An Overview of EU-China Comprehensive Agreement on Investment (CAI)

Why CAI?

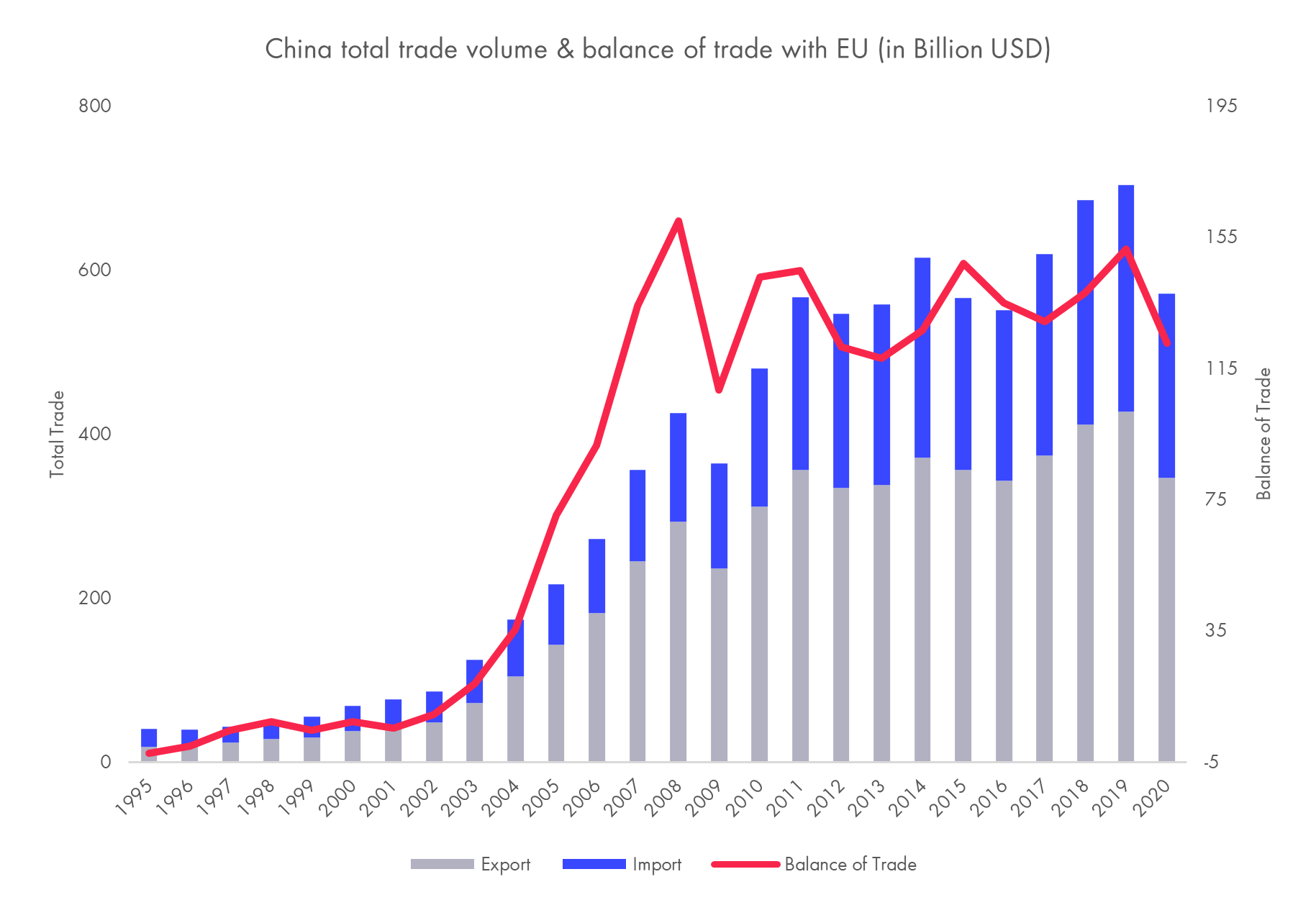

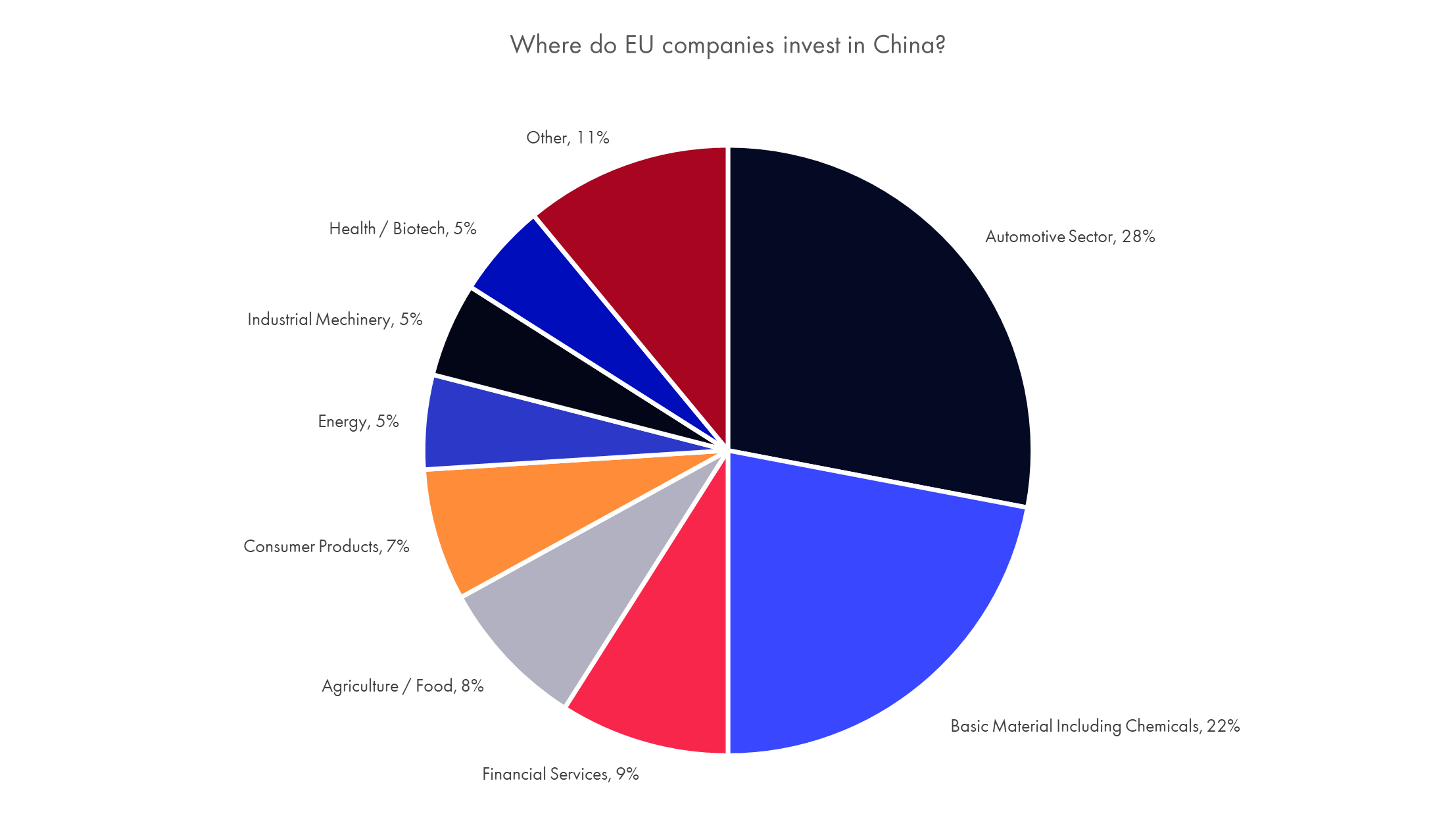

- Increased cooperation between China and the EU; the high volumes of bilateral trade and investments (especially from the EU to China).

- Vagueness of the legal frameworks and the disparities between foreign and domestic enterprises.

