state creating a deviation from the UN resolution of the “One China principle”. Therefore, from a domestic China perspective the state visit of Nancy Pelosi (as the US house speaker and second in succession of the US Presidency) to Taiwan is considered a formal official “state-to-state” visit. And was warned prior to the visit, that the visit would be considered a violation of the One-China principle and an unnecessary change of the “status quo”.

On one hand this event has further increased the complexity of the China-Taiwan-US relationship while both domestically in Taiwan and in the US the rationale and potential gains of this visit is unclear and there is still an ongoing ambiguity whether the visit represented the official Biden administrations or not, as source state that the visit was made based on Nancy Pelosi insistence without the support of the US white house. In Taiwan, an internal debate is also ongoing regarding Tsai Ing-wens rationale to accept the visit and the rationales behind the considerations made by the current administration by accepting this visit. On the other hand, by reading through the lines of this event, the visit was a complicated subject and without a straightforward stance by any of the involved parties. I.e. The visit by Nancy Pelosi to Taiwan was held unconfirmed until late Monday and sources state that the final itinerary was even kept from the lawmakers accompanying Pelosi until after they boarded the plane. Furthermore, the flight from Malaysia to Taiwan took a rerouted flight that avoided Chinese official airspace. Taiwan domestic policy makers was not the initiative taker for this visit and China did not interfere with the visit as the visit proceeded accordingly and left Taiwan on Wednesday. Meanwhile Washington released statements to continue to adhere to the “One China Policy”.

Going forward, of course it should be expected that there will be increased complexity of the China-Taiwan-US relationships after this visit due to sensitivity of this issue and the goal to preserve the “One-China Principle”. The Sino-US relationship is the most important bilateral relation in the world economy as the two largest and most dominate economies in the world currently. Therefore, similar to Nixons quote above, all nations and entities will have a lot to gain from an improved relationship between these two countries. However, despite some short-term volatility prior to this event, domestic markets have stabilized as Q2 earnings and underlying economic fundamentals remains the key focal point for the markets.

Thereby in this environment of high inflation / rate hikes and uncertain external environment – the key for us is to continue to focus on the Chinese domestic market economy (internal circulation) especially in those sectors with structural growth demand, policy support and sequential trend-based demand improvement with limited external correlation, as overall offline activities improved in the final weeks of July and recent announcement of total sales of NEV in the period Jan-June 2022 reached 2.6 million corresponding to a YoY growth of +120% and amounted to ca. 22% penetration of total vehicle sold in H1 2022.

Best Regards,

Yining, Jason and the NA Team in Stockholm & Shanghai

5th of August 2022

CATL

CATL (Contemporary Amperex Technology) is a global lithium-ion battery pack solutions provider for new energy vehicles and energy storage applications. The company holds a leading market position with integrated value-chain and R&D capabilities across material-cell-battery system developments. Thereby CATL has the capacity to design and develop tailored battery pack solutions with high energy density, long-cycle life, stringent safety standard at competitive costs. In 2021, the company’s installed battery capacity reached 96.7 GWH corresponding to a nr 1 global market share of 32.6% (vs nr 2 LG Energy Solutions of 20.3%, nr 3 Panasonic 12.2%) and is a key supplier to Tesla, BMW, Toyota, NIO, Xpeng, Geely among many other EV car brands. In 2021, the company’s sales and net profit were 130.3 billion yuan and 15.9 billion yuan, respectively, corresponding to a YoY growth of +159.1% and +185.3%, driven by the fast growth of the domestic EV car industry penetration in China. Its new Qilin series of battery pack solutions has the ability to increase driving range to +1000 Km while ensuring fast charging to reach 80% change in 10 mins.

