Nordic Asia Industry Insights: Sportswear Industry

The Better Sub-categories

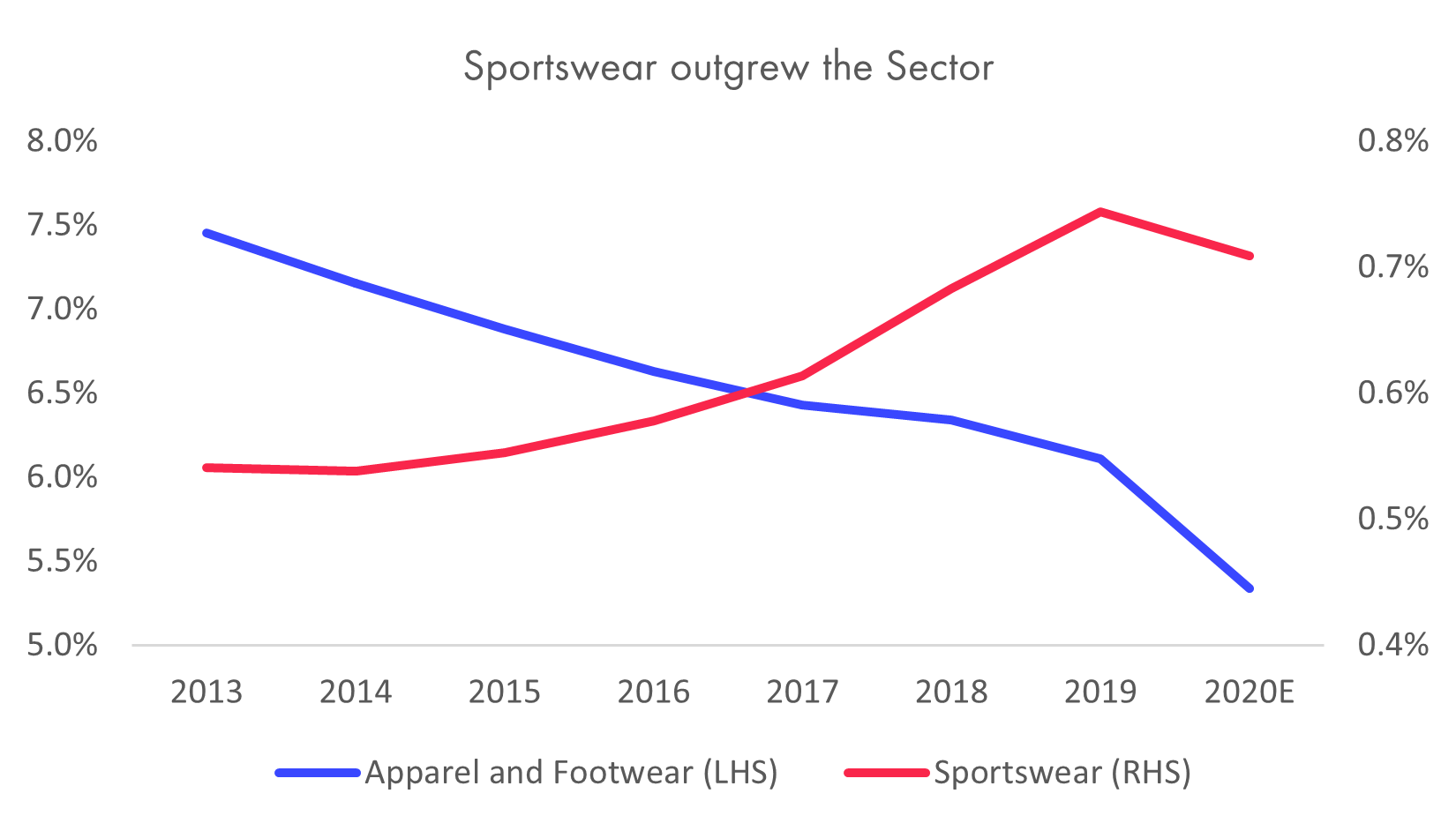

China’s apparel and footwear market has been growing by a relatively slow CAGR of 5.95% from 2014 to 2019 while dropped significantly by 9.7% in 2020 in light of pandemic. However, the China sportswear maintained double digit CAGR in the same period by 16.6%. Additionally, China sportswear achieved resilient result with only 1.5% decline in retail sales in 2020. The market size of sportswear will continue to outgrow the industry along with the rising healthcare consciousness and consumption upgrade.

