Nordic Asia Portfolio Insights: Contemporary Amperex Technology (CATL)

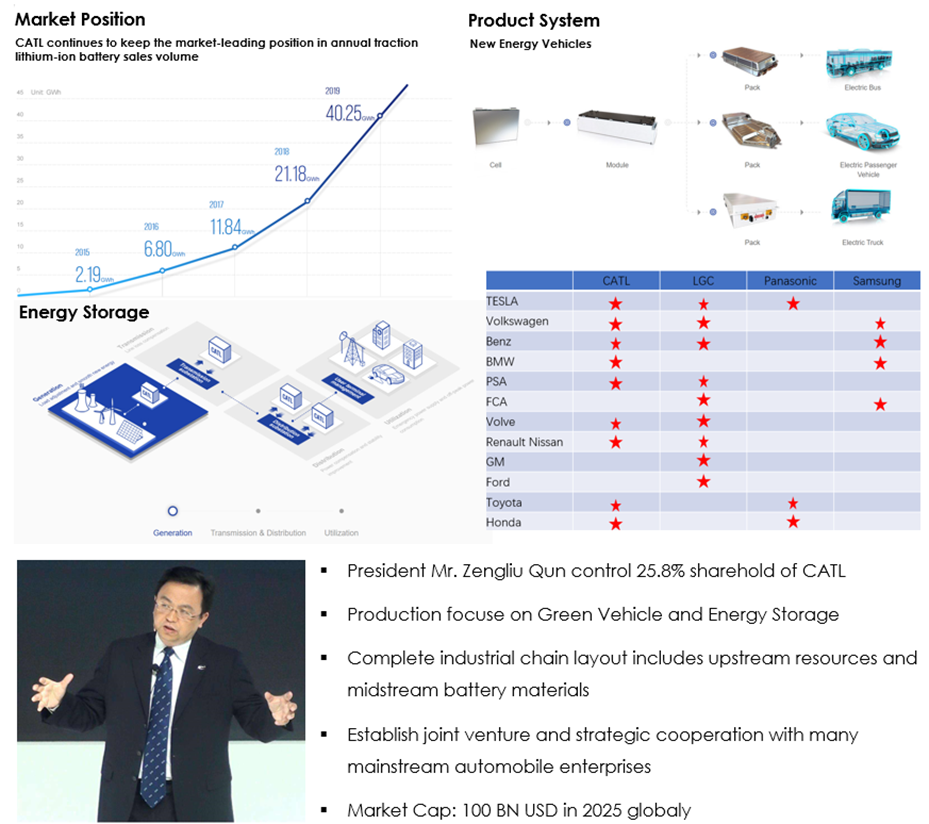

CATL - Company introduction

CATL was founded in 2011 and is headquartered in Ningde, Fujian Province. The company focuses on the research and development, production, and sales of New Energy Vehicle battery systems. It is one of the first Chinese battery manufacturers that successfully competes on a global market. Its batteries can be found in some of the world's top international automakers such as Tesla, Mercedes-Benz, BMW, Toyota, and Volvo as well as in some of the top China automakers such as BAIC Motor, Geely, SAIC Motor and Foton Motor. Based on annual shipments, CATL is currently the world's third largest provider of New Energy Vehicle battery solutions behind Panasonic and BYD.