While the EV industry is in its fast growth phase, the global market for EV car lithium-ion battery in 2021 was approx. 297 GWh while for energy storage it reached 70 GWh. However, as EV car penetration is expected to grow rapidly globally, the market size for EV car lithium-ion battery is expected to grow to +1.300 GWh and energy storage market size to grow to approx. 500 Gwh for a total market demand above +1.800 GWh by end of 2025 compared to current size of approx. 370 Gwh in 2021.

Currently approx. 80% of CATL sales are still domestic in China, however oversea sales more than tripled in 2021 and is currently building a new battery factory in Germany with expected production in 2022 and recently signed a deal with Ford motors to be its key supplier for its Mustang Mach-2 and F-150 Lightning models.

We believe that CATL‘s early and continuous expansion of production will release further economies of scale to meet the needs of vehicle manufacturers for power battery procurement and lay the foundation for high growth ahead. In this capital and technology intensive industry those with leading market positions today is expected to gain from further industry growth and economies of scale both in terms of capacity expansion, supplier costs reductions and new technology breakthroughs. Thereby CATL is well positioned to capture the continued market growth of EV vehicle penetration and energy storage applications.

Juewei Food

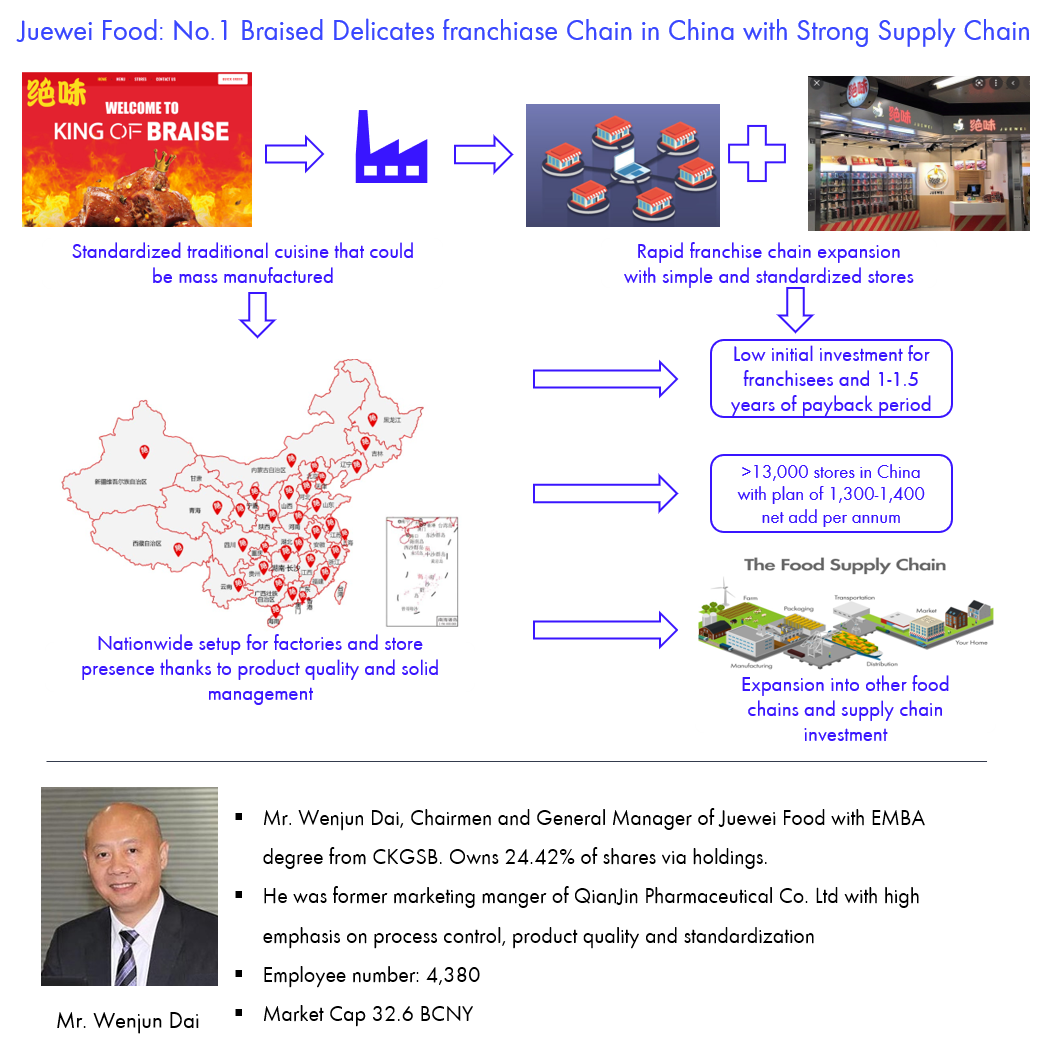

Juewei Food is the largest braised retail food franchise chain in China with 13,714 stores across the country as of 2021. Juewei generated 6.55BCNY revenue in 2021 mainly from selling braised poultry products, a traditional Chinese cuisine that had been transformed into a new FMCG snack food category. Such highly standardized product allowed Juewei’s successful and rapid expansion via mass manufacturing and unified store model replication. The store front normally needs only small area for merchandize shelf and little reliance of staff force which saved franchisees from heavy initial investment. On the industry level, braised food industry has been growing by >10% CAGR with industry size of 329.6BCNY in 2021 driven mainly by the penetration of branded stewed food and nationwide industry level expansion in the past decades. Nonetheless, the top 4 players only accounts for 19% of market share, in which Juewei was the largest with 9% share. Juewei has developed stronger than peers supply chain and franchisee management. Juewei’s 21 manufacturing plants spreading nationwide enables same day order, manufacturing, delivery and start selling in 24 hours within the 300-500km radius to ensure product quality and efficiency. The widespread and self-owned factories also helped Juewei in further penetrating