Investment philosophy & framework

The company's investment philosophy is based on long-term growth potential and can be summarized according to the following framework for investment assessments:

- The market's potential: Analysis of each industry's underlying driving forces, growth prospects and competitive landscape. Nordic Asia sees each holding company as part of society's ecosystem that solves or simplifies a societal problem through its product, which is why great importance is placed on understanding the companies' market potential.

- Companies' potential: Company analysis where Nordic Asia forms a good understanding of the companies' market positioning by evaluating strategic competitive advantages in the form of integrated value chains, user base, brand, IP rights, distribution channels, etc. This is done to understand the companies' value proposition to their customers in order to evaluate the companies' ability to take market shares in their respective markets.

- Financial analysis, risks and forecasts: Financial analysis and internal forecasts for the holding companies' profit growth. The risk in a potential investment is evaluated and the Company's assumptions in its forecasts are put in relation to the expected return (IRR) during the ownership period.

- Long-termism & fundamentals: An investment is only made in companies where Nordic Asia believes that the companies' long-term potential is underestimated in the market, and that the companies' fundamental business risk is relatively low compared to both the expected return and the assumptions that form the basis of the Company's investment analysis.

Strengths and competitive advantages

- Focus on the consumer shift in China benefiting from a growing middle class and China's strategic shift towards a consumer led economy.

- Unique Swedish-Chinese organization with local connections in both Sweden and China with offices in Stockholm and Shanghai.

- Strong investment team on site in Shanghai with good insight into the market and proximity to the companies.

- Investment company structure with a strategic portfolio composition with good knowledge of the holdings.

- Low correlation with the Nordic market, which allows for diversification.

- Focus on long-term ownership based on internal company analysis and fundamental profit growth in the holding companies.

- Focus on owner-managed companies or where management owns a large proportion of shares.

- Access to a portfolio of companies that are otherwise difficult to invest in as a Nordic investor.

- High transparency with Swedish ownership company and only listed holdings listed in Shanghai, Shenzhen, Hong Kong and the USA with a market value of at least USD 1 billion.