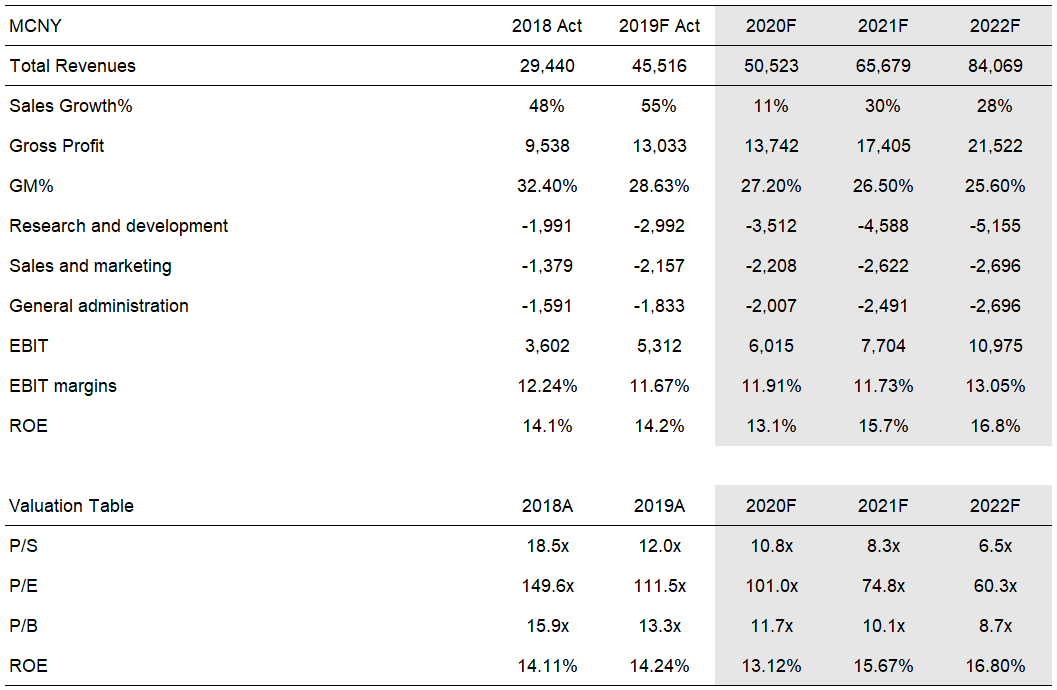

Business overview

Financial overview

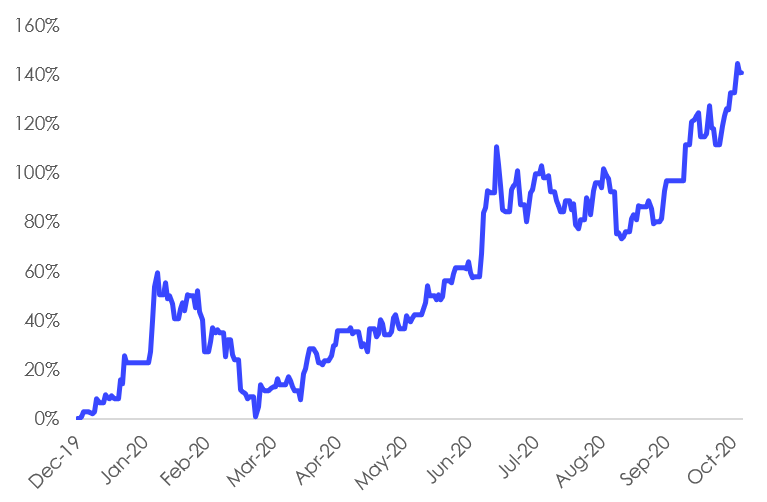

Share price performance YTD 2020

Interview with Nordic Asia’s Partner – Investment Research Director Yu Zhang on his views on CATL

From Nordic Asia’s perspective what is the investment case for CATL?

From our point of view, the bright spots of CATL are very prominent. Firstly, the company is a leading company in China's New Energy Vehicles battery industry. In the next five years, the company will fully benefit from the increase in global penetration of New Energy Vehicles and achieve rapid revenue growth. Secondly, the company's products have been accepted by the world's top automakers such as Tesla, Mercedes-Benz, BMW, Toyota, and Volvo, and the company enjoys high profitability. Thirdly, the company's products rank among the top in the world in key indicators such as energy density ratio and consistency. Finally, the company is backed by the Chinese market, and its complete supply chain advantage allows the company to enjoy a long-term cost advantage, and thus its products price-performance ratio is more competitive compared with its competitors.

How does CATL differentiate itself from its local rival BYD as well as from its international rivals such as LG Chem and Panasonic

LG and Panasonic are Korean and Japanese battery manufacturers, which are beyond the scope of our stock coverage. However, at this stage, the secrets of the success of the world's top two lithium battery suppliers LG and CATL are relatively similar. On the one hand, the continuous investment and accumulation of electrochemical materials ensure a high energy density ratio and safety performance of the products. On the other hand, the companies focus on improving the product economy by controlling costs. Under the premise of ensuring a certain battery endurance, reducing the cost of Electric Vehicle battery packs is the core issue that OEMs need to consider.

Below, we will mainly explain some differences observed in the development of CATL’s domestic competitor BYD and CATL in the past few years. In China, there are three main manufacturers of lithium batteries for Electric Vehicles, namely CATL, BYD and Guoxuan. These three companies basically account for more than 90% of the market, of which CATL and BYD rank as the top two.

