Nordic Asia Portfolio Insights: China Merchants Bank

CMB - Company introduction

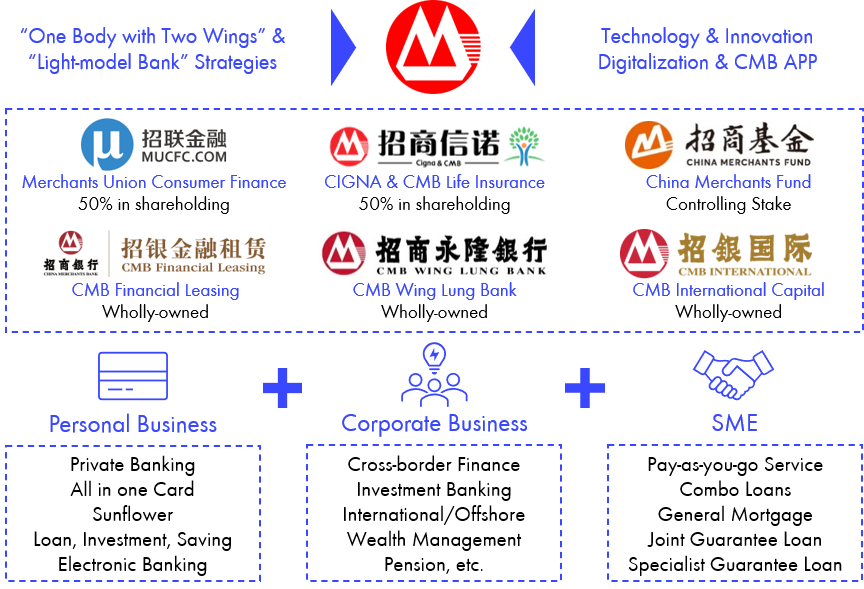

Founded in 1987 headquartered in Shenzhen, China, China Merchants Bank (CMB) is a national commercial bank equipped with various financial licenses mainly focusing on the market in China with its distribution network covering major cities in mainland China and oversea international financial centers. CMB has more than 1,800 branches worldwide. The Company provides customers with various wholesale and retail banking products and services. It also operates treasury businesses for both proprietary purpose and on behalf of customers. Besides, CMB also provides transaction banking services and offshore business services including global cash management, asset management, financing, investment banking, etc. CMB APP now has an aggregate MAU of 145 million, the total AUM from retail customers totaled 8.94 trillion CNY, and customer deposits reached 5.63 trillion.

CMB – Business Overview

CMB – 2020 Results Highlights

Sales: CMB realized 290.5bn CNY in revenue (+7.1% YoY) and 79.3bn in attributable net income (+4.9% YoY). The growth is mainly driven by the excellent asset quality and rapid growing asset management business (commission income +35.7% YoY). Margin: The profit margin recorded 52.9% and the net interest margin decreased 0.1% to 2.49 mainly due to the narrowing of net interest margin. The NPL ratio improved to 1.07% and the Core CAR improved to 12.29%.