Investment Principles – Focus on Long-Term Profit Growth

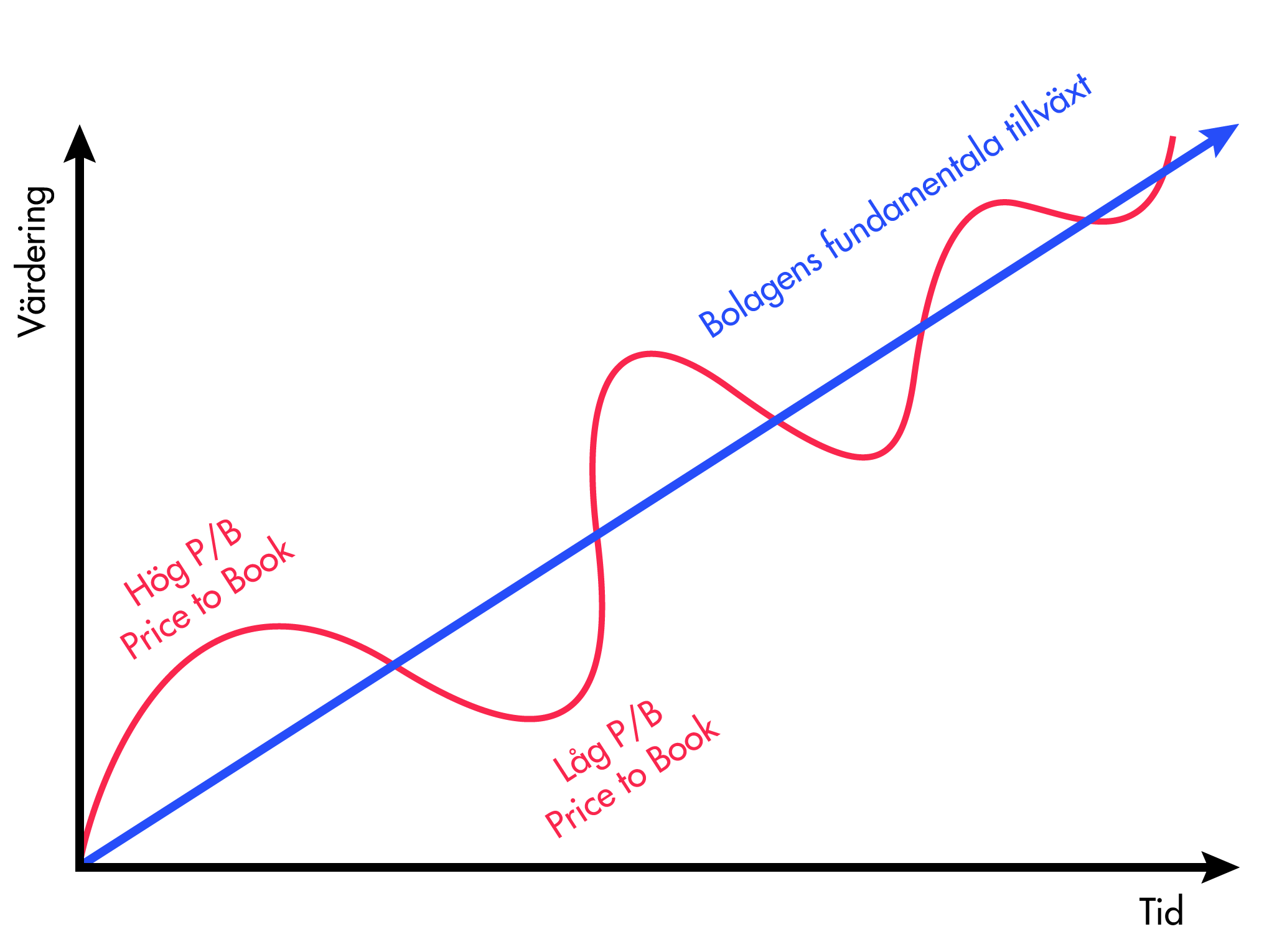

Today's digitized stock market is a complex market driven by different actors with different incentives, investment strategies and global money flows. In this world, company valuations fluctuate around companies' long-term profit growth, which we call "multiple fluctuations". The same company with the same company profit can be valued around different multiples based on the investor's future estimates of the company's profit growth or the impact of cash flows from index-related products. It is very difficult to predict and understand the short-term multiple fluctuations, but on the other hand, we can focus on the companies' fundamental profit growth and count on return scenarios based on the companies' profit outcomes when meeting operational objectives. By focusing on the companies' ability and business potential to deliver profit growth and internal return models that reflect the company's fundamental growth, we are not affected by the short-term multiple fluctuations caused by other macroeconomic factors.

The advantage of our investment company structure is that we can act, invest and own the companies as if they were in an "unlisted environment" but still get good liquidity, easy access and transparency like the companies in the listed environment. The investment company structure thus gives us the best of both worlds in that we can apply a long-term owner- and company-specific return model but at the same time gain access to a broad investment universe, good liquidity and a high degree of transparency and accessibility. Nordic Asia takes this Swedish model for long-term value creation to China and applies it to the growing consumer market.

Nordic Asia Investeringskriterier

- The target company must hold a strategically important market position within a niche market with structural market growth.

- The company's strategy must be clear and implementation of the strategy must clearly strengthen the company's market positioning and the company's long-term competitiveness.

- The company must have a distinctive competitive advantage in the market.

- The company should preferably be owner-led or where management in the company owns a large share of the company.

- The company must be able to demonstrate a good history of consistent growth in equity and gradual improvement in ROE.

- The company should preferably be able to drive organic growth via its own cash flow and maintain a very low net debt.

- The company's market cap must be at least USD 1 billion.