- Technical comparison

The rapid rise of CATL is due to its technical strength. The ternary lithium battery produced by CATL is using Lithium Nickel Manganese Cobalt Oxide (LiNiCoMnO2). It gives the battery the characteristics of high energy density and low cost. This is the characteristic that made the batteries of CATL quickly recognized by the market. In the past, BYD’s car batteries were mainly Lithium Iron Phosphate batteries, which are characterized by low energy density but fast charging. When the market began to recognize ternary lithium batteries, BYD's market share dropped rapidly.

- Comparison of economies of scale

The competitiveness of any manufacturing enterprise ultimately needs to be reflected in cost, and the larger the scale, the lower the cost and the stronger the competitiveness. Enterprises without scale advantages in the industry will be eliminated the industry will eventually reach a stable state. From the perspective of scale, CATL is the largest in the industry, and its cost control is extremely strong. At present, BYD's ternary lithium battery production lacks scale which has led to high costs.

- Business model

BYD’s business model is to own the entire New Energy Vehicle value chain. Its batteries are mainly for BYD’s own use, and the New Energy Vehicle business has become the main source of BYD’s revenue. CATL only manufactures Electric Vehicle batteries. This, together with the technical advantages of CATL’s battery will make car manufacturers in the New Energy Vehicle market inevitably choose CATL before BYD. As a result, CATL surpassed BYD to become the number one New Energy Vehicle battery company in China in 2017. When comparing the two, CATL has a slight size advantage, and today there is no obvious technological gap, but the business direction of the two companies are slightly different. CATL has more advantages as it mainly focuses on the Lithium Iron Phosphate technology in batteries for buses, and the ternary lithium battery for passenger cars, including pure electric, hybrid and light hybrid vehicles. BYD has always used the low-energy density Lithium Iron Phosphate battery as its main research and development focus which makes its focus relatively simple.

How did CATL perform during H1 2020 and how was it affected by COVID-19?

In the first half of 2020, the company achieved revenue of CNY 18.8 billion, down 7.1% year-on-year. Operating profit was CNY 2.6 billion, down 7.8% year-on-year. Net profit was CNY 1.9 billion, down 7.9% year-on-year. Net cash flow from operating activities was CNY 5.8 billion, a year-on-year decrease of 19.9%. Basic earnings per share was CNY 0.88, and the weighted average return on net assets was 5.0%. The decline in net profit was mainly due to the sharp drop in sales of New Energy Vehicles due to the epidemic, which led to a decrease in demand for lithium batteries. Affected by the epidemic, from January to July 2020, China’s New Energy Vehicles sales totaled 486,000, a year-on-year decrease of 32.8%. Affected by the negative growth of China’s New Energy Vehicles in the first half of the year, China’s installed battery capacity was 17.48 GWh in the first half of the year, a year-on-year decrease of 41.7%. We expect that the impact of the epidemic on battery shipments in the second half of the year will be reduced, with battery sales resuming growth.

In 2020, China’s New Energy Vehicles policy has continued to improve, and subsidies have been extended to the end of 2022. It is generally expected that China’s New Energy Vehicles sales will continue to grow in the second half of the year. The European New Energy Vehicles market is expecting high growth. In the first half of 2020, the European New Energy Vehicles market penetration rate reached 7.9%, and the penetration rate of pure Electric Vehicles was 4.3%, which was higher than the cumulative penetration rate of 3.6% in 2019. Combined with relevant European policies and industry trends, the growth rate of New Energy Vehicles in Europe will exceed 50% in 20 years. The increase in sales of New Energy Vehicles in China and abroad has driven the demand for batteries.

Which are the key drivers and challenges for CATL that we should follow during the coming twelve months?

We believe that on the one hand, we need to pay attention to the impact of industry cost changes on the company's profitability. Especially the price fluctuations of lithium and cobalt will affect the cost of battery manufacturers. In addition, it is necessary to track the shipment of New Energy Vehicles. At this stage, more and more New Energy Vehicles are being introduced to the market. The sales of several mainstream Electric Vehicles presented by Tesla are representative of the overall penetration rate of the New Energy Vehicle industry. Therefore, it is necessary to track the sales of mainstream New Energy Vehicles and to use this trend to judge the battery shipments and the future performance of CATL.