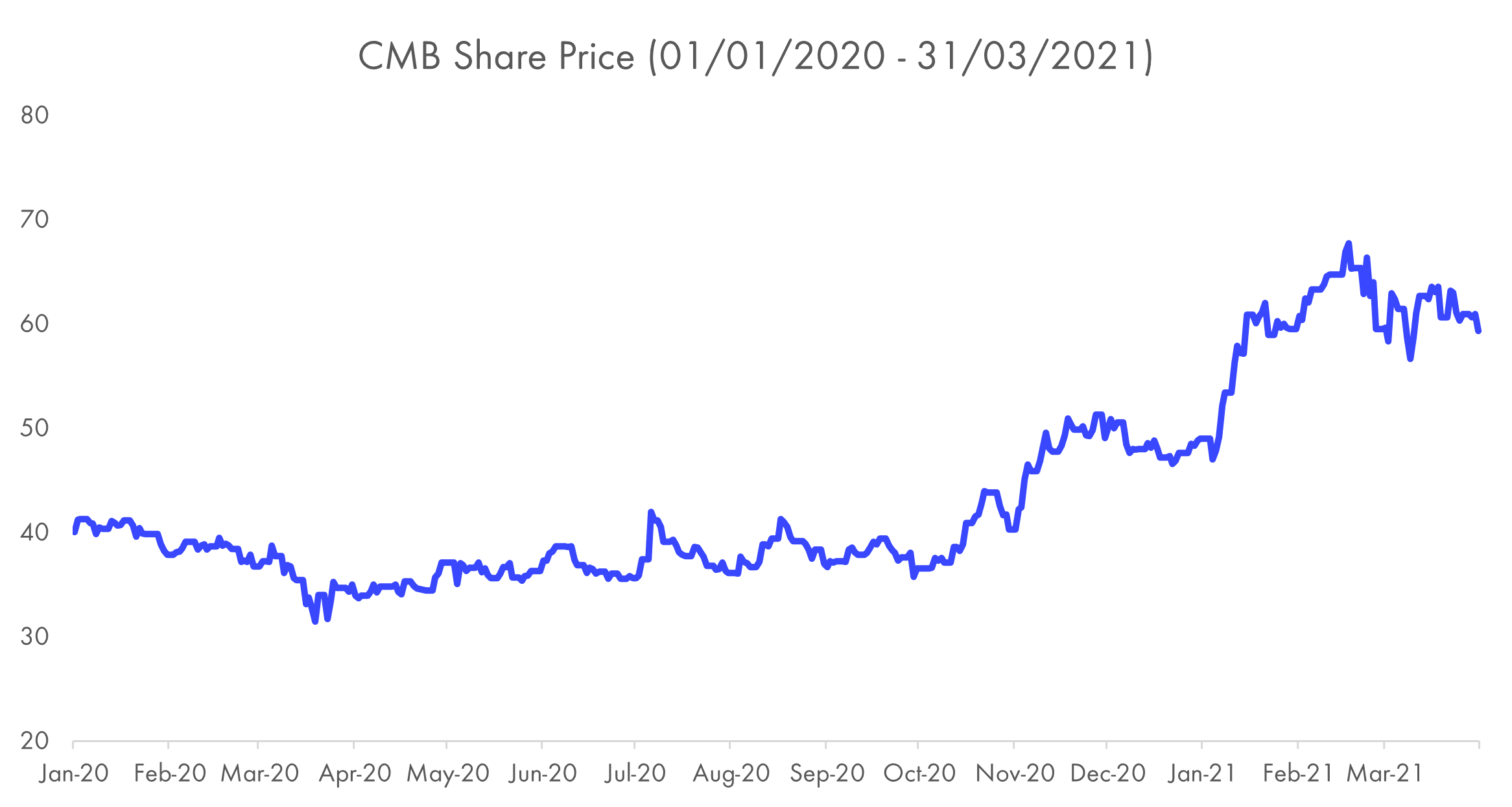

CMB – Share price performance from 1st Jan 2020 to 31st Mar 2021

Interview with Nordic Asia Investment Research Director – Jason Zhang on his views on CMB

From Nordic Asia’s perspective what is the investment case for CMB?

China Merchants Bank represents the highest management level of China's retail commercial banks. With the rapid growth of China's GDP, the wealth of residents continues to grow. We believe that the asset management needs of the middle to high class will constitute a huge market demand. When we invest in China Merchants Bank, we value the company's large-scale operations in the wealth management market and its nationwide network. Through the early-stage credit card business first-mover advantage, CMB accumulates huge customer information, and through the layered services of the wealth management team, it continues to refine various high-quality wealth management products and promotes them to the corresponding customers with different risk appetites. In this business segment, wealth management managers of CMB have long-term customer stickiness and master high-quality customer resources. The company has a significant competitive advantage in the institutional channels and has strong bargaining power in its cooperation with downstream asset management companies. The above is our long-term investment logic of China Merchants Bank.

How does CMB differentiate itself from its peers such as China Construction Bank and Industrial and Commercial Bank of China?

CCB and ICBC are both state-owned banks in China. In terms of management, CMB has a stronger market-oriented advantage than these two banks. CMB can provide professionals with a wealth of promotion channels and incentives. In retail, CMB has built a large team of professional financial planners and has accumulated more reputation in serving high-net-worth individuals in financial management. At the same time, the technological empowerment in the field of retail business asset custody is obvious, and the volume of its asset custody business continues to grow. Compared with the traditional business, the retail business can greatly increase the ROE of the bank, so CMB has a more reasonable income structure.

How did CMB perform during 2020 and how was it affected by COVID-19?

In 2020, the overall performance of China Merchants Bank maintained high-quality growth. Net profit attributable to shareholders of the Bank was 97.3 BCNY, a YoY increase of 4.8%; operating income was 290.5 BCNY, a YoY increase of 7.7%; the weighted average return on equity (ROAE) was 15.7%; the non-performing loan ratio was 1.1%, which has declined for four consecutive years. The company’s two major apps reached 107 million monthly active users (MAU); total retail management customer assets (AUM) reached 8.9 TCNY, an increase of over 1.4 trillion yuan during a year; customer deposits reached 5.6 TCNY, and the deposit structure was further optimized. The average daily balance of demand deposits reached 60%, a YoY increase of 2.0%; the balance of wealth management products reached 2.5 TCNY, and the scale of asset custodied exceeded 16 TCNY. The risk of the credit card business, which has the greatest impact on asset quality, has been exposed due to the epidemic. At the end of June 2020, the non-performing rate of credit card loan has increased by 50BP to 1.85% from the beginning of the year. However, the occurrence of non-performing credit cards loan has clearly stabilized in the second quarter.

Which are the key drivers and challenges for CMB that we should follow during the coming twelve months?

The company's continuous investment in wealth management, financial technology and risk management represents the company's future business highlights. First, we must continue to pay attention to the market advantages of the company's retail business. Non-interest income in 2020 increased by +9.2% YoY, accounting for 36.3% of revenue, an increase of 0.48% from 2019. We need to pay attention to whether the scale of corporate retail, golden sunflower, and private banking customers can continue to maintain a strong growth momentum in 2021, and whether the growth of customer AUM can continue to reach new heights. Second, fintech maintains high investment and clearly empowers operations. In 2020, the company invested 11.921 billion yuan in information technology, +27.25% year-on-year, accounting for 4.45% of revenue with an increase of 0.73% YoY. The continuous investment in financial technology empowered the company's digital transformation. The retail digital transformation is continuously promoted in the areas of the product, channel, and customer group service system; the public business online transformation improved customer experience, and continuously tap customer value with hierarchical operation; middle and back office intelligent risk management capabilities and data governance capabilities continued to improve. Financial technology is closely related to customer experience, and continuous progress in this field is also the focus of our future follow-up. Third, as of the end of 2020, the company's provision coverage ratio was 437.7%, an increase of 12.9% from Q3. The non-performing loan ratio was 1.07%, a YoY decrease of 0.09%. The company actively optimized its loan structure, and the proportion of corporate working capital loans with a higher non-performing loan ratio decreased. All the capital adequacy ratio indicators increased, of which the core tier 1 capital adequacy ratio was 12.29%, an increase of 0.34% YoY. The company maintained a relatively strong level of endogenous capital capability with relatively stable and rapid growth. Risk control capability is the foundation of a bank, and we will continue to pay attention to the improvement of the company's risk control performance.