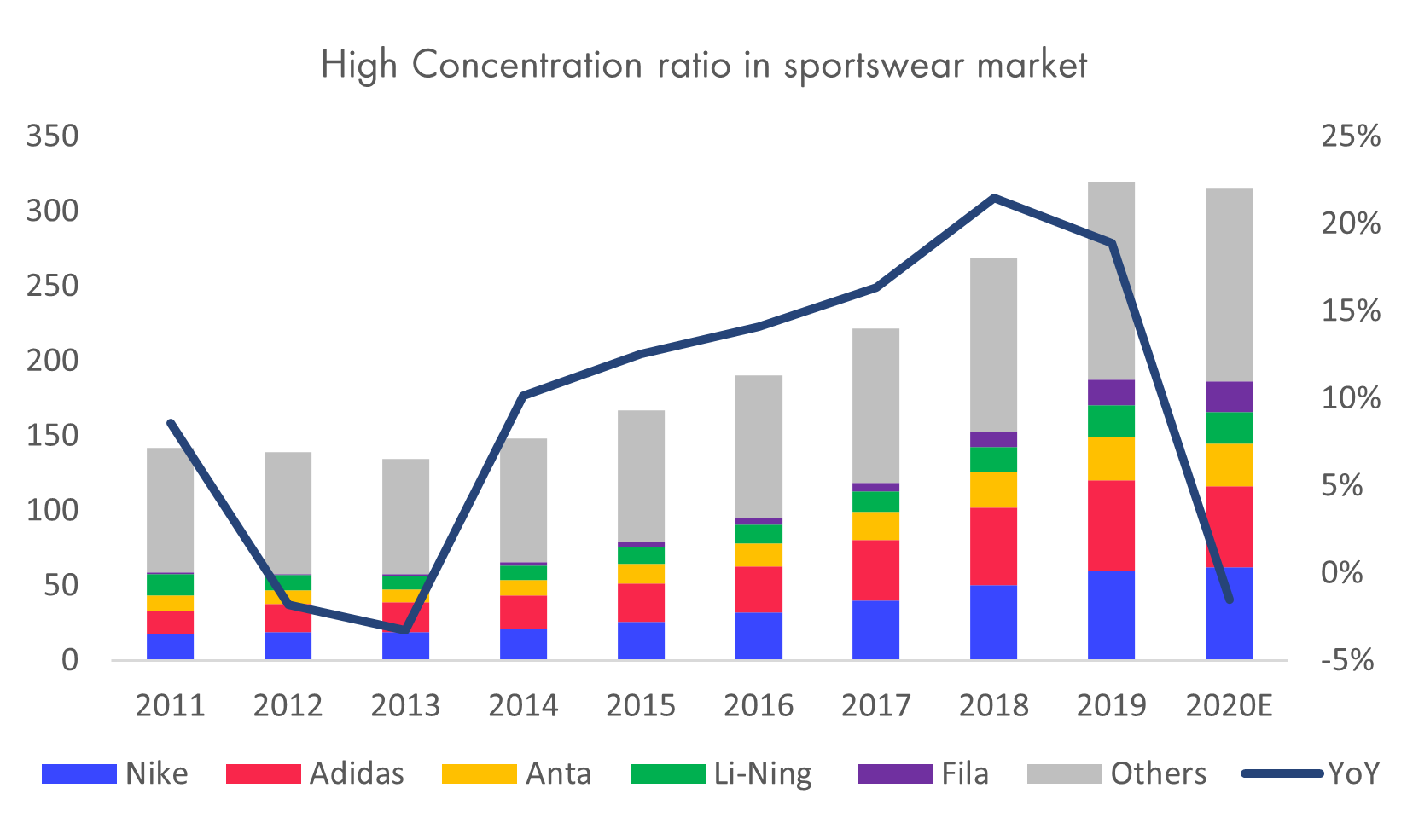

Fragmented Landscape in Apparel and Footwear but High Concentration in Sportswear

Apparel and footwear market was fragmented in China with top 8 concentration ratio (CR8) at only 11.2% in 2020 but up from only 6.4% in 2011. 5 out those 8 brands are sportswear with Nike and Adidas ranked top 2 thanks to the higher growth for the sportswear subcategories. However, in terms of the landscape in sportswear, the concentration ratio is relatively high with CR5 at 59% in 2020, up from 41% in 2011. The room to consolidate may be small but the high growth of the categories will continue benefit the leaders. Anta Sports ranked the third with its Anta brand and Fila brand.

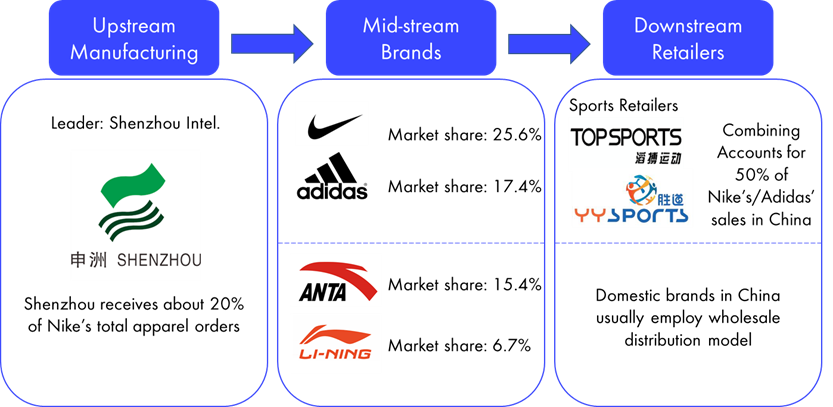

Value Chain of Sportswear in China

The value chain of sportswear in China benefited from the category’s higher than sector growth and enjoyed strong momentum in the past few years.

Upstream: Shenzhou International, the leader of the sportswear manufacturer with Nike and Adidas as core clients. Its sportswear revenue growth was higher at 14.3% than casual wear’s 4.3% revenue growth in 2019.

Mid-stream: The top brands has better performance than the sector. Anta brand, Fila brand, Li Ning, Nike brand and Adidas brand enjoyed 21.8%, 73.9%, 32%, 16.1% and 20.9% growth in 2019 respectively.

Downstream: Topsports and Pou Sheng International are the two largest sports retailers in China who enjoyed rapid revenue growth.

See Nordic Asia’s insight on Shenzhou International Here

See Nordic Asia’s insight on Anta Here