Nordic Asia on the postponement of Ant Group’s IPO

Background

On October 24th, founder of Ant Group and Alibaba, Jack Ma had a speech about financial regulation and innovation in Shanghai. He believes financial regulation should not hold back the innovation and that Basel Accords is not fit.

In his speech, Jack Ma claimed that capital requirements were outdated and should not apply to China as China’s financial system is still emerging. He further commented that an implementation of the Basel Accords (which is a set of internationally agreed banking supervision regulations) would tip the balance between risk control and innovation to focus too much on risk control which would hinder further development of the financial ecosystem in China. The speech can be seen as a culmination of an escalating rivalry between Jack Ma and a state-dominated banking and regulatory system controlled by the government.

On November 2nd, China’s regulators, including China central bank, CBIRC, CSRC and FX regulator, conducted a regulatory talk with Ant Group’s top executives and founder Jack Ma. On the same day, a new regulation was initiated by CBIRC targeting micro-loan companies, which is the entity Ant is doing its credit services. On November 3rd , Shanghai Stock Exchange officially postponed Ant Group’s IPO and pending Ant Group’s disclosure over the regulation matter. Ant Group’s H-share IPO was hence also postponed due to the announcement of the regulation.

Why Regulation?

Micro Consumer loan Co-lending was initiated in the past 3-4 years in China. The size then grew sharply from zero to over CNY 2 trillion for the whole market driven by fintech giant Ant Group, Tencent, JD etc. whose digital platforms mainly matches end user consumer loans to partnership banks but they also share a minor part of the loan through a “Co-lending” structure. The core aim of the new regulation is to prevent systematic risk of too rapid unregulated growth of consumer credit micro loans via these fintech platforms who does not bear adequate risk in the consumer credit loans generated via their platforms. Therefore, the regulation is seen as a responsible to reduce moral hazard by internet firms entering the consumer credit space.

How would the new regulation impact Ant Group?

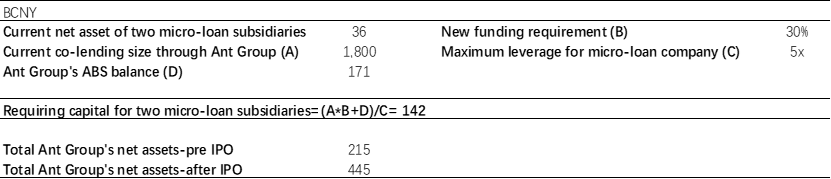

Essentially, new regulation is equivalent to posing a capital requirement similar to commercial banks over micro-loan companies which would limit micro loans companies in co-lending activities. In recent years, via its micro-loan subsidiaries, Ant Group grew the size of its credit balance through its platform rapidly with two methods: securitizing the loan granted and entering a co-lending agreement with partner banks, in which Ant Group and partner banks jointly provide funding to the credits Ant Group originates via its platform. Currently, Ant Group only provides 1-2% of the total co-lending loan value in most cases. Under the new regulation, a minimum of 30% of funding is required on the micro-loan companies for each consumer loan to share a greater proportion of the credit risk with its partnership banks. Furthermore, the loan granted by micro-loan companies, with securitized loan included, should not exceed 5x of companies’ net assets.

To be specific in Ant Group’s case, Ant Group’s current co-lending size is CNY 1.8 trillion and its securitized consumer credit balance is at CNY 170.8 billion as of June 2020. If the new regulation is to be implemented on the current co-lending balance, Ant Group is estimated to require a total of CNY 142 billion of net asset in its micro-loan subsidiaries vs. current CNY 36 billion. This would imply an increase of capital requirements up to 4x the current net asset. Therefore, the new regulation will require significant higher capital requirements for Ant Group and slow down the rapid growth of new consumer credit originations.

What is the current situation and potential impact?

It is very clear that regulators’ target is to contain financial risks by restraining the growth of the co-lending market. On the market level, the demand for consumer and small business credits will not be impacted despite the fact that the new regulation will pose restrictions over the growth of the co-lending market.

Furthermore, Ant Group has options to use its consumer finance license and move away from the micro-loan licenses. This move would reduce the net asset requirement compared to the new regulation required on micro-loan companies. However, it would still require significant higher capital requirements compared to today. Secondly, Ant group might be able to give up the co-lending structure and accept a lower commission fee from their partner banks in the distribution of its consumer credit loans.

In the short term, there are still a number of uncertainties around the implementation of this new regulation and the final details of this. However, the new regulation will definitely impact the growth rate of Ant Groups consumer credit services that stands for approximately 39% of current sales. Therefore, the current IPO had to be postponed since the IPO valuation and listing price did not factor in a significant change of regulatory environment that would limit its growth rate and therefore affect its IPO valuation.

In the long term, we think this regulation will favor the larger platforms such as Ant Group as the higher capital requirement would set significant higher barrier to entry for new market entrants. Furthermore, the new regulation does not alter Alipay’s strategic market position in mobile payments, daily services, and its financial services distribution via one super app with a high user stickiness and a user base over +700 Million Monthly Active Users. Therefore, when the final details of the regulatory impact and adjustments made in Ant Group is cleared and when the IPO pricing and growth rate is adjusted, for new investors the renewed IPO offering might be more attractive than that of today.