CAI Core Points

As regards investment, the EU-China Comprehensive Agreement on Investment (CAI) will be the most ambitious agreement that China has ever concluded with a third country. In addition to rules against the forced transfer of technologies, CAI will also be the first agreement to deliver on obligations for the behavior of state-owned enterprises, comprehensive transparency rules for subsidies and commitments related to sustainable development.

- Improved investors’ access. Broadening the EU investors’ access to the Chinese market by eliminating JV requirements, equity caps, etc.

Opening of the investment fields. Improved market access commitments by China in domestic Manufacturing, Computer service, Financial service and Automotive industries, etc.

- Improving level playing field, fair treatment of investors in both markets. Protection against unfair treatment and unlawful discrimination. Ensuring transparency, predictability, and legal certainty of the investment environment and clear, fair, and transparent procedures.

- Support to sustainable development initiatives. Encouraging responsible investment and the corporations’ uptake of CSR. Promoting core environmental and labor standards and effectively implementing the Paris Agreement on climate change.

Future Expectation

- Deepen bilateral economic cooperation and help promote the EU’s economy recovery and the high-quality development of China.

- Global competitiveness and the future growth of EU industry. EU investors are to achieve better access to a fast growing 1.4 billion consumer market and compete on a better level playing field in China.

- China will benefit from the intensive sustainable cooperation with EU in corporate investment, technology R&D and geopolitical aspects.

- Chinese companies have strong competitiveness in related fields such as wind power and photovoltaics and are to benefit from the EU’s openness in new energy, environmental protection and digitalization fields.

Affected Industries

- Manufacturing - China has made comprehensive commitments with only very limited exclusions (in particular, in sectors with significant overcapacity). Roughly half of EU FDI is in the manufacturing sector (transport, health equipment, telecommunication equipment, etc.)

- Automotive - China has agreed to remove and phase out joint venture requirements. China will commit market access for new energy vehicles.

- Financial services - China will grant and commit to keep financial services opening to EU investors. JV and foreign equity caps requirements removed for banking, trading in securities, insurance, asset management.

- Health (private hospitals) - China will offer new market opening by lifting JV requirements for private hospitals in key Chinese cities, including Beijing, Shanghai, Tianjin, Guangzhou and Shenzhen.

- R&D (biological resources) - China has not previously committed openness to foreign investment in R&D in biological resources. China has agreed not to introduce new restrictions and to give to the EU any lifting of current restrictions in this area that may happen in the future.

- Telecommunication /Cloud services - China has agreed to lift the investment ban for cloud services. They will now be open to EU investors subject to a 50% equity cap

- Computer services - Significant improvement of market access for EU investors. Included a ‘technology neutrality' clause ensuring that equity caps imposed for value-added telecom services will not be applied to other services such as financial, logistics, etc. if offered online.

- International maritime transport - China will allow investment in the relevant land based auxiliary activities, enabling EU companies to invest without restriction in cargo-handling, container depots and stations, maritime agencies, etc.

- Air transport-related services - China will open up in the key areas of computer reservation systems, ground handling and selling & marketing services and has removed the minimum capital requirement for rental and leasing of aircraft.

- Business services - China will eliminate JV requirements in real estate services, rental and leasing services, repair and maintenance for transport, advertising, market research and management consulting etc.

- Environmental services - China will remove JV requirements in environmental services such as sewage, noise abatement, solid waste disposal, cleaning of exhaust gases, nature and landscape protection, etc.

- Construction services - China will eliminate the project limitations currently reserved in their GATS commitments.

Conclusion

The agreement is of great significance to both China and Europe. Once the agreement enters into force and is conscientiously implemented, it will be a major breakthrough in China's reform and opening up process. CAI only involves investment issues, but also involves issues such as the docking of competition systems between China and Europe. It will directly involve China's new round of reform and opening up to the specific areas and goals. There will be greater room for European investment in China to rise, and the investment environment for Chinese companies in Europe will also be more open and fair. The conclusion of CAI not only promote the China-EU comprehensive strategic partnership to a higher level, but will also enhance the confidence of the international community in economic globalization and free trade, and help China and Europe to better play the role of the “twin engine” of the world economy. The recovery of the world economy during the epidemic has brought more business opportunities to the world.

For the full report, please click HERE