Nordic Asia

Nordic Asia Investment Group 1987 AB (“Nordic Asia”) is a Swedish investment company focused on long-term strategic equity investments in market-leading Chinese companies with exposure to China’s domestic consumer market. Through a well-defined investment model, a locally present investment organization in Shanghai and a comprehensive partner network, Nordic Asia aims to identify and own a concentrated portfolio of around 20 companies. Nordic Asia’s objective is to generate an annual return in excess of 15% over time with a low correlation to other markets. Nordic Asia invests in listed companies with a market capitalization of at least USD 1 billion that are listed for trading in Shanghai, Shenzhen, Hong Kong and the US (through ADRs).

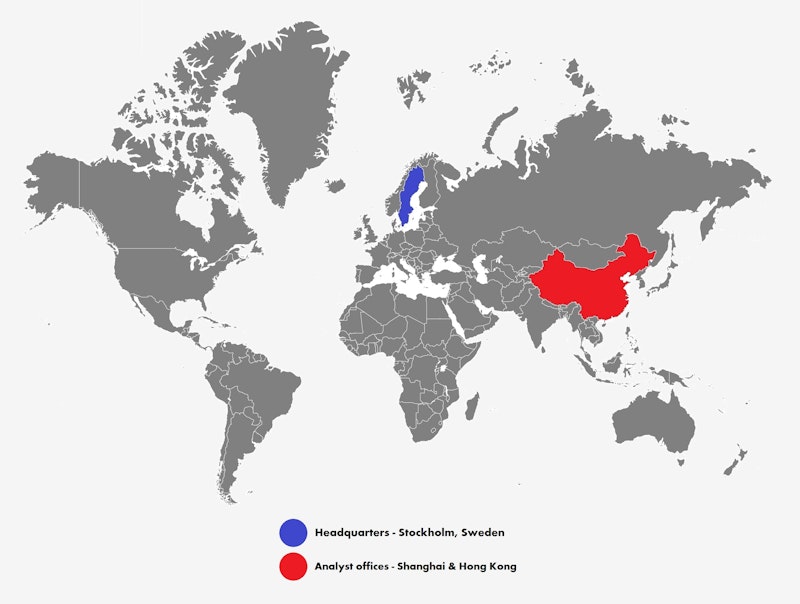

Nordic Asia is based out of Stockholm with offices in Hong Kong and Shanghai and is structured as a Swedish investment company (LLC) with high standards on transparency. Since December 2021 Nordic Asia is listed on Nasdaq First North with its B-share being traded under the ticker NAIG B.

Local market presence

Geographical presence

Nordic Asia has access to three local analysts conducting investment research out of Shanghai

Market access

Local market presence and knowledge enables us to follow and analyze the markets in real-time leveraging on local information

Partner network

Partner network of top-tier research firms providing high quality market and company coverage

Investment strategy

Nordic Asia's investment strategy is based on identifying market-leading companies with exposure to the growing consumer market in China. The growing middle class is expected to be an increasingly important pillar of the Chinese consumer market, being expected to more than double over the decade, corresponding to an increase of more than 400 million new middle-class consumers. Nordic Asia focuses on value creation by investing in portfolio companies which will generate long-term earnings growth. This investment model is based on fundamental company analysis and a good understanding of the market positions of the portfolio companies and the markets in which they operate. To execute on this strategy, Nordic Asia has created a dedicated investment organization with local market presence in China and Hong Kong with strong operational experience and a well-established business network.

Investment screening process

Nordic Asia has established a clear screening process for portfolio selection: from an investment universe of over 1 500 companies, with a sector-by-sector screening and an internal watch-list of about 200 companies, divided into approximately 20 companies per sector, with 60 companies being added to the short-list. The short-listed companies are continuously monitored, after which a target list is created and an internal analysis schedule is created to carry out a deeper analysis of the companies.

Once the internal analysis has been completed, the company is presented to Nordic Asia's internal investment committee, after which an investment decision is made, subject to the CEO’s approval.

Active monitoring and evaluation of the portfolio companies

Following a new investment, a lead analyst is appointed to cover the portfolio company. The lead analyst is tasked to continuously meet with the portfolio company, the portfolio company's industry experts, as well as update the internal financial models with new relevant market information.

The portfolio companies are continuously monitored and evaluated in relation to potential new portfolio companies brought to the investment committee. If a portfolio company’s performance deviates significantly from Nordic Asia's analysis of the portfolio company's potential or a new target company offers a more attractive risk-adjusted return potential, the portfolio holding is re-evaluated by the investment committee.

Interview with CEO Yining Wang

Partners