more cities in the future. Juewei also has strong management with solid experience in consumer goods and chained stores that excels in managing franchisees’ return expectation. Currently, Covid-19 situation is the major short-term pressure for the chained braised food market which has caused another round of industry consolidation. Juewei is currently actively gaining market share by continue store opening and franchise network expansion. With added retail sales network and new franchisees, we expect Juewei to further benefit from increased foottraffic in China. Furthermore, Juewei also expanded into a new channel to provide its braised products for catering and B2B restaurant business as its second growth driver. During the first half of 2022, we expect sales to be slowed down in Q2 due to the Covid-19 outbreak especially in Apr-May but partly offset due to its new store expansions.

According to channel experts, Juewei’s average store sales further improved in July from June as more stores re-opened since the ease of Covid impact showing a continued sequential recovery from Covid-19 outbreak in Q2. Covid-19 flare ups might continue to affect sales in H2 2022 in the short-term but in the long-term the current store expansion, consumption upgrade trends should benefit the company to drive further market share gains.

Disclaimer

This e-mail is for marketing purposes only and does not constitute financial advice to buy or sell any financial instrument. This e-mail and the documents within may not be distributed further and is only for people and companies' resident in the European Union, the EES and Switzerland. This e-mail is therefore not intended for any person or company resident in the United States, Canada, Japan or Australia or in any other country in which the publication of this material is forbidden. If the laws and regulations is as described above, the reader is then prohibited to take part of this –mail. In accessing this e-mail the reader confirms that he or she is aware of the circumstances and requirements that exist in respect of accessing this e-mail and that these have not been violated. Nordic Asia disclaims any responsibility for any typos and do not guarantee the validity in the information and documents in this mail including typos, corrupt e-mails and/or for actions taken as a result of the mail and/or the documents within. All investments is always attached to a risk and every decision is taken independently and on their own responsibility. The information is this mail is not intended to be used instead of the professional financial advises as the individual receiver might need. There is no guarantees that the Company will fulfil its obligations under the loan financing which is referred to in this e-mail. Any funds invested